by Legalnaija | Sep 18, 2023 | Blawg

🚀 Exciting News Alert! 🚀

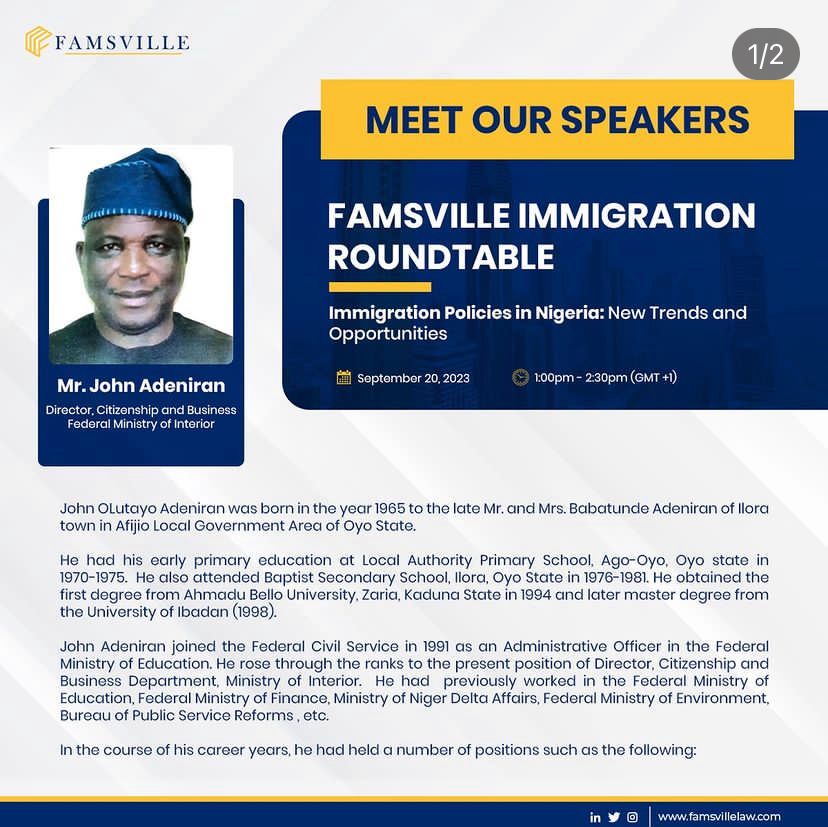

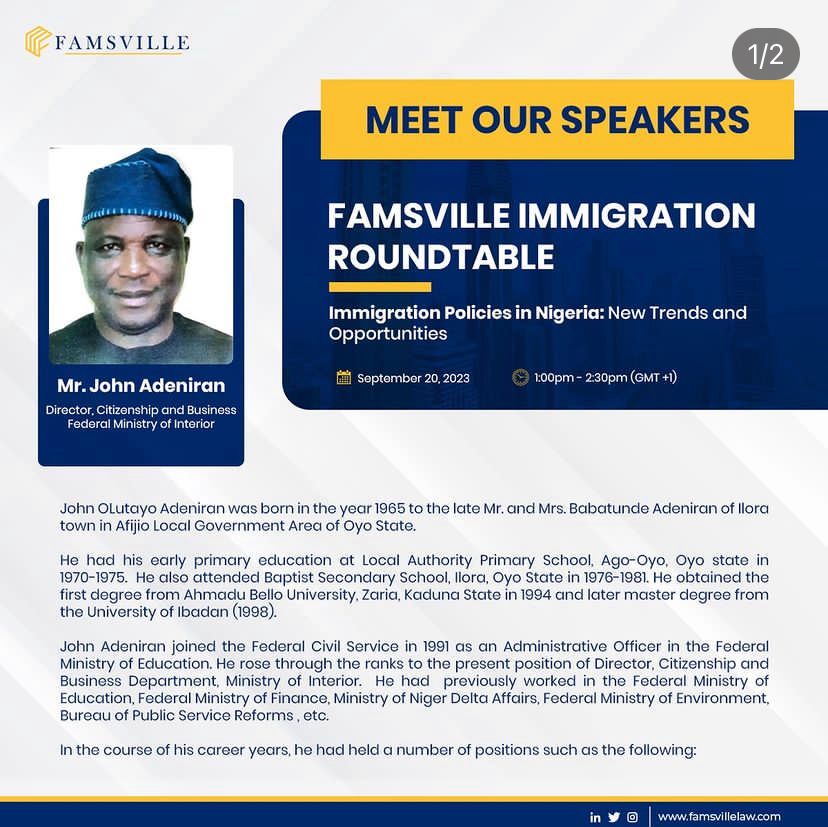

Prepare to embark on an eye-opening journey into the world of immigration policies in Nigeria with Famsville, a Pan-African commercial law firm.

Join us for an exclusive immigration roundtable on the topic “Immigration Policies in Nigeria: Emerging Trends and Opportunities.”

Date: Wednesday, September 20th, at 1:00 PM (GMT+1).

What you will learn:

➢ Visa Categories: Understand benefits and challenges of new visa classes.

➢ Legal Framework: Explore laws and regulations governing visas.

➢ Permanent Residency: Learn eligibility, requirements, and procedures.

➢ Compliance Challenges: Identify regulatory hurdles and processing times

➢ And so much more

Don’t miss out on this opportunity to expand your knowledge and seize new possibilities.

Register to secure your spot now: https://bit.ly/RegistrationLinkFamsville

#FamsvilleWebinar #NigeriaImmigration #FamsvilleWebinar #NigeriaImmigration #Famsvilleimmigrationroundtable #legalevents #immigrationconsultant

by Legalnaija | Jul 3, 2023 | Blawg, Family Law

In private international law, the principle of domicile was first propounded and developed in the Middle Ages by the Italian school of Post glossators, as a result of the development in the ease of mobility of persons from one state to another. This led to the reasoning that persons should be attributed to a particular legal system. The reason for this line of thinking includes the perceived importance attached to the notion of belonging to a country/state; this Martin Wolff appropriately posited as ascribing to any given individual a legal ‘centre of gravity’; and determining which legal system has jurisdiction in cases pertaining to personal law.[i]

According to the Blacks Law Dictionary, Domicile is the place where a person has fixed his habitation and has a permanent residence, without any present intention of removing therefrom. The different types of Domicile are domicile of origin, domicile of dependency and domicile of choice. The first domicile which a person acquires is the domicile of origin. This type of domicile is determined by the domicile of the parents at the point of a person’s birth, as determined in Bell v Kennedy.[ii] Domicile of choice is acquired by a person of full capacity. This is gotten by fulfilling all the requirements of domicile of the particular state one wants to get domiciled in. This can be acquired by an adult of full mental capacity acting in his own will to permanently settle elsewhere. Once the domicile of choice is acquired, the domicile of origin of such person goes into abeyance. Domicile of Dependence focuses on married women, children under 21 years, and mentally disordered persons. Married women acquire domicile being that of the husband upon celebration of a valid marriage. This domicile of dependence can apparently be terminated either by divorce or death of one of the couple.

The topic of domicile is important as it is a guide for determining the question of personal law, especially when it relates to Divorce Proceedings, as the Matrimonial Causes Acts in Section 2, states that a petitioner must be domiciled in Nigeria at the time of his filing of a petition for divorce. This was illustrated in the case of Omotunde v. Omotunde (2020) LPELR 10194 CA, wherein the petitioner, who had been consistently domiciled in the United States of America since 1993 up to the time he filed his petition on the 21st day of April, 1998. The Court held it cannot be said of him that as at 21/4/98 when he was filing his petition through his learned Counsel, he was domiciled in Nigeria.

Regarding female spouses, due to the fact that Nigeria inherited its laws from the United Kingdom, Nigeria adopted the position that a wife inherits the domicile of her husband. It’s important to note that this concept is an archaic and anachronistic one which views the wife as incapable of having an independent existence from the husband, therefore appurtenant to the domicile possessed by the husband. Law being a dynamic element: forward thinking jurisdictions such as England has abolished this by enacting the Domicile and Matrimonial Proceedings Act 1973 which provides that married women can have domicile independent of their husbands. This has been exemplified in cases such as Inland Revenue Commissioners v Duchess OF Portland.[iii] The existence of this class of domicile eludes common sense and objective reasoning especially because of the fact that the woman before and during the existence of marriage may be subject to different laws from that of the husband and by reason of the relationship that exists between them, will not offer justification for the imposition of the domicile of the husband upon the wife. Lord Denning in relation to this point stated, “the last barbarous relic of a wife’s servitude”.

On the side of judicial activism, the Nigerian court has put a step forward in the abolishing of this class of domicile. The court in Bhojwani v Bhojwani per Uwaifo JCA stated that;

“there are strictly two types of domicile. One is domicile of origin and the other, domicile of choice. There is no separate domicile known as domicile of dependence as was canvassed by Professor Adesanya in the present case and also in Osibamowo v. Osibamowo, and there in that case accepted by this court[iv].

While the issue of domicile continues to come up in legal matters, it will be interesting to see the decision of the Court in similar matters going forward.

Read more law articles on www.legalnaija.com/blawg

[i] Martin Wolff, Privte International Law (2nd ed. Clarendon Press 1950) 5

[ii] (1868) UKHL 566 1.

[iii] [1982] BTC 65.

[iv] Ewenike E. Ebuka and Araka Chukwunweike. (2023). Gauging The Current Position Of The Principle Of Domicile In Nigeria. [Online]. DjetLawyer. Available at: https://djetlawyer.com/gauging-the-current-position-of-the-principle-of-domicile-in-nigeria/ [Accessed 28 June 2023].

by Legalnaija | May 8, 2023 | Blawg

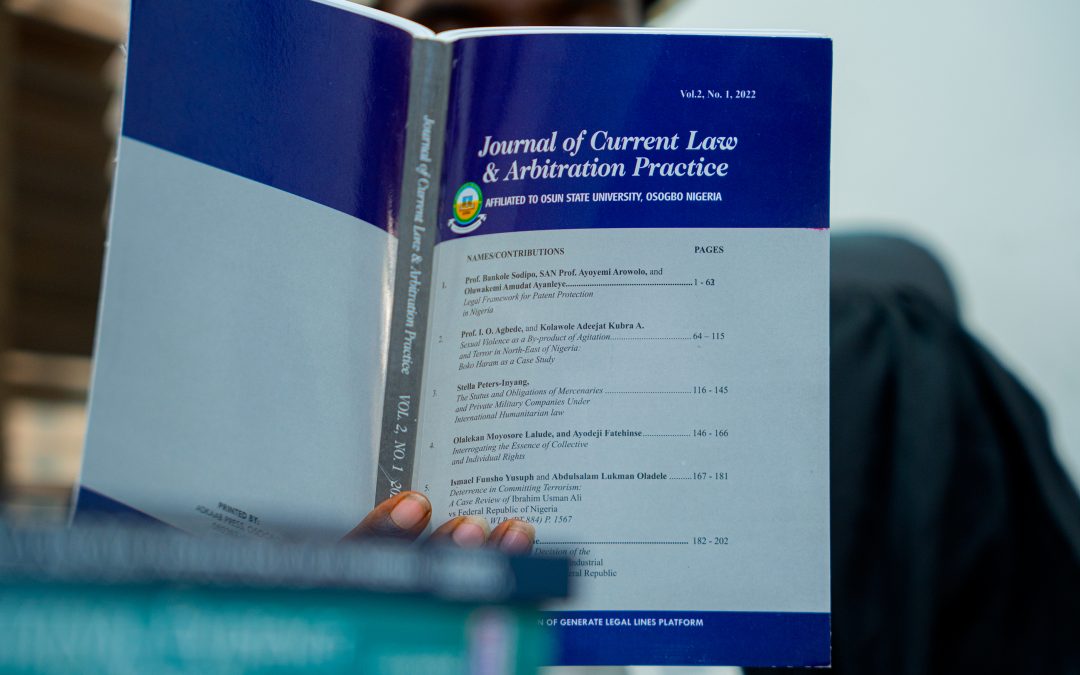

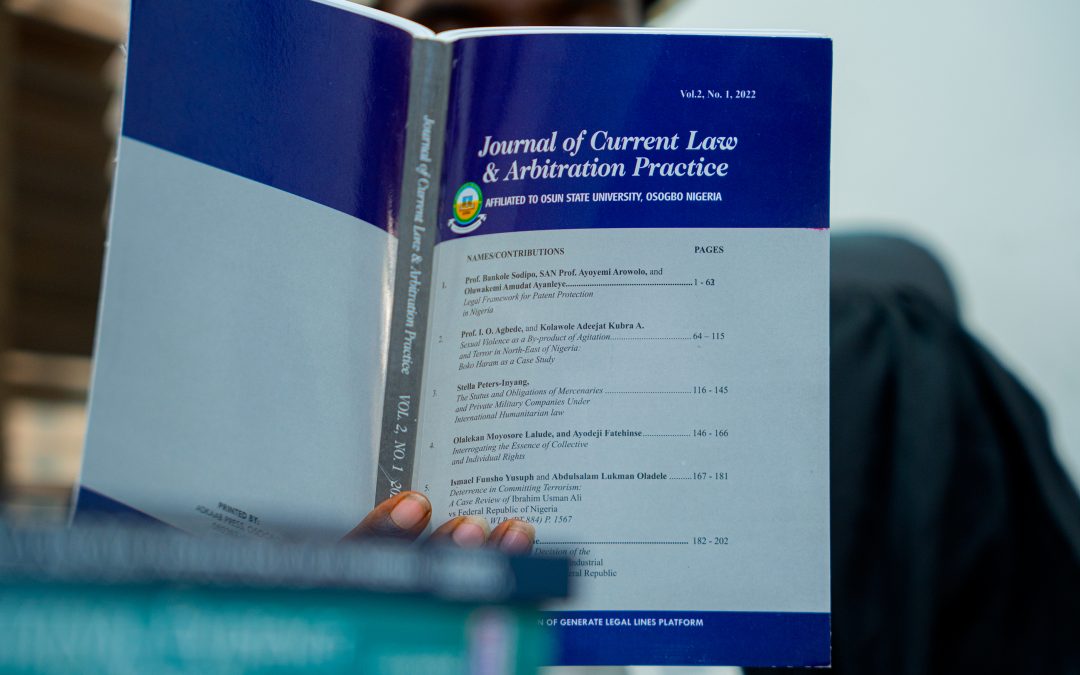

This journal is a triannual reportage of essays in all branches of Law and Alternative Dispute Resolution (ADR), with a particular focus on evolving areas like Medical Law, Arts & Entertainment Law, Information Technology, Energy Law and much more.

There are currently 4 volumes and you can see the topics on Vol 1 – 3 below;

Volume 1 No1 2020

- Mediation and conciliation: Traditional rulers ‘Panacea for Settling Land Disputes’ – Olufemi Ogunleye and Olusesan Oliyide.

- The Lagos State Street Trading and Illegal Markets Law: Making Norms Work– Adedotun Onibokun and N. U donmba.

- Fragility of Law and the Environment Nigeria as a Case Study – Gbadamosi, Oladele Abass

- Discourse on Legal Scholarship: The Emergence of Sociology of Law as a Discipline– Akuchie Henry A.

- Online Dispute Resolution (ODR): A Viable Solution to Speed and Efficiency Issues in ADR– Morenike, Obi-Farinde FCIArb

- Providing a Legal Framework for the Committal of the Mentally ill in Nigeria– Deborah Okemiri-Ikonne

- ODR in Africa:The Emergent Face of Dispute Resolution Post Covid 2019 – Morenike, Obi-Farinde FCIArb

- Exploring Alternative Dispute Resolution In Medical Malpractice Disputes In Nigeria – wadzi Vivian aboki, FCIrb

- Mekwunye v Imoukhuede – The Consistent Strides of Nigerian Arbitration (or, is it?) – Adebayo Adenipekun SAN, FCIArb, FCArb.

Volume 1 No2 2021

- The Effect Of Corporate Governance On The Performance Of Money Deposit Banks In Nigeria – toluwase T. Ajibade LLB,B.L,ACIArb, and Deji olanrenwaju LL.B,LLM, B.L, MSC, FCIB, FIMA, FCMR.

- Legal and Other Impacts of Foreign Investments in Nigeria since the second Republic – Olusesan Oliyide LL.M (Lagos) , Chinaka Emmanuel LL.M(BU) and Bunmi Osifeso,LL.M.(OAU).

- Getting it right between Criminal Liability and Anti- Social Behaviour – Akuchie Henry, a. b.Sc, (Hons) M.A (Houston), JD (California), LL.M (Virginia), and LL.D (South Africa).

- The imperative of establishing appellate court over Industrial Disputes in Nigeria – Festus Gboyega Oyebade B.Sc, LLB, BL, LLM (Ife). MA. Med, Mphil Law (Ife), Ph.D (Ibadan)

- Arbitration in Criminal Matters: Hoax or a possibility – Hon. Ipoola Aderemi Binuyo LL.B, ll.m, m.phil (Ife), B.L., FCIArb.

- The Companies and Allied Matters Act 2020 – Pastor ‘Niyi Odunsi

- Obafemi Awolowo University vs Inaolaji Builders Limited: A Needless Judicial Intervention– Funmi Roberts LL.M,C.Arb., FNCIArb., F.IOD

Vol.2, No.1.2022

- Bankole Sodipo, SAN, Prof.AYOYEMI Arowolo, and Oluwakemui Amudat Ayanleye – Legal Framework for Patent Protection in Nigeria.

- I.O. Agbedde and Kolawole Adeejat Kubra A. – Sexual Violence as a By-product of Agitation and Terror in the North-East of Nigeria : Boko Haram as a case study

- Stella Peters-Inyang – The Status and Obligations Of Mercenaries And Private Military Companies Under International Humanitarian Law.

- Olalekan Moyosore Lalude, and Ayodeji Fatehinse – Interrogating the Essence of Collective and Individual Rights.

- Ismael Funsho Yusuph and Abdulsalam Lukman Oladele – Deterrence in Committing Terrorism: A case Review of Ibrahim Usman Ali vs Federal Republic of Nigeria (2017) ALL WLR (PT 884) P.1567

- Francis Ohiwere Oleghe – A Critical Review of the Decision of the Decision of the High Court in Process & Industrial Developments Limited v The Federal Republic of Nigeria.

Vol.2, No 2, 2022

- Dr Effiong Esu – A Critical Appraisal Of Derivative Action Under The Companies And Allied Matters Act 2020

- Ogunleye, Olufemi Adewunmi, LL.M– Protecting Religious Minorities within Nigeria for African Traditional Religion: A challenge for international Human Right and National Laws.

- Francis ohiwere Oleghe – A Critical Analysis of Law and Justice as Instrument for Social Engineering in Nigeria.

- Gazu Gideon Nyuimbe – Reinvogorating the Ethics of Corporate Governance in the Nigerian Banking Sector

- Justice Adedotun Onibokun– Renewable Energy and the law in Nigeria

- Oluwagbemiga Atere – The Denovo effect of the Fade to periphery principle in the court of arbitration for sports . a Threat to the Right of Appeal and and its Legal Merits.

- Olufunmilola Olabode – Extending The Arbitration Agreement To Non- Signatories : A Contravention of The Consemsual Nature of Arbitration?

- Bolarinwa Levi Pius – Arbitration of Securities Disputes in Nigeria: Issues And Viable Reforms.

To order copies of the Journal, follow these links below or contact 09029755663.

- Get your copy of Vol 1 No. 1

- Get your copy of Vol 1 No. 2

- Get your copy of Vol 2 No. 1

- Get your copy of Vol 2 No 2

by Legalnaija | Nov 8, 2022 | Blawg

The Chairman-Designate of the International Law Association (ILA) Arbitration Committee, Mr. Tolulope Aderemi, has decried the prohibitive cost of arbitration and urged his colleagues to ingeniously review the cost of accessing justice through alternative methods to litigation- arbitration, etc.

Aderemi aired these views during panel sessions at the International Chamber of Commerce (ICC) Commission on Arbitration and the just-concluded International Bar Association conferences, both held in the United States of America.

According to Aderemi, the pandemic’s consequences are such that parties in arbitration are increasingly concerned about the cost of prosecuting or defending their cases before arbitration tribunals. He stressed further that this is increasingly limiting access to justice and arbitration practitioners must now pay closer attention to this.

In his view, Nigeria must aggressively consider embracing 3rd party funding of parties and urged the President of the Federal Republic of Nigeria to give his assent to the amendment to the Nigerian Arbitration and Mediation Bill, a Bill which provides for third-party funding amongst other initiatives. Aderemi’s view is that in addition to embracing third-party financing as an alternative to funding arbitration, parties may also consider arbitration insurance as an alternative method of parties funding arbitration. This, according to Aderemi must be infused into the arbitration contract at the negotiation time. This will be a second-level improvement to dispute avoidance which companies must now embrace.Arbitration Practitioners must consider alternatives to the prohibitive cost of arbitration- Tolu Aderemi

The Chairman-Designate of the International Law Association (ILA) Arbitration Committee, Mr. Tolulope Aderemi, has decried the prohibitive cost of arbitration and urged his colleagues to ingeniously review the cost of accessing justice through alternative methods to litigation- arbitration, etc.

Aderemi aired these views during panel sessions at the International Chamber of Commerce (ICC) Commission on Arbitration and the just-concluded International Bar Association, both held in the United States of America.

According to Aderemi, the pandemic’s consequences are such that parties in arbitration are increasingly concerned about the cost of prosecuting or defending their cases before arbitration tribunals. He stressed further that this is increasingly limiting access to justice because of charge, and arbitration practitioners must now pay closer attention to this.

In his view, Nigeria must aggressively consider embracing 3rd party funding of parties and urged the President of the Federal Republic of Nigeria to give his assent to the amendment to the Nigerian Arbitration and Mediation Bill, a Bill which provides for third-party funding. Aderemi’s view is that in addition to embracing third-party financing as an alternative to finding arbitration, parties may also consider arbitration insurance. This, according to Aderemi must be infused into the arbitration contract at the negotiation time. This will be a second-level improvement to dispute avoidance which companies must now embrace.

The arbitration expert encouraged arbitrators to remain sensitive to current economic realities when discussing Arbitrator fees so that Users/Clients of the process will not view the mechanism. as a money-making venture, which it is not.

Arbitration is an alternative dispute resolution for commercial matters. It encourages party autonomy by allowing the parties to determine the resolution of their dispute, including the appointment of 3rd party neutrals, experts, duration of the hearing, seat and place of arbitration, etc. It is an alternative to traditional litigation, which sometimes outlive the parties in the Nigerian courts.

by Legalnaija | Nov 1, 2022 | Blawg

By the nature of business, it is impossible for any business entity to operate like an island. Every business has customers, suppliers, thereby interacting with the larger society in different ways. One very essential part of this interaction are agreements. Agreements for supply, for sale, and for services for instance.

Agreements are terms of defined expectations or guidelines in place to guide the parties in a contract. A well and sound drafted agreement is integral for commercial sustainability and success. Businesses that payed less attention to their agreements have had bitter experiences and most times jeopardized their chances of getting legal redress at the end of the day.

A major feature of agreements is that they help outline the expectations and deliverables of both parties, thereby removing any ambiguity to the intention of the parties. In any business environment, it is critical to have legal documentation in place to establish a system of rules and policies governing the legal enforcement of promises. Whether it be to simply memorialize a common understanding of an organizational relationship or govern future venture needs, the protections afforded by strong contracts are invaluable to operating a successful business.

Protecting your business in the event of a breach of contract is also a major advantage of having an Agreement. A breach of contract means that the party in breach has acted contrary to the terms of the contract by performing a contract negligently and not in accordance with its terms. When there is a breach of contract, the aggrieved party can be awarded damages. Damages are awarded to restore the plaintiff as far as money can to the position he would have been if there had been no breach.

There are other advantages of having an agreement but businesses can only benefit from them, when there is an Agreement. Such Agreement could be written or verbal, however, written agreements are better as they are easier to prove.

If you have any comments, questions or remarks about Agreements, you can simply drop a comment or send us an email.

AOC Solicitors

www.aocsolicitors.com.ng

info@www.aocsolicitors.com.ng

09029755663.

Originally published by AOC Solicitors

by Legalnaija | Nov 1, 2022 | Blawg

Introduction

Nigerian entrepreneurs have long been harmed by adverse regulatory conditions that make it more difficult to launch, build, and scale an innovative enterprise. According to a 2020 report from World Bank[1] on doing business, Nigeria was ranked low in the ease of doing business ranking as it was ranked 131 out of 190 countries that made the list. Nigeria’s low ranking in this report did not come as a surprise because the nation’s business ecosystem with specific emphasis on the tech space contends with frustrating and stifling policies from the government and a number of other challenges. A number of promising tech startups in Nigeria with the potential to immensely drive profit of the Nation’s economy stopped operation because of the government’s approach to policies that relate to tech support. To remedy this situation plaguing the Nation’s business environment, the Nigerian Startup Bill was forwarded to the senate on March 1, 2021. On October 19, 2022, President Muhammadu Buhari signed the Nigerian Startup Bill into law. As such, the nation for the first time has a unifying law to regulate its startup ecosystem; The Nigerian Startup Act (“the Act”).

Prior to the Nigerian Startup Act, the laws that govern Startups and SMEs were found in different legislations, which made for proliferation of taxes to be paid to numerous agencies. These legislations also provide for the payment of tax to different regulatory agencies. Some of these legislations includes The Companies and Allied Matters Act, 2020, The Investment and Securities Act, The Companies Income Tax Act and The Personal Income Tax Act.

The introduction of the Nigerian Startup Act (the “Act”) is an innovative development that aims to improve the business environment for startups in Nigeria. The major objective of the Act is to create an enabling environment for startups by providing a legal and institutional framework for the development of startups, creating incentives for the development and growth of technology related talents, removing regulatory constraints, and positioning Nigeria’s startup ecosystem as the leading digital technology centre in Africa. The bill eradicates the legal uncertainties that have trailed the startup industry in the past. It provides for what qualifies a company to register and obtain startup status. This article aims at giving a brief overview of the salient provisions of the Act which embodies 51 Sections, and one Schedule.

Salient Provisions of the Nigerian Startup Act 2022

Definition of Startups under the Act

Startups are defined under the Act as a company in existence for not more than 10 years, with its objectives being the creation, innovation, production, development, or adoption of a unique digital technology innovative product, service, or process.[2]

According to this definition, the Act will be applicable to tech-enabled startups, which are businesses that use current, cutting-edge technical advancements to address operational problems or enhance consumer experience. Small and medium enterprises (SMEs) that are not tech related would consequently not be covered by it.

Startup Labelling

The Act provides that before a company can be labelled a startup, it must obtain a certificate known as the startup label. This means that only companies with the startup label will be recognized as startups. By virtue of section 13(2) ; a startup will be granted a startup label where it is registered as a limited liability company under the Companies and Allied Matters Act for a period not more than ten years, with its objects being innovation, development, production, improvement and commercialization of a digital technology innovative product or process; to be regarded as a startup by virtue of section 13(2), such company must have at least one Nigerian as a founder or Co-founder of the startup, provided that the Nigerian founder or co-founder will share from profit or revenue from the sale of shares and at least 51% of its shares should be held by Nigerians. Companies whose foreign participation exceeds 49% will still qualify where the ultimate beneficial owners of its foreign corporate shareholders are Nigerian citizens. Companies issued with a startup label are required by the Act to adhere to the requirements stated above and failure to comply with these obligations can revoke their startup label.[3]

The Act mandates that a Startup Support and Engagement Portal should be established to facilitate the issuance of the startup label and also bridge the gap between regulators and startups. The Startup portal shall also be responsible for creating opportunities for startups to participate in challenges and programs that would enhance financing, innovation and provision of incentives among others.[4]

The Startup Consultative Forum

The Act established a Startup Consultative Forum (the “Forum”)[5], which will be made up of industry stakeholders and representatives, to prevent onerous regulatory policies. The Forum provides stakeholders with a constant channel of communication with the Nigerian government for the advancement of the startup ecosystem. The Act also mandates the National Digital Innovation, Entrepreneurship, and Startup Policy’s implementation in order to foster the growth of the startup ecosystem. The introduction of aggressive government measures that impede the ecosystem’s growth is expected to be reduced to a minimum by the execution of the Policy and ongoing engagement with stakeholders.

Establishment of the Council for Digital Innovation and Entrepreneurship

The Act establishes a council known as the national council for digital innovation and entrepreneurship.[6] The council has the duty to ensure the realisation of the objectives of the Bill, harmonise laws that regulate startups and ensure the development of digital technology through grants to persons and institutions involved in research and technology.[7] The council shall also have the power to examine the regulations and directives of Ministries, Departments and Agencies that directly affect the functioning, funding and operations of startups in Nigeria.[8] The National Information Technology Development Agency shall serve as the Secretariat of the Council (“the Secretariat”)[9], and shall be in charge of managing the labelling process of a startup, providing access to information and performing such other duties as required by the bill.

Establishment of Startup Investment Seed Fund

The Act establishes a fund known as Startup Investment Seed Fund to be managed by the Nigeria Sovereign Investment Authority otherwise known as the fund manager.[10] The startup investment seed fund by virtue of section 19 aims to provide special seed funds to startups. The fund will provide finance and tech reliefs to startups. This will undoubtedly increase access to funding for startups and improve the startup ecosystem in Nigeria.

Training, Capacity Building, and Talent Development

The Act introduces a program that will enhance the training[11] and development of talents[12] in the Nigerian startup ecosystem. It provides support for academic research institutions geared towards startup development[13]. The implication of this is that startups and their employees will have access to educational programs that will empower them with the right skills and enhance their competitiveness in the industry.

The Act empowers the secretariat to collaborate with the National Universities Commission, universities, and polytechnics within Nigeria to develop modules, programs and hold workshops aimed at impacting knowledge necessary for the establishment and running of a startup in Nigeria. The Secretariat shall establish centres for the acquisition of digital technology in the six geopolitical zones of Nigeria for the promotion of digital technology utilisation, strengthening of digital technology management capability, and information systems. The Secretariat shall also support the activities of an academic research institution to the development of a startup.

Introduction of Tax and Fiscal Incentives

Companies labelled as startups will benefit from some tax reliefs and incentives under the Act. These labelled startups are eligible for pioneer status incentives and other tax reliefs[14]. Labelled startups with at least ten employees where 60% of the employees have no prior work experience within three years of graduation or any vocational program have access to percentage-based tax relief of 5% on income tax[15]. Labelled Startups under the Act will also be eligible for export incentives and financial assistance from the Export Development Fund, Export Expansion grant and the Export Adjustment Scheme Fund.[16]

The Act further provides for access to government grants, loans and financial support through a credit guarantee scheme.[17]

The Act encourages investment in startups by providing tax incentives and reliefs for investors investing in a labelled startup.[18] Tax incentives are also provided to employees and external service provides for labelled startups.[19] By virtue of section 31, an eligible employee of a labelled Startup shall be entitled to personal income tax exemption of 35% on the income of the employee for a period of two years from the date of engagement by the labelled Startup. The criteria for eligibility of an employee will be determined by the Secretariat and the Joint Tax Board.

Provision of Regulatory Support

The Act enhances regulatory support for startups. It provides for collaboration with regulatory bodies to facilitate seamless processes for labelled startups. The provision for regulatory support applies to bodies like the Corporate Affairs Commission[20], Nigerian Copyright Commission, and Trademarks, Patent and Design Registries,[21] Securities and Exchange Commission,[22] National Office for Technology Acquisition and Promotion,[23] Central Bank of Nigeria,[24] and Nigerian Exchange Limited.[25]

Introduction of Incubation and Accelerator Programs

The Act also provides for the establishment of accelerator and incubator programs that will grow the startup ecosystem. The Act seeks to create a policy that will aid the establishment and development of accelerators and incubators, it also aims to regulate the relationship and promote collaboration between accelerators, incubators and startups.[26]

These incubators will help startups solve operational issues they are bound to encounter in running their business.

Shortcomings of the Act.

Despite the several innovations introduced by the startup act, it is not devoid of certain shortcomings.

One major shortcoming of the Act is the proliferation of laws and regulators, although the act is in line with international standards, it introduces additional bodies and regulations to enterprises that will typically fall within the ambit of CAMA, thus resulting in the proliferation of laws. Similarly the introduction of more administrative bodies would add an extra hurdle in the operation of startup companies.

Conclusion

The introduction of the Act is truly a step in the right direction in creating an enabling environment for Startups to thrive in Nigeria. It seeks to reduce regulatory hurdles currently faced by Startups and relevant regulators including the Corporate Affair Commission and the Securities and Exchange Commission in controlling the startup ecosystem in Nigeria. However, like with previous laws, there is no certainty that the Nigerian government will put the provisions of the Act into practice, but the new law, in the opinion of Oswald Osaretin Guobadia, Senior Special Assistant to the President on Innovation, leaves room for business owners to take the initiative.

The Act seeks to leverage the growing digital economy in the country. A regulatory framework like this will improve the ecosystem for startups as well as encourage investors to invest in startups which will in effect create more employment and improve the economy of the nation.

AOC Solicitors

Adedunmade Onibokun & Co.

info@aocsolicitors.com.ng

www.aocsolicitors.com.ng

[1] World Bank “Doing Business 2020” available at https://openknowledge.worldbank.org/bitstream/handle/10986/32436/9781464814402.pdf?sequence=24&isAllowed=y (Accessed 20 October 2022)

[2] Section 13(2) of the Nigerian Startup Act 2022

[3] Section 17 of the Act, withdrawal of a Startup Label

[4] Section 10(1) and (2) of the Act.

[5] Section 12 0f the Act

[6] Section 3(1) of the Act

[7] Section 7(1) of the Act

[8] Section 7(2) of the Act

[9] Section 9 of the Act

[10] Section 19 of the Act

[11] Section 21 of the Act

[12] Section 22 of the Act

[13] Section 23 of the Act

[14] Section 24 of the Act

[15] Section 26 of the Act

[16] Secton 27 of the Act

[17] Section 29 of the Act

[18] Section 30 of the Act

[19] Section 31 of the Act

[20] Section 33 of the Act

[21] Section 34 of the Act

[22] Section 35 of the Act

[23] Section 36 of the Act

[24] Section 37 of the Act

[25] Section 39 of the Act

[26] Section 41 of the Act

Originally published by AOC.

by Legalnaija | Jul 29, 2022 | Blawg

DIY Legal Agreements!

Do you know you can generate customized legal documents on our website and it takes less than 10 minutes?

Using our smart contract templates is cheaper, faster and easier than any other alternative. Documents available include;

– Affidavits

– Tenancy Agreement

– MOUs

– Employment Agreement

– Uber Agreement

– Non Disclosure Agreement

– Licensing Agreements

And more.

Visit our website to get started https://app.legalnaija.com/shop/templates

Bet your friends, colleagues and family members will find this useful.

@legalnaija

www.legalnaija.com

One-stop-shop for legal

09029755663

by Legalnaija | May 10, 2022 | Blawg

What is an art licensing agreement?

An artist licensing agreement allows an artist while retaining full copyright ownership of their work, to grant permission to another party to use their art.

How it works

As an artist, your job is to paint masterpieces and you must have created some amazing pieces of art in your career, which are no doubt collectors’ items. Now imagine, a brand or company wants to use your art in a promotional material, film or commercial. A licensing agreement is the legal document the artist signs with the brand or company wanting to use the art work. In this relationship, the artist is known as the Licensor, while the company or brand is known as the Licensee.

As an artist and the creator of your works of art, you are the sole owner of your work’s copyright, until you sell or transfer the copyright to another entity. Whether you become involved in an artist licensing agreement for a short amount of time, or permanently, you still own the rights to your work. As sole owner, you retain several absolute rights for the works you produce under the Copyright Act.

The Terms Covered in an Artist Licensing Agreement are

* Who the artist is and who the client is

* The duration of time that the licensing agreement will last

* The products that the artist’s images will appear on

* The distribution and the selling of the products that have the artist’s artwork on them

* The artist will have approval in how the client treats the artwork

* How much the client will agree to pay the artist in advance and in royalties

* The frequency that the client will pay the artist for the use of their work

* How the artist can exit the licensing agreement if they no longer want to be apart of it

The benefit of licensing your work can be quite substantial including more financial income.

If you are considering getting a licensing agreement for your images, you can customize and download one in less than 5 minutes to your email. Plus its cheaper, faster and easier.

Simply visit legalnaija.com to get started.

@Legalnaija

www.legalnaija.com

by Legalnaija | May 7, 2022 | Blawg, Book, Directory

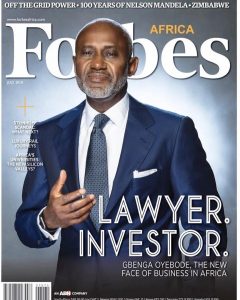

Did you know some of the richest lawyers in Nigeria include Wole Olanipekun SAN, Chief Afe Babalola SAN, Wale Babalakin SAN, and Gbenga Oyebode. Also, some of the richest lawyers in the world according to Biglaw Investor, include Wichai Thongtang from Thailand worth $1.8 billion; Charlie Munger worth $1. Billion, and Bill Neukom worth $850 million. You may be familiar with some of these names. Contrary to what some people will have you believe, being a lawyer is still one of the highest paying careers in Nigeria and the world.

However, like every other profession or career, success does not come easy, it takes hard work, dedication, and integrity to become a successful lawyer. Also, Nigerian lawyers have an advantage over certain lawyers in other jurisdictions, being that Nigerian lawyers are called as Barristers and Solicitors, meaning you can earn money either as a Barrister, a Solicitor, or both.

If you will like to become one of the highest paying lawyers, here are a five tips you can include in your everyday schedule that will have on your way;

- Learn, unlearn and relearn every day.

- Be Organized

- Build and maintain a network

- Take advantage of technology

- Be creative and innovative

Interestingly, at Legalnaija, we also have tools that can help advance your law career, increase your income and promote your brand. Some of these include;

- The Lawyers Directory which helps users find you online through your area of practice, location and gender.

- The Blawg on which you can publish your expert opinions, commentaries and law articles for the public to read.

- Our Contract Templates which cut drafting time by over 98% so you can focus on more serious matters.

- The Online Bookstore where you can order some of the most recent legal textbooks and journals in your area of practice.

- A Research Assistant that cuts your research time significantly by providing you with quick answers, and

- Our Online Dispute Resolution platform where you can negotiate, record and resolve your client disputes.

All the tools mentioned above are available on our website www.legalnaija.com and taking advantage of them is what you need to get you on your way to success.

Remember, we are always rooting for you.

Image credit: www.bellanaija.com

by Legalnaija | Mar 8, 2022 | Blawg, Law

“it’s money 2.0, a huge, huge, huge deal” – Chamath Palihapitiya. Venture Capitalist.

Hardly does a week go by, that there is no news about cryptocurrency or Bitcoin. It’s either the urgency to invest in it or its volatile nature. Infact, Nigeria through its Central Bank activated on Monday, 25th October, 2021 it’s digital currency (Central Bank Digital Currency – CBDC) called ‘e-Naira’

Advocate of digital currency see it not just as the future of money but it’s present.

“Bitcoin will do to banks what email did to the postal industry” – Rick Falkvinge (Swedish Pirate Party Leader).

“as the value goes up, heads start to swivel and skeptics begin to soften. Starting a new currency is easy, anyone can do it. The trick is getting people to accept it because it is their use that give the money value” – Adam B. Levine.

There are those who do not see any value in Digital Currency (cryptocurrency). They don’t understand it nor care to, they consider it a fraud/scam.

“What value does cryptocurrency add? No one has been able to answer that question to me” – Stevie Eisman.

“It is a mirage basically, it’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money too. Are checks worth a whole lot of money just because they can transmit money?… The idea that it has some huge intrinsic value is just a joke in my view – Warren Buffett

Digital currency is any means of payment for goods and services that exists in a purely electronic form, it is not physically tangible like a money note or coin. It is a medium for daily transactions but it is not cash. It is important to state that the money in your online bank account is not digital currency because it takes on a physical form when you withdraw it from an ATM (Automated Teller Machine). In 2020, Warren Buffett had this to say ” cryptocurrency basically has no value and they don’t produce anything. They don’t reproduce, they can’t mail you a check, they can’t do anything and what you hope is that somebody else comes along and pays you more for them later on, but then that person’s got the problem. In terms of value: zero”

Like it or not, there are people who belong to the same school of thought as Warren Buffett.

Before answering the question, If it is possible to buy a property with digital money? Let’s understand what digital money (currency) is and how it works?

The fact that it doesn’t exist in physical form does not mean it isn’t worth anything. The basis for the creation of digital currency was to fix the flaws with the way money is transmitted from one person to another.

There are different types of digital currency:

- Central Bank Digital Currencies (CBDC):- are currencies issued by the Central Bank of a country. It is a virtual form of a country’s fiat currency. It aims to ease monetary policy implementation by removing intermediaries (banks and financial institutions) and establishing a direct connection between the government and the average citizen. It can also be used for financial inclusion. Examples; e-Naira (Nigeria), Sand Dollar (Bahamas), DCash (Antigua and Barbuda). According to Alanticcouncil.org CBDC tracker, 87 countries are now exploring a CBDC. 7 countries have now fully launch a CBDC, Nigeria being the latest country to launch its CBDC.

- Cryptocurrencies:- are digital currencies designed using cryptography (Blockchain technology). Examples; Bitcoin, Ethereum, Binance coin, Cardano, Tether, Solana, Polkadot, Doge coin etc.

- Virtual Currencies: are digital representations of value, its transactions occur solely on online networks or the internet. They are largely unregulated, issued and controlled by its developers. They are used and accepted electronically among members of a specific virtual community i.e. private organizations or groups of developers.

Examples are tokens and cryptocurrencies. They are not used as a payment method in mainstream society, but mostly in gaming communities.

Digital currencies, Virtual currencies, cryptocurrencies all sound and work in a similar way, however they are different. All Virtual currencies and Cryptocurrencies are digital currencies but not all digital currencies are virtual Currencies, for example; CBDCs are not virtual currencies or cryptocurrencies.

Digital currencies can be regulated or unregulated. CBDC is an example of a regulated digital currency and Bitcoin is an example of an unregulated digital currency. Cryptocurrencies uses cryptography to secure their networks while Virtual currencies may or may not use cryptography.

Digital Currency is built through the Blockchain technology, which is a digital ledger where all transactions involving a digital currency are stored. All digital currencies are created, stored and exchanged on their own separate Blockchain networks. A digital currency’s blockchain network is a digital ledger of all transactions on that currency. New transactions are grouped into blocks, each block is confirmed and validated by multiple users through out the network, before being added at the end of the chain. Every user has their copy of the ledger and it is constantly updated.

How do people use digital currency? How can fraud and manipulation be eliminated from a transaction between users? This leads us to a process called ‘ Mining’. Miners confirm all the transactions inside a new block so it can be recorded and sealed on the Blockchain ledger. To regulate the supply of the currency and control inflation, the blockchain software protocol makes it increasingly difficult for miners to generate hashes and confirm new blocks as the network grows in size. This guarantees accountability, transparency and stability for networks and their currencies.

Remember that digital currency does not exist in physical form, then how do I store it?

When digital currency are mined on their blockchain and transferred between users, they must be stored in a digital currency wallet. The wallets are pieces of software which can be used to store digital currencies securely for an indefinite period of time. All digital currency wallets have a public key and at least one private key.

When you send and/or receive digital currency

,the transaction is recorded on the ledger, everyone can see but it documents only your wallet location and none of your personal identifiable information this ensures anonymity. The private key can only be seen by the owner of the wallet. It contains the cryptographic information needed to authorize transfers out of the wallet, this key should never be shared.

WHY IS DIGITAL CURRENCY (CRYPTOCURRENCY) SO POPULAR?

- It is seen by some as the currency of the future therefore there is the urgency to buy them now before they become more valuable.

- There are no intermediaries, no third party financial institution is required to oversee the transactions.

- It is decentralized. There is no single data center where all transactions data is stored. Data from this digital ledger is stored on hard drives and serves all over the world.

- Because there are no intermediaries, transmission of money is faster and cuts back on costs.

- There is no need for a physical storage and safekeeping unlike cash.

- Digital Currency transactions can become censorship resistant and impervious to tracking by government and other authority.

- It ensures the inclusion of groups of people previously excluded from the economy. For instance; the unbanked can still participate in the economy using digital currency in their online wallets or mobile phones.

- It simplifies accounting and recording keeping for transactions through technology.

As with all things, there are upsides and downsides. The disadvantages of digital currency are:

- It is an uncharted and unfamiliar territory for most policy makers thus presenting challenges on the policy framework.

- It is a target for hackers who can steal from digital wallet

- It has its own cost. You need digital wallet to store your digital currencies, system that uses Blockchain also have to pay transaction fees.

The use of digital currency is growing everyday and may take center stage in financial transactions. Buying a property, be it for home ownership or investment purposes is a huge and important decision and security is a critical element in real estate investment. Presently, you can pay for a property using cash, bank transfers and credit card payments. The question is can I buy or sell a property using digital currency?

Nigerians are heavy cryptocurrency users, second to the United States of America. According to paxful platform, in 2020, 1.1 million cryptocurrency trades were recorded per month in Nigeria.

Why is cryptocurrency popular in Nigeria?

Some use it to protect their savings against the Naira depreciation, others as an alternative source of income, as a way to get around foreign currency restrictions etc. Despite, it being a high risk investment, its usage and trading in Nigeria continue to increase.

Back to the question, if one can buy or sell a property using digital currency? Yes, it is possible in some markets though it is a novel concept. For instance, the first property to be sold for Bitcoin was in Austin, Texas in 2017. It is important that you understand cryptocurrencies, digital Currencies, how it works, before using them for real estate assets.

In certain markets and jurisdiction, the Crypto- property market is gradually opening up. There are property sellers and buyers willing to accept cryptocurrencies. There are also Property Lawyers in crypto real estate transactions. In October, 2017, the first Ethereum real estate transaction was conducted, Michael Arrington (Founder of TechCrunch) bought an apartment in the Ukrainian market using an Ethereum smart contract.

Before you buy a property using cryptocurrencies, you must:

- Understand and educate your about digital Currencies and Cryptocurrencies. How it works, the market and the risks involved.

2 .Find a seller willing to accept it as payment. In some markets, there are sellers and agents who list their properties stating their willingness to accept cryptocurrencies, though some use this as a strategy to generate buzz for their properties. Some request for payment split between cryptocurrencies and traditional currency.

- Set the standard. Cryptocurrency is highly volatile therefore when using it to purchase a property, it is best to set the purchase price of the property in fiat currency (government issued currency. Modern paper money e.g. US Dollars, British Pounds, Naira etc). The contract must expressly state how the cryptocurrency will be settled. For instance: if the purchase price for the property is 20 Million Naira and the price/value of the cryptocurrency drops at the close of the purchase transaction, the buyer must make up the difference or where the price/value of the cryptocurrency increases in value and the transfer has been done, the surplus should be returned to the buyer.

- Verify: Always conduct your due diligence because the use of cryptocurrencies in real estate transactions is a novel concept, cryptocurrencies are volatile, susceptible to hacking and can be used for money laundering.

- Find the right people to work with. Because many people still do not understand how it works, others see cryptocurrencies as ‘fake internet money.

CONCLUSION

Despite the advantages in using cryptocurrencies in real estate transactions, it must be understood that it has a high price volatility risk. The value can change in seconds during the course of a sale transaction which may lead to the seller opting out. Further it is a new concept, many are not familiar with it and thus it would be difficult to find a seller willing to accept it over the traditional currency particularly in the Nigerian property market. Where one even finds a willing seller, he/she may be nervous about closing a transaction because of its price volatility.

In the real estate market, cryptocurrencies are considered as very risky or an unknown, therefore there are very few players willing to work with it

REFERENCES

- Investopedia

- com/how digital currency works.

- com Forbes.com Bloomberg.com Thisday.com Rockethq.com Chainalysis

- org/CBDC Tracker Wikipedia

- ng

Ololade O. Soda-Pereira is a Legal practitioner, Writer and Researcher with 15 years experience in legal practice and specialization in the following practice areas; Property Law, Estate Planning and Succession, Commercial Law, Legal Audit for SMEs and financial institutions. She is known for her Law and Me Series currently on her social media handles where she answers questions on the problems and challenges faced in the acquisition and investment in real estate and offers legal tips for SMEs to scale up their businesses and improve their service delivery.