by Legalnaija | Sep 18, 2024 | Blawg, Book

Customer Review Highlight On The Legalnaija Bookstor

Being the only online bookstore for lawyers in Nigeria has been an interesting and challenging journey, filled with both rewarding moments and tough obstacles. We have had extremely satisfied customers like this customer in Lagos who wrote;

“At first I was unsure whether to trust Legal Naija especially as you didn’t offer a pay on delivery service. However, the books are relatively affordable, high quality, and not pirated.You are genuine with seamlessly timeous delivery.”

– N. Egbumokei (Lagos)

We have also had customers whose books were delivered late like the customer in Kano who wrote;

“You’re indeed a reliable law bookstore. Your law books are such worthy that any serious legal practitioner must have them on his bookshelf. However, my only problem with you is the way of your delivery. For those of us who’re outside your place of business, it takes up to two weeks or more before the books we order reach us. I sometimes even started thinking that I might have been trapped by scammers due to the time the books took before they reached my destination. Anyway, you’re reliable. Thanks.”

– M. Mahmoud (Kano)

While we’re thrilled to hear that our law books are a must-have for any serious legal practitioner! Your trust means the world to us. We acknowledge the delivery delays for our customers outside our immediate area and are actively working to improve this in collaboration with our delivery Partners. We’re committed to ensuring faster and more reliable delivery times so you can get your essential legal resources without the wait.

At Legalnaija, we’re dedicated to providing the best resources for your legal journey. Visit us to discover a wide range of legal texts, guides, and more. You can always access over 150 law books and resources on www.legalnaija.com/store.

You can also get 10% off all your orders this month of September when you use the voucher code: NQ4CYAVV at check out.

Explore the World of Legal Knowledge at Legalnaija Bookstore! Stay tuned for updates on new arrivals, events, and exclusive offers!

Thank you for your patience and continued support!

by Legalnaija | Sep 15, 2024 | Blawg, Book

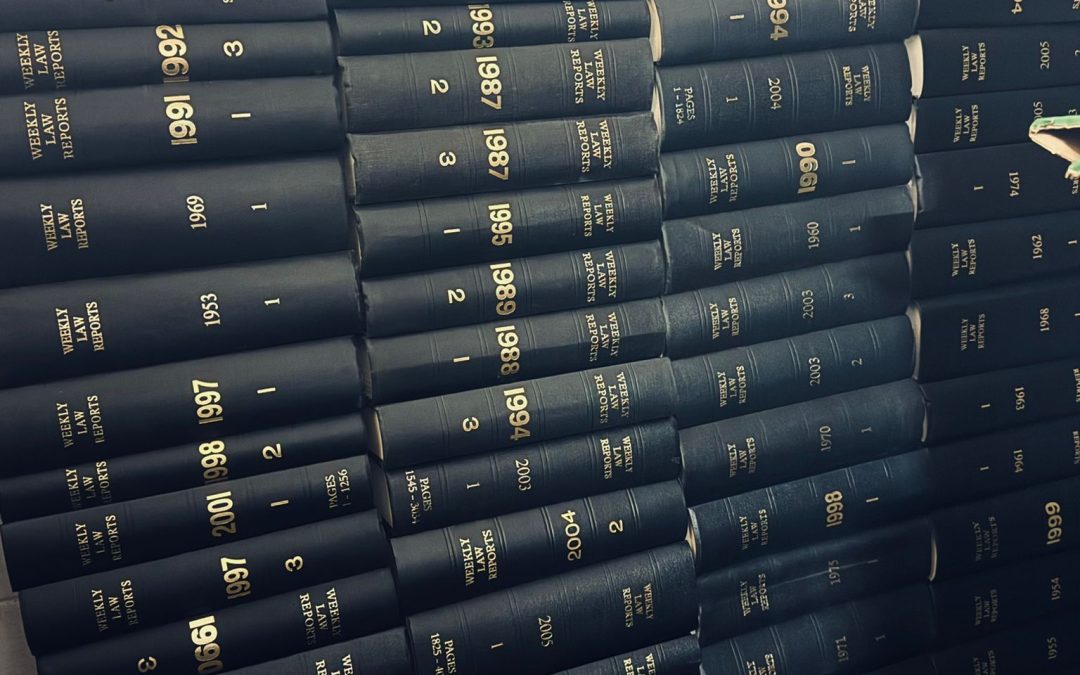

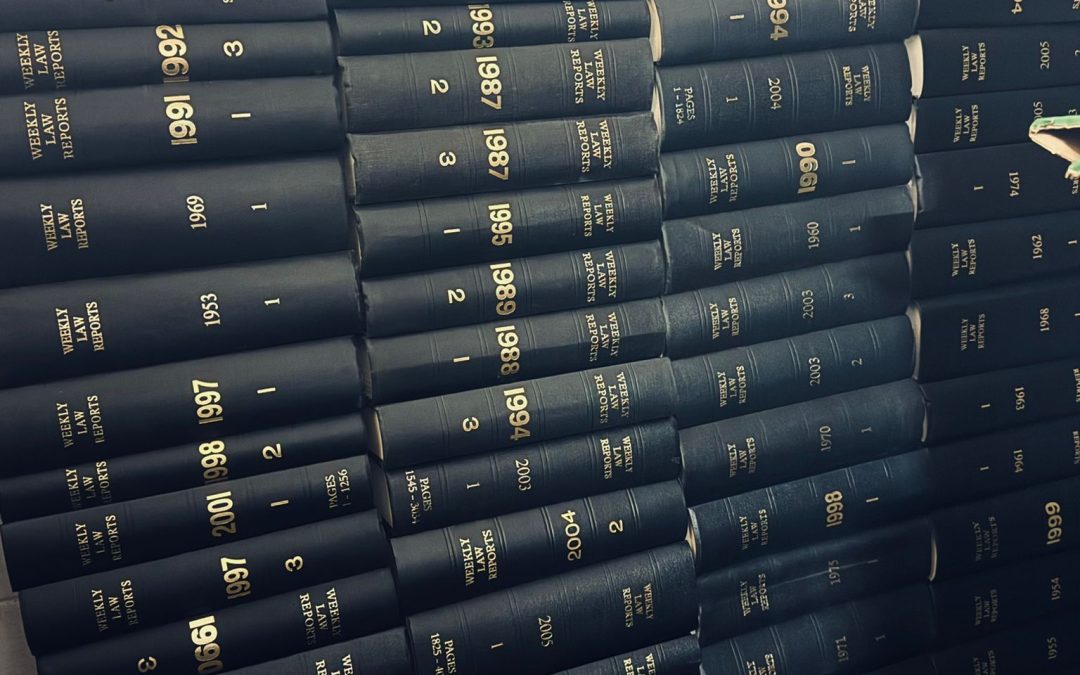

Attention Lawyers and Law Firms! Update Your Library With International Textbooks And Law Reports

Enhance your legal library with premium law reports and resources available at the @Legalnaija Bookstore. We offer a wide range of essential legal texts to support your practice:

1. Criminal Appeal Reports (1909-2014)

2. Atkins Court Forms 2D** – Complete set of 90 volumes

3. Atkins Court Form

4. All England Law Reports

– 1950-2000

– 1950-2002

– 1945-2009

– 1558-1935

5. Encyclopedia of Forms and Precedents- 110 volumes

6. Encyclopedia of Forms and Precedents 4th Ed

7. Halsbury Statutes:

– 80 vols set for

– 90 vols set for

– 100 vols set

8. Weekly Law Reports- 500 mixed volumes

9. Weekly Law Reports (1953-2008)

10. Weekly Law Reports (1953-2012)

11. Atkins Court Forms- 100 volumes set

12. Criminal Appeal Reports (1909-2014)

13. Current Law Statutes (1976-2012)- Around 200 volumes

14. Cambridge Law Journal (1969-2007)

15. Bankruptcy and Personal Insolvency (2002-2013)

16. Lloyds Law Reports (1976-2012)

17. Butterworths Company Cases (1984-2011)

18. Journal of Planning and Environmental (1987-2017)

19. Industrial Relations Law Journal (1984-2003)

Don’t miss out on these invaluable resources! Visit our bookstore today and elevate your legal practice with the best in legal literature.

To order copies, send a mail to hello@legalnaija.com or call 09029755663.

by Legalnaija | Sep 13, 2024 | Blawg, Book

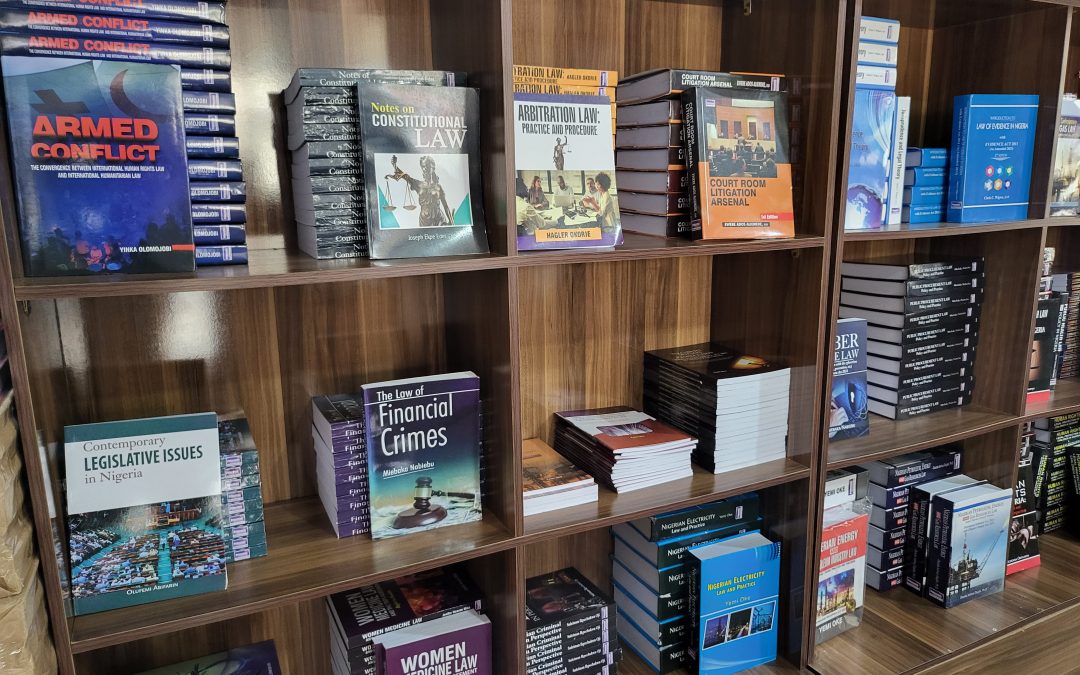

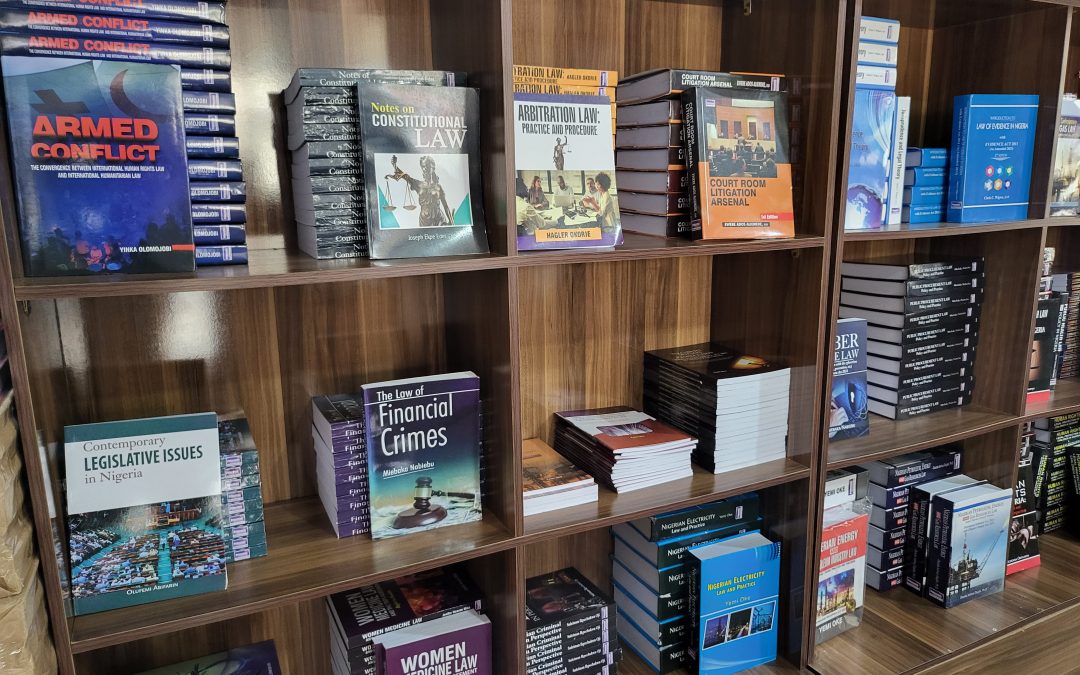

Discover the Latest Additions at Legalnaija Bookstore!

We’re excited to announce that our bookstore has been updated with a fantastic selection of new law books! Whether you’re a seasoned lawyer, a law student, or simply passionate about legal knowledge, we have something for everyone.

Explore our diverse collection, including titles on criminal law, corporate governance, human rights, and more. Here are just a few of the new arrivals.

Visit https://www.legalnaija.com/store to browse and order your copies today.

Stay informed, stay ahead. Happy reading!

Legalnaija Team

#legalnaija #bookstore #nigerianlawyers #lawbooks #lawpublications #law #legal #legalnaijabookstore

by Legalnaija | Sep 2, 2024 | Blawg

ILA CONGRATULATES PATRON, AARE AFE BABALOLA, SAN, OFR, CON, FKC, LL.D (LONDON), ON THE DECLARATION OF AFE BABALOLA DAY BY NIGERIAN MONARCH

The International Law Association (ILA) has congratulated the Chancellor and Founder of Afe Babalola University, Ado Ekiti (ABUAD), Aare Afe Babalola, SAN, OFR, CON, LLD (London), on the royal proclamation of October 18 as Afe Babalola Day.

Recall that on 23rd August 2024, revered Nigerian monarch, the Ewi of Ado Ekiti, His Royal Majesty, Oba (Dr) Adeyemo Adejugbe Aladesanmi III, CON, JP, by royal proclamation directed that: “The Pride of Ado Ekiti, Aare Afe Babalola should be honoured and celebrated with pomp and pageantry on every 18th day of October with effect from 2024 and this shall henceforth be celebrated annually…”

By this royal gesture, Aare Afe Babalola, SAN, OFR, CON, LLD, Founding Patron of the International Law Association, Nigeria; distinguished member of the Bar of England and Wales, a foremost lawyer and Senior Advocate of Nigeria, a philanthropist, winner of the African Man of the Year in Food Security (2014 and 2024), the Aare Baamofin of Yoruba Empire, a celebrated advocate of quality and functional education in Nigeria, former Pro-Chancellor of the University of Lagos, former Chairman of all Pro-Chancellors of Nigerian Universities and the Founder of the prestigious Afe Babalola University, Ado-Ekiti (ABUAD) ranked by Times Higher Education Impact Rankings as number one in Nigeria for impact for three consecutive years: 2022, 2023 and 2024, No. 4 in Africa, and No. 142 amongst the 2,152 universities ranked globally in 2024 – becomes only one of the handful of Nigerians ever to be so honoured.

The President of the International Law Association, Nigeria, who is also a United Nations Independent Expert, Professor Damilola S. Olawuyi, SAN, FCIArb, has consequently sent a letter of congratulations to the living legend and foremost mentor on this rare and prestigious honor.

According to Professor Olawuyi, SAN “Aare Afe Babalola’s remarkable journey as a renowned advocate, farmer, philanthropist, educator, bridge builder, author and global citizen is an inspirational example of everything we strive to do as international lawyers: to advance global peace, to empower, and to give back to the poorest of the society. His outstanding dedication to educational reform, relentless quest for justice, and exemplary devotion to lifting others through his matchless record of philanthropy make him a deserving recipient of such a rare and prestigious honour. We are so proud of our Patron, and we earnestly look forward to organizing a World Press Conference on October 18 to celebrate the Afe Babalola Day.” the Learned Silk concluded.

Founded in 1873 in Brussels, the International Law Association is a learned society dedicated to the study, clarification and development of international law and the advancement of peace, equity and justice worldwide. The Nigerian Branch regularly organizes conferences, workshops and events aimed at promoting the study, elucidation, and advancement of international law.

by Legalnaija | Aug 31, 2024 | Blawg

The Benefits of Legal Directories for Lawyers and Law Firm

In today’s digital age, having a strong online presence is crucial for lawyers and law firms. One of the most effective ways to enhance visibility and attract potential clients is by listing in legal directories. Here are some key benefits:

1. Increased Online Visibility

Legal directories are powerful tools for amplifying your law firm’s online presence. By being easily searchable by practice area, location, and other categories, these directories help potential clients discover your services more efficiently.

Enhanced SEO

Listings in reputable legal directories can significantly boost your website’s search engine optimization (SEO). These directories often provide authoritative backlinks to your site, which search engines recognize as a sign of credibility and relevance. This can lead to higher rankings in search results for keywords related to your practice areas.

3. Improved Reputation and Trust

A well-maintained profile in a legal directory showcases your firm’s achievements, experience, and client reviews. This not only strengthens your online reputation but also builds trust with potential clients. Trust is a critical factor in the legal industry, where clients seek reliable and experienced professionals.

4. Lead Generation

Legal directories act as a magnet for potential clients actively seeking legal assistance. By providing detailed information about your services, contact details, and areas of expertise, these directories can drive highly relevant traffic to your firm. This alignment increases engagement and supports a stronger local SEO presence.

5. Cost-Effective Marketing

Compared to other forms of advertising, listing in legal directories is often more cost-effective. Many directories offer free or affordable listing options, making it accessible for firms of all sizes to leverage this marketing tool.

6. Networking Opportunities

Being part of a legal directory also opens up networking opportunities with other professionals in the industry. This can lead to valuable collaborations, referrals, and a stronger professional network.

Why Legalnaija Directory is the Best for Nigerian Lawyers

For Nigerian lawyers, the Legalnaija Directory stands out as the premier choice. It is specifically tailored to the Nigerian legal market, providing a comprehensive platform that connects lawyers with potential clients and peers. With its user-friendly interface, detailed profiles, and extensive reach, Legalnaija ensures that your firm gets the visibility and recognition it deserves. Join the Legalnaija Directory today and take your practice to the next level!

Visit app.legalnaija.com to visit the lawyers directory and subscribe.

by Legalnaija | Aug 30, 2024 | Blawg

ABSTRACT

Financial crime is a menace constantly plaguing many nations of the world and Nigeria is not an exception. In 2002, the FATF (Financial Action Task Force), an inter-governmental body responsible for combating money laundering globally, reported that Nigeria has been non-cooperative in the fight against money laundering. It was on this premise that the Economic and Financial Crimes Commission (Establishment) Act 2002 was enacted by the Obasanjo led administration to fight against money laundering. The Act was repealed by the EFCC Act 2003 and then subsequently the EFCC Act 2004. This paper will appraise the effectiveness of the Act in combating financial crimes. This paper employs the doctrinal methodology and finds, among other things, that the provision of section 14 (2) of the Act which empowers the Commission to compound offences, does not serve as a deterrent against financial crimes, though a faster means to dispense with cases by the Commission, it does not stop the commission of financial crimes but rather encourages the commission of financial malpractice. Furthermore, this paper finds that the Act allows the Commission to accept monetary gifts and property from a person or an organization. This paper recommends that the provision of Section 14 (2) should be applied with caution to avoid abuse and the Commission should desist from relying on the Section for plea bargain in releasing criminals which is not the contemplation of the aforesaid Section. Also, that Section 35(3) of the Act should be expunged from the Act because as an anti-graft agency, accepting monetary gifts can undermine the integrity of the Commission in the fight against financial crimes especially cases involving politically exposed persons.

- INTRODUCTION

Among the most difficult challenges inherited by the Nigerian democratic government in 1999 was excessive corruption[1]. To tackle corruption and financial crimes, the Obasanjo led administration enacted the Economic and Financial Crimes Commission (Establishment) Act 2002 which was subsequently repealed by the EFCC Act 2003 and then same was further repealed by the EFCC Act 2004 which is subsisting till date. The Actand other laws such as the Money Laundering Act[2], the Advanced Fee Fraud and Other Related Offences Act[3], Independent and Corrupt Practices & Other Related Offences Act[4], the Failed Banks (Recovery of Debt and Financial Mal-practices in Banks) Act (As Amended)[5]were established to combat corruption and financial crimes particularly the EFCC Act which was enacted as a response to the report published by the FAFT (Financial Action Task Force)in 2002 over Nigeria’s non-cooperativeness in the fight against money laundering globally[6].

The Act established the Economic and Financial Crimes Commission designated as the Financial Intelligence Unit (FIU) in Nigeria, charged with the responsibility of co-ordinating the various institutions involved in the fight against money laundering and enforcement of all laws dealing with economic and financial crimes in Nigeria[7]. Therefore, the primary role of the Commission is to investigate and prosecute economic and financial crimes, such as advance fee fraud, money laundering and misapplication and misappropriation of publicfunds etc[8]. The Act consist of 47 sections, 7 parts and 1 schedule. To evaluate the significance or effectiveness of the Act, it will be in order to consider the performance of the Commission which was established by the Act to carry out the prescribed provisions of the Act. In a recent public sensitization lecture at the University of Abuja, the newly appointed Executive Chairman of the Commission, Mr Ola Olukoyede disclosed that the Commission secured 3,175 convictions and recovered N156,276,691,242.30 (One Hundred and Fifty-six Billion Two Hundred and Seventy-six Million Six Hundred and Ninety-one Thousand Two Hundred and Forty-two Naira Thirty Kobo) between 29 May 2023 and May 29, 2024 when President Bola Ahmed Tinubu assumed office[9].However, the Commission has had to suffer some losses as well as being plagued with challenges such as interference with the activities of the Commission by politically exposed persons, internal challenges within the Commission, weak judicial system, fraudulent practices by defence attorneys, delay in prosecution due to immunity guaranteed by the Constitution etc[10].

This paper is divided into 9parts; part 1 is the introduction, part 2 deals with financial crime and its impact in Nigeria, part 3 covers the functions and powers of the Commission, part 4 highlights the offences and penalties prescribed by the Act, part 5 analyses the effectiveness of the Act in combating financial crimes, part 6 examines the challenges with the administration of the EFCC Act in combating financial crimes, part 7 deals with the comparison between Nigeria, France and Ireland in combating financial crimes, part 8 is the conclusion and part 9 is the recommendation.

- FINANCIAL CRIME AND ITS IMPACT IN NIGERIA

Prior to the enactment of the Act of 2002 as amended by the EFCC Act 2004, there was no comprehensive definition of what constitutes financial crime. Section 46 of the Act[11]defines financial crime as the non-violent criminal and illicit activity committed with the objectives of earning wealth illegally either individually or in a group or organized manner thereby violating existing legislation governing the financial actions of a government and its administration and includes any form of fraud such as: money laundering, embezzlement, bribery, looting and any form of corrupt malpractices, illegal arms deal, smuggling, human trafficking and child labour, illegal oil bunkering and illegal mining, tax evasion, foreign exchange malpractice including counterfeiting of currency, theft of intellectual property and piracy, open market abuse, dumping of toxic waste and prohibited goods etc.Financial crimes are crimes committed not only with the intention of getting financial benefit but they are targeted directly on funds and financial instruments. Although, there is no significant line between financial and economic crimes, not all financial crimes are economic crimes. Financial crimes may be carried out by individuals, corporations, or by organized crime groups. Victims may include individuals, corporations, governments and an entire economy.[12]

In recent years, it has given Nigeria a bad name in international finance circle to the extent that Nigerian government had to respond with the establishment of the Economic and Financial Crimes Commission and the Independent Corrupt Practices and Other Related Offences Commission to deal with the enormous negative consequences of financial crimes. This can be seen from the consistent ranking of Nigeria as one of the most corrupt countries in the world by the Corruption Perception Index (CPI) since its inception in 1995 and also the listing of Nigeria as non-cooperative country and territory by the FAFT in 2001[13]. Financial crimes have a negative consequence on the Nigerian economy with over N85 billion recovered so far through government directed efforts; there is no doubt that financial crimes remain a serious threat to Nigeria’s quest for development.[14]

Some of the financial crimes associated with Nigeria include: cheque fraud, that is, suppression, dub cheques, diversion of proceeds, cheque kitting etc. unauthorized credits, telex, transfer frauds, electronic payment fraud, advanced fee fraud, embezzlement etc. these crimes were noted to have contributed significantly to the failure of the Nigerian Project. It has also been noted that the lack of political will to fight financial crimes, lack of adequate training exposure, incentives to law enforcement agencies, failure of sanctions, phenomenal advances in technology and permissiveness of criminal conduct in Nigeria are major encouraging factors in economic and financial crimes.[15]

- FUNCTIONS AND POWERS OF THE COMMISSION

The Act provides for both the functions and special powers of the Commission. The functions of the Commission are expressly provided for in the Act[16]. Section 6 (m) and Section 46 of the Act vest in the EFCC the function and duty of investigating and prosecuting persons reasonably suspected to have committed economic and financial crimes[17]. The special powers of the Commission include:

- To cause investigations to be conducted as to whether any person, corporate body or organization has committed an offence under this Act or other law relating to economic and financial crimes.[18]

- to cause investigations to be conducted into the properties of any person if it appears to the Commission that the person’s life style and extent of the properties are not justified by his source of income[19].

In addition to the powers conferred on the Commission by the Act, the Commission shall be the co-ordinating agency for the enforcement of the provisions of[20] –

- the Money Laundering Act 2004

- the Advance Fee Fraud and Other Related Offences Act 1995

- the Failed Bank (Recovery of Debt and Financial Mal-practices in Banks) Act as amended

- the Bank and Other Financial Institutions Act 1991, amended

- Miscellaneous Offences Act and

- Any other law or regulation relating to economic and financial crimes, including the Criminal Code and Penal Code.

It is worthy of note, sub-section (2) of Section 7 of the Act allows the Commission to investigate and prosecute Economic and Financial Crimes under the existing legislation such as the Constitution particularly Section 419[21]. The Section empowers the EFCC to enforce other existing penal statutes. The EFCC Act is an Act which was promulgated to stem the scourge of advance fee fraud[22]. Indeed, the effect of the combined provisions of Sections 6 (b); 7(1)(a) & (2)(f) and 13(2) of the EFCC (Establishment) Act, leaves no doubt that the EFCC has the power to investigate, enforce and prosecute an offender on any other statute, in so far as the offence relates to commission of economics and financial crimes.[23]

- OFFENCES AND PENANLTIES PRESCRIBED BY THE ACT

- Offences relating to Financial Malpractice[24]:

Section 14 provides for offences relating to financial malpractices. This section provides that an officer of a bank or non-financial who fails or neglect to secure compliance with the provisions of this Act; or fails to secure authenticity of any statement submitted pursuant to the provisions of this Act commits an offence and is liable upon conviction to 5 years imprisonment or a fine of N500,000 or both. Section 14 (2) provides for powers of the Commission to compound any offence. Compounding crime consists of the receipt of some property or other consideration in return for an agreement not to prosecute or inform on one who has committed a crime[25]. The content of the provision in Section 14(2) of the Economic and Financial Crimes Commission Act, 2004 is that the following factors are present: the EFCC has the power to compound an offence, the offence compounded must be one that is punishable under the EFCC Act, the EFCC can accept money in compounding the offence, the sum of money the EFCC can accept must be that which mustexceed the maximum amount to which that person would have been liable to pay if he had been convicted of that offence.[26]

- Offences in relation to Terrorism[27]:

A person who wilfully provides or collects by any means, directly or indirectly, any money from any money from any other person with intent that the money shall be used or is in the knowledge that the knowledge that the money shall be used for any act of terrorism, commits an offence under this Act and is liable on conviction to imprisonment for life[28]. Any person who commits a terrorist act or participates in or facilitates the commission of a terrorism act, commits an offence under this Act and is liable on conviction to imprisonment for life.[29] Any person who makes funds, financial assets or economic resources or financial or other related services available for use of any other person to commit or attempts to commit, facilitate or participate in the commission of a terrorist act is liable on conviction to imprisonment for life.[30]

- Offences relating to False Information:[31]

Any person who in the discharge of his duty under this Act gives information which is false in any material particular to any other act in relation thereto commits an offence under this Act and the onus shall be on him to prove that he exercised due diligence to prevent the commission of the offence having regards to the nature of his function and circumstances. Anyone found guilty shall be liable to be imprisonment for a term not less than 2 years and not more than 3 years, provided that where the offender is a public officer the penalty shall be imprisonment for a term not less than 3 years and not more than 5 years.

- Offences in relation to Economic and Financial Crimes and Penalties[32]

A person who engages in the acquisition, possession or use of property knowing at the time of its acquisition, possession or use that such property was derived from any offence under this Act, engages in the management, organization or financing of any of the offences under this Act, engages in the conversion or transfer of property knowing that such property is derived from any offence under this Act or engages in the concealment or disguise of the true nature, source, location, disposition, movement, rights with respect to or ownership of property knowing that such property is derived from any offence under this Act, commits an offence under this Act and is liable on conviction to imprisonment for a term not less than 2 years and not exceeding 3 years.

- Disclosure of Assets and Properties by an Arrested Person[33]

Where a person is arrested for committing an offence under this Act, such person shall make a full disclosure of all his assets and properties by completing the Declaration of Assets Form as specified in Form A of the Schedule to this act. Failure to make full disclosure of his assets and liabilities or knowingly makes a declaration that is false or neglects or refuses to make a declaration or furnish any information in the Declaration Form, commits an offence under this Act and is liable on conviction to imprisonment for a term not exceeding 5 years.

- Offences in relation to Forfeiture Orders[34]:

Any person who without due authorization by the Commission deals with, sells or otherwise dispose of any property or asset which is the subject of an attachment, interim order or final order, commits an offence and is liable on conviction to imprisonment for a term of five years without the option of a fine. Any manager or person in control of the head office or branch of a bank, other financial institution or designated non-financial institution who fail to pay over to the Commission upon the production to him of a final order, commits an offence under this Act and is liable on conviction to imprisonment for a term of not less than one year and not more than three years, without the option of a fine.

- Power to Receive Information Without Hindrance:[35]

The Commission shall seek and receive information from any person, authority, corporation or company without let or hindrance in respect of offences it is empowered to enforce under this Act. A person who wilfully obstructs the Commission or any authorized officer of the Commission in the exercise of any of the powers conferred on the Commission by this Act or fails to comply with any lawful enquiry or requirements made by any authorized officer in accordance with the provisions of this Act commits an offence under this Act and is liable on conviction to imprisonment for a term not exceeding five years or to a fine not below the sum N500,000 or to both such imprisonment and fine.

- Protecting Informants and Information etc and Penalty for False Information:[36]

Any person who makes or causes any other person to make to an officer of the Commission or to any other Public Officer in the course to the exercise by such public officer of the duties of his office, any statement which to the knowledge of the person making the statement or causing the statement to be made is false or intended to mislead or is untrue in any material particular or is not consistent with any other statement previously made by such person to any other person having authority or power under any law to receive or require to be made such other statement notwithstanding that the person making the statement is not under any legal or other obligation to tell the truth, shall be guilty of an offence and shall on conviction be liable to a fine not exceeding N100,000 or to imprisonment for a term not exceeding 2 years or both.

- EFFECTIVENESS OF THE ACT IN COMBATING FINANCIAL CRIMES

Section 1 (1) of the Act[37] provides for the establishment of the Commission with its functions outlined in Section 6 of the Act. The EFCC Act vests the Commission with exhaustive and sweeping anti-corruption functions which includes investigating financial crimes and adopting measures for the identification, tracing, freezing, seizure and confiscation of the proceeds of terrorist activities and economic and financial crimes. The EFCC Act also ascribes a wide and open ended definition to the term economic and financial crimes, which necessitates it (the Commission), to liaise with several other law enforcement agencies.[38]This paper opines that the provisions of the Act cannot be effectively achieved without the Commission.[39] It is the Commission that carries out the provisions of the Act. Therefore, the effectiveness or otherwise of the Act in combating financial crimes is dependent on theextent to which the Commission applies the provision of the Act in prosecuting and combating financial crimes.

Since the establishment of EFCC, the Commission has been able to recover moneys from alleged corrupt officials. EFCC in 2017 and 2018 has achieved tremendous success, for instance in January 2017, EFCC directed two directors of Ontario Oil and Gas Limited to make restitution of 754 million naira (US$2,464,952), and they were also sentenced to 69 years by Justice Latifat Okunmu of Lagos State High Court. In February 2017, the Commission has recovered N3.04 billion naira (US$9,803,921) from Andrew Yakubu, former Group Managing Director of NNPC. Two ex-governors, Joshua Dariye and Jolly Nyame of Plateau and Taraba States were each convicted and sentenced by a Federal Capital High Court to 14 years imprisonment. Thus the 473 billion naira ($153,744,336) recovered in 2017 included the US$43 million recovered from an apartment in Osborne Towers in Lagos, and money recovered from Allison Madueke (the former Minister of Petroleum). Payment of US$1,044,724 to 20 whistleblowers who provided information that led to the recovery of over 11.6 billion naira in 2017. From May 2003 to June 2004, EFCC recovered money and assets of over N700 billion and arrested over 500 on advance fee fraud cases.

From 2010 to 2014, EFCC recovered N65.3 billion (US$360million). Between January 2015 and November 2018, EFCC secured 703 convictions. Out of these convictions, 103 and 194 were in 2015 and 2016 respectively. Cases of advance fee fraud accounted for 54% of offences investigated by the EFCC in 2015, while in 2014 and 2013 the Commission investigated 59% each in both years. 33% of the cases were Federal related investigations, 58% and 9% were for State and Local Governments respectively. However, most of these prosecutions were targeted on opponents and were being subjected to frequent political interference and is often seen as an arm of the incumbent government without an independent mandate[40]. While corrupt public officials in Nigeria appeared to be protected from the anti-graft institutions as long as the president desired, whereas oppositions or non-loyalists are being terrified by those institutions.[41] In an effort to repatriate stolen money from abroad which was diverted during Abacha’s administration, between 2002 to February 2020, the sum of $4.6 billion (N1.4 trillion) was repatriated to Nigeria. Despite these achievements, EFCC has been accused of not informing the public about the status of cases of many governors, whether such cases have been settled out of court or not.[42]

Currently, the EFCC is seeking to arraign the former governor of Kogi State, Yahaya Bello before the Federal High Court, Maitama, Abuja whose arrest was forestalled by the Kogi State High court. The State High court ruled that the attempt to arrest, detain and prosecute the estranged governor unjustly without proper investigation was a breach of his fundamental right.[43]The former governor is being prosecuted by the EFCC on 19 counts bordering on alleged money laundering, breach of trust, and misappropriation of funds to the tune of N80.2 billion.[44]The anti-graft commission had declared Bello wanted after his successor, Governor Usman Ododo allegedly whisked him away on April 17, 2024, preventing EFCC operatives to arrest Bello when they laid siege to his Abuja residence. The Commission has also received a refund of the sum of $760,910 by the American International School Abuja for an advanced school fees paid to the school by Yahaya Bello.

The EFCC has filed fresh charges, including alleged fraudulent foreign exchange allocation $2 billion, against former CBN governor, Godwin Emefiele. In the fresh 26-count charge filed at the Lagos State High Court in Ikeja, the anti-graft agency said Mr Emefiele while being CBN governor arbitrarily allocated foreign exchange in the aggregate sum of $2 billion.[45] In the Abuja case, the anti-corruption Commission EFCC, accused the former CBN governor of criminal conspiracy, conferring undue advantage, and breach of trust, among others but Mr Emefiele denied the allegations originally captured in six counts. He was first arraigned on 28 November 2023 before the EFCC amended the charges necessitating a re-arraignment. The Commission, in the amended charges increased the number of counts from 6 to 20. The offences, according to the EFCC contravened the provisions of Sections 17 and 19 of the Corrupt Practices and Other Related Offences Act, 2000 as well as Sections 315, 363 and 364 of the Penal Code.

The Chairman of the Economic and Financial Crimes Commission (EFCC), Ola Olukoyede, has said that the anti-graft agency recovered N30 billion in the case involving former Minister of Humanitarian Affairs and Poverty Alleviation, Betta Edu[46]. The Minister was suspended following the approval of N545.2 million into a private account. Following the development, the President ordered an investigation into the allegations and subsequently suspended her from office.[47] The Commission says it has not absolved any of the suspects facing investigations over allegations of corruption perpetrated at the Ministry of Humanitarian Affairs, Disaster Management and Social Development.[48]

In addition, there are a plethora of reported cases of commission of financial crimes by individuals. The acts that constitute the commission of this crime ranges from fraud, identify theft to even obtaining by false pretence. For instance, a report showing the conviction of 8 internet fraudsters also referred to as ‘yahoo yahoo boys’ by the Federal High Court sitting in Calabar, Cross River State on two count separate charges bordering on criminal impersonation, identity theft and obtaining by false pretence.[49] Another instance can be seen in the arrest of ex-bankers for fraud to the tune of N4.2 million by the Commission.[50] These are among the many cases handled by the commission to curtail the widespread of financial crimes in the country.

[1]I. Ahmed, ‘Economic and Financial Crimes Commission (EFCC) and Anti-Corruption Crusade in Nigeria: Success and Challenges’ [2021] 4 GIJMSS <> accessed 5 June 2024

[2] 2004

[3] 1995

[4] 2000 No 5 Laws of the Federation of Nigeria

[5]1994

[6]EFCC, History of EFCC, <http://www. efcc.gov.ng/efcc/about-us-new/history-of-efcc> accessed 6 June 2024

[7]Section 1 (1) (C) EFCC Act 2004

[8]KayodeOladele, ‘The Legal Basis For Relevance, Role and Existence of EFCC – A Rejoinder to Agbakoba’ (2023) <https://www.thecable.ng/the-legal-basis-for-relevance-role-and-existence-of-efcc-a-rejoinder-to-agbakoba/amp/> accessed 9 June 2024

[9]D. Oyewale, ‘EFCC secures 3,175 convictions, recovers N156 billion in one year’ Premium Times (Nigeria)

[10]I. Umar ‘Challenges of the Economic and Financial Crimes Commission and Their Influence on Adoption of Forensic Accounting: A Conceptual Framework’ (2016) QRC <https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://qualitative-research-conference.com/download/proceedings-2016/37-ibrahim%2520umar%2520105 109.pdf&ved=2ahUKEwiq1qC7q86GAxXpTkEAHaBcALMQFnoECB0QAQ&usg=AOvVaw1va9o35qnjgsXf8UQK1ZoJ> accessed 7 June 2024

[11]Economic and Financial Crimes Commission (Establishment) Act 2004

[12]Ikhu-Omorege Sunday and Enimola Henry Bamidele, ‘Financial Crime and its Implications on Banks Performance in Nigeria: A General Appraisal’ International Journal of Sciences: Basic and Applied Research <https://www.core.ac.uk> accessed 26 June 2024

[13]Ibrahim Umar, Rose Shamsiah Samsudin, Mudzamir Mohammed, Ascertaining the Effectiveness of the Economic and Financial Crimes Commission (EFCC) in Tackling Corruptions in Nigeria (2018) Journal of Financial Crime <https://doi.org/10.1108/JFC-01-2017-003> accessed 2 July 2024

[14]Onipe Adabenege Yahaya, Impact of Financial Crimes on the Nigerian Economy, <https://www.researchgate.net/publication/358769842> accessed 26 June 2024

[15]ibid

[16]Section 6 (a)-(q) EFCC Act 2004

[17]Kalau v FRN &Ors (2016) LPELR – 40108 (SC); Section 7 (1) (a)

[18] Section 7 (1) (a) EFCC Act 2004

[19]ibid (b)

[20]Ibid (2) (a)(b)(c)(d)(e)(f)

[21]Nwude v. FRN &Ors(2015) LPELR – 25858 (CA)

[22]Ibid

[23]Nwobike v FRN (2021) LPELR – 56670 (SC)

[24]Section 14 of EFCC Act 2004

[25]Black’s Law Dictionary (9thedn, Thomas Reuters, St Paul MN 2009)

[26]Romrig (Nig) Ltd v FRN (2017) LPELR-43834 (SC)

[27]Section 15 EFCC Act 2004

[28]Ibid (1)

[29]Ibid (2)

[30]Ibid (3)

[31]Section 16 EFCC Act 2004

[32]Section 18 (1)(a)(b)(c)(d) and (2) EFCC Act 2004

[33]Section 27 EFCC Act 2004

[34]Section 32 EFCC Act 2004

[35]Section 38 EFCC Act 2004

[36]Section 39 EFCC Act 2004

[37]EFCC Act 2004

[38]Emilia Onyema et al, The Economic and Financial Crimes Commission and the Politics of (in) Effective Implementation of Nigeria’s Anti-corruption Policy, (2018) <https://eprints.soas.ac.uk/31283> accessed 1 July 2024

[39]Jonah, Uyo-obong Ime, B.L, LL b (Hons)(Calabar); in private practice with Phoenix & Volge LP 100 Marian NLC building, Calabar, Cross River State. Email: uyobongjonah8@gmail.com

[40]Onyema et al, ‘The Economic and Financial Crimes Commission and the Politics of Effective Implementation of Nigeria’s Anti-corruption Policy’ ACE SOAS Paper No. 7/2018 <https://ace.soas.ac.uk> 1 July 2024

[41]Musa I. ‘Assessment of the Effectiveness of Anti-corruption Institutions in the Federal Public Service of Nigeria’(Doctoral dissertation, Ahmadu Bello University 2011) <http://www.kubanni.abu.edu.ng//> accessed 1 July 2024

[42]ibid

[43]Dennis Erezi, Court restrains EFCC from arresting, prosecuting Yahaya Bello, The Guardian <https://guardian.ng/court-restrains-efcc-from-arresting-prosecuting-yahaya-bello/> accessed 6 July 2024

[44]KayodeOyero, Yahaya Bello: EFCC confirms receipt of $760,000 from Abuja American School, Channels https://www.google.com/amp/s/www.channelstv.com/2024/04/27/yahaya-bello-efcc-confirms-receipt-of-760000-from-abuja-american-school/amp/ accessed 6 July 2024

[45]AmehEjekwonyilo, EFCC to Arraign Emefiele on Fresh Fraud Charges, Premuim Times, <https://www.premuimtimesng.com> accessed 6 July 2024

[46]Kingsley Nwezeh, EFCC Probing 50 Bank Accounts Linked To Betta Edu’s Stashed Funds Case, Recovers N30bn, Arise News <https://www.arise.tv/efcc-probing-50-bank-accounts-linked-to-betta-edus-stashed-funds-case-recovers-n30bn/> accessed 6 July 2024

[47]ibid

[48]Ameh Ejekwonyilo, Betta Edu SadiyaFarouq, Others Not Yet Cleared of Alleged Fraud-EFCC, Premium Times <https://premiumtimesng.com/news/top-news/686059-betta-edu-sadiya-farouq-others-not-yet-cleared-of-alleged-fraud-efcc.html> accessed 6 July 2024

[49] Lovina Anthony, ‘EFCC Secures Conviction of 8 Internet Fraudsters in Uyo’, Daily Post <https://dailypost.ng/2024/06/22/efcc-secures-conviction-of-8-internet-fraudsters-in-Uyo/> accessed 24 June 2024

[50] Adetutu Sobowale, ‘EFCC Arrest Ex-bankers For N4.2m Fraud’, Punch <https://punchng.com/efcc-arrests-ex-bankers-for-n4.2m-fraud/> accessed 23 June 2024

by Legalnaija | Aug 30, 2024 | Blawg

Professor Olawuyi, SAN commends new NBA President for prioritizing Legal Education, calls on all stakeholders to embrace pedagogy innovation

Newly appointed Chairman of the Legal Education Committee of the Nigerian Bar Association and Deputy Vice Chancellor at Afe Babalola University, Ado Ekiti (ABUAD) Professor Damilola Sunday Olawuyi, SAN has commended the President of the Nigerian Bar Association (NBA), Mazi Afam Osigwe, SAN for prioritizing legal education in his inaugural address to the bar.

Recall that while reeling out his agenda to reposition the legal profession in the country over the next two years, the newly sworn-in 32nd President of the NBA, Afam Osigwe (SAN) announced the immediate constitution of the NBA Legal Education Committee, stating that:

“This Committee will formulate and present the NBA position on the reform and development of legal education in Nigeria, drive a proposed review of curricula in Law Faculties of Nigerian Universities and the Nigerian Law School to bring them in conformity with contemporary developments and international standards, propose criteria for employment of law lecturers and retraining program for Law lecturers, push for an improvement of infrastructural conditions in the Nigerian Law School campuses, develop a programme to have practising lawyers actively involved in teaching several courses at the Nigerian Law School and Faculties of Law and introduce a mentorship scheme for aspirants to the Bar (whereby Law students would be assigned to established Law Firms), beginning at the Law Faculties and continuing into the Law School as it obtains in other developed jurisdictions. The Committee will also collaborate with donors to establish an Endowment Fund for Legal Education. The Fund will support law teachers in conducting research aimed at advancing the justice sector, promoting constitutionalism in Nigeria, and furthering ‘curriculum and academic development.”

Announcing the membership of the Committee, the NBA President noted that “the Committee shall comprise of Prof. Damilola Olawuyi, SAN (Chair), Prof Kamal Dawud (Alternate Chair), Dr. Jonathan Ekperusi (Secretary), Dr. Matthew Anusiem.”

While reacting to his appointment as Chairman of the NBA-LEC, the frontline legal scholar and Professor of International Law, who is also a United Nations Independent Expert, Professor Olawuyi, SAN noted that:

“Over the last years, especially at the recent NBA Legal Education Summit in 2022, which I chaired its organizing committee, members of the legal profession have consistently called for a reimagination of legal education in Nigeria, including the need to develop practice-ready lawyers who can contribute meaningfully to Nigeria’s development. By identifying the reform of legal education as his top priority, the NBA President Mazi Osigwe, SAN has demonstrated his commendable and exemplary desire to spearhead transformational innovation in our training of future lawyers. Academic members of the bar must seize this new momentum by engaging actively with the NBA Legal Education Committee as we unveil innovative programs aimed at paving the way for legal entrepreneurship and technology-driven advancements in the teaching and practice of law in Nigeria.”

Professor Olawuyi noted that “Just as the problems facing our society are not static, legal education cannot afford to be static. This is why knowing the law alone is no longer sufficient to succeed in today’s world. We need lawyers that are skilled in business management, use of data analytics and artificial intelligence, as well as equipped with market awareness and entrepreneurship skills needed to move beyond traditional practice areas and become leaders in contemporary and emerging areas of law, such as artificial intelligence and cybersecurity law, space and aviation law, healthcare law, food and agricultural law, renewable energy, carbon finance law and international development law amongst others. The NBA Legal Education Committee is well placed to continue this important discussion and we look forward to working with all stakeholders in this important task.” the Learned Silk concluded.

by Legalnaija | Aug 30, 2024 | Blawg

NBA-SBL Announces Historic Leadership Handover

Following the resounding success of the 2024 Annual Conference of the Nigerian Bar Association Section on Business Law (NBA-SBL) held in Abuja in June, the NBA-SBL has officially transitioned its leadership, marking a historic moment in the Section’s 20-year history. Dr. Adeoye Adefulu who served as the chairman for the NBA-SBL in the last 2 years, has officially handed over the mantle of leadership to Mrs. Ozofu ‘Latunde Ogiemudia, who served as his Vice-Chair for part of his tenure; making her the first woman in 13 years and the second woman ever to assume the position of the Chairperson of the NBA-SBL.

The official handover ceremony took place at the Annual General Meeting of the NBA-SBL, at Tafawa Balewa Square (TBS), Lagos, on the 28th of August, 2024, with members and stakeholders in attendance to witness this historic milestone. Reflecting on the significance of this milestone, Mrs. Ogiemudia expressed her deep sense of honour in assuming the role, acknowledging the pioneering efforts of previous predecessors, saving Mrs. Mfon Usoro the first female Chair of the NBA-SBL for the last. “It is an honor to follow in the footsteps of Mrs. Usoro and to be the second woman to hold this esteemed position. I am committed to building on the strong foundation laid by my predecessors as we continue to advance the practice of business law in Nigeria,” Mrs. Ogiemudia stated.

Dr. Adefulu’s leadership maintained the high standards set by past Chairs while also raising the bar for the future. His tenure was marked by significant achievements, including the launch of the popular Business Law Weekly webinar series that provides free knowledge sharing on various topical issues at 2pm on Thursdays, the successful organization of a Northern Zonal Conference in October 2023 and an Eastern Zonal Conference in March 2024 and two Annual International Business Law conference. Under his guidance, the SBL remained a beacon of excellence in the legal community, consistently delivering impactful programs and initiatives and championing legislative and regulatory advocacy. With Mrs. Ogiemudia now at the helm, the Section is poised for continued growth and innovation, driven by her vision and passion.

In her inaugural speech, Mrs. Ogiemudia emphasized the importance of innovation, education, and capacity building as cornerstones of her leadership. She highlighted the role of the NBA-SBL in shaping the landscape of business law in Nigeria, particularly in an era marked by rapid change and global integration. “Our responsibilities are both challenging and crucial as we navigate this dynamic environment,” she stated, underscoring her commitment to fostering a vibrant, inclusive, and forward-thinking Section.

The leadership team under Mrs. Ogiemudia includes Baba Alokolaro as Vice Chair and Ayoyinka Olajide Awosedo as Secretary, both of whom bring a wealth of experience and dedication to their new roles. The Annual General Meeting of the NBA-SBL was a celebration of the NBA-SBL’s legacy and a look forward to its future under an exciting new leadership.

About NBA-SBL

The Nigerian Bar Association Section on Business Law (NBA-SBL) is a specialized section of the Nigerian Bar Association focused on advancing the practice and development of business law in Nigeria. The NBA-SBL hosts an annual business law conference that serves as a platform for legal professionals to engage with contemporary issues in business law, policy, and regulation.

by Legalnaija | Aug 26, 2024 | Blawg

A Grand Opening: NBA Conference Ignites with Visionary Leaders and Bold Calls for Nigeria’s Future*

The opening ceremony of the NBA Conference at Eko Hotel and Suites was a powerful showcase of brilliance, unity, and visionary leadership, setting the stage for a transformative week ahead. The event drew a distinguished gathering, including Nigeria’s Vice President Kasshim Shettima (representing President Bola Ahmed Tinubu), Lagos State Governor Babajide Sanwo-Olu, Plateau State Governor Caleb Muftwang, Dr. Ngozi Okonjo-Iweala, Director-General of the World Trade Organization, the Ooni of Ife, and other esteemed figures in law and governance.

As the ceremony began, the energy in the room was palpable. The Master of Ceremony, Eugenia Abu of the NTA, skillfully introduced the dignitaries, followed by welcoming remarks from the NBA Publicity Secretary Akorede Habeeb Lawal and the Chairperson of the Planning Committee, Oyinkansola Badejo-Okusanya while the Assistant Publicity-Secretary Charles Ajiboye led the opening prayer. The anticipation was high as the stage was set for what would become a truly memorable event.

Chief Folake Solanke, SAN, Nigeria’s first female Senior Advocate, ignited the ceremony with her stirring goodwill message. She urged senior lawyers to mentor the younger generation and charged young lawyers to embrace knowledge and hard work, reminding them, “Absorb every lesson, listen intently, and let this conference be a catalyst for your growth and success in the legal profession.”

NBA President Yakubu Chonoko Maikyau, OON, then delivered an address that resonated deeply with the audience. He reiterated the need for a change of heart among professionals, invoking the wisdom of Nigeria’s first indigenous lawyer, Sapara Williams, who famously said, “The legal practitioner lives for the direction of his people and helps people and the advancement of the cause of the nation.” Maikyau emphasized the critical role of lawyers in society, urging them to embody the strength and vision symbolized by the eagle on the conference flyer. He commended the conference’s keynote speaker, Dr. Ngozi Okonjo-Iweala, for her exceptional leadership and contributions to Nigeria’s economic development, encouraging participants to engage fully with the plenary sessions for the wealth of knowledge they promised to offer.

Following this, Prada Uzodimma took the stage reading a citation of the keynote speaker, Dr. Ngozi Okonjo-Iweala. Uzodimma, in her citation, lauded Okonjo-Iweala’s exceptional career, highlighting her educational background, her groundbreaking work as Nigeria’s Finance Minister, and her current role as the Director-General of the World Trade Organization. Describing her as a visionary with a deep-rooted passion for justice and equity, Uzodimma emphasized that true leadership is not about position and power, but about using it to uplift others. Her words set the tone for the keynote address, framing Dr. Okonjo-Iweala as a beacon of hope and inspiration for all.

Then came the moment everyone had been waiting for—the keynote address by Dr. Ngozi Okonjo-Iweala. In her speech titled *“A Social Contract For Nigeria’s Future,”* Okonjo-Iweala delivered a compelling call to action, urging Nigerians to embrace a unified vision for the nation’s future. She outlined a four-part social contract essential for Nigeria’s progress: consistency in economic policies, preservation of key economic institutions, provision of basic infrastructure, and ensuring the true independence of the judiciary and electoral commission. Drawing on global examples like South Korea and Peru, she emphasized that a collective effort is needed to tackle the country’s challenges, asking the audience a resonating question: “Are we ready?”

The keynote address left the room buzzing with renewed energy and purpose.

Governor Sanwo-Olu, inspired by Dr. Okonjo-Iweala’s speech, committed to upholding the principles of the social contract within his administration. He acknowledged the challenge presented by the keynote and affirmed that all hands must be on deck for Nigeria to thrive. Attorney-General Lateef Fagbemi, SAN, echoed this sentiment, pledging that the Ministry of Justice under his leadership would strive to adhere to the high standards set by Dr. Okonjo-Iweala’s admonition.

Adding to the depth of the event, the representative of the Acting Chief Justice of Nigeria (CJN) Hon Justice Kudirat Kekere-Ekun addressed the gathering, highlighting the pressing challenges facing the Bar and Bench. He called on the NBA to take an active role in advocating for necessary reforms and emphasized the importance of collaboration between the judiciary and the legal profession to drive national progress.

Vice President Kasshim Shettima closed the ceremony with the President’s address, praising the choice of venue and acknowledging the country’s challenges. He assured the audience that the administration would continue to uphold the rule of law, promising that in the fullness of time, Nigeria would overcome its obstacles and emerge stronger.

The opening ceremony was not just an event—it was a clarion call for the legal profession and the nation to press forward with determination, vision, and a shared commitment to rebuilding Nigeria. With such a powerful and inspiring start, the NBA Conference is poised to be a pivotal moment in shaping the future of law and governance in Nigeria.

by Legalnaija | Aug 24, 2024 | Blawg

HiiL Launches the Justice Needs and Satisfaction (JNS) 2024 Report: A Comprehensive Examination of Nigeria’s Justice Landscape

HiiL invites justice professionals, policymakers, data experts, and all interested parties to a webinar unveiling new data and insights into Nigeria’s evolving justice challenges.

HiiL (The Hague Institute for Innovation of Law) is pleased to announce the launch of the Justice Needs and Satisfaction (JNS) 2024 report. This pivotal update provides an in-depth analysis of the most pressing justice issues Nigerians face today. This report continues the journey started with the JNS 2023 study, meticulously tracking the development of legal challenges faced by the same group of individuals over three years.

Since 2018, HiiL has been actively engaged in Nigeria, working to understand and address the justice needs of its people. Our mission is to bring justice closer to the population by identifying the most common legal challenges and the barriers that prevent effective resolution. The JNS 2024 report builds on this foundation, delivering fresh insights and data to inform policymakers, legal practitioners, and the public on how to create more accessible and equitable justice systems.

Why This Matters

Justice in Nigeria is more than just crime statistics and court cases; it encompasses the everyday struggles people encounter, the solutions they seek, and the outcomes they either achieve or fall short of attaining. HiiL’s research, conducted since 2018, underscores the critical need for justice systems that are accessible and centered around the needs of the people.

Key Findings from the JNS 2024 Report

- Access to justice remains a significant issue in Nigeria, with challenges such as land disputes, neighbor conflicts, and domestic violence being the most prevalent. ● Over half of those who reported no legal problems in 2023 faced new issues in 2024, highlighting the pervasive nature of legal challenges in the country.

- While approximately 55% of the problems identified in the initial study were fully or partially resolved by 2024, many unresolved issues continue to have a profound impact on people’s lives, emphasizing the urgent need for sustainable, people-centered justice solutions.

Exclusive Event Invitation

We invite you to join an exclusive online event where HiiL’s research team will present the findings of this comprehensive study. This is an opportunity to gain unique insights into the pressing justice issues facing Nigerians today and to engage directly with experts at the forefront of this research.

Event Agenda

- Welcome and Opening Remarks

- Introduction to HiiL’s Work in Nigeria

- Presentation of the JNS 2024 Report: An in-depth look at Nigeria’s justice landscape ● Q&A Session: Engage with our experts

- Closing Remarks

Don’t Miss This Opportunity

This event is a must-attend for those interested in understanding and addressing the justice challenges in Nigeria. Register now to secure your spot and contribute to the dialogue on shaping a more just and equitable system.

For More Information

Register now: https://us06web.zoom.us/webinar/register/WN_yvVciWCATXWftubmV_aOcw#/registration

To learn more about this event or to request an interview, please contact:

Maryam Abba

Operations Officer

Email: maryam.abba@hiil.org

Website: www.hiil.org

About HiiL

HiiL (The Hague Institute for Innovation of Law) is a civil society organisation committed to people-centred justice. That means justice that is affordable, accessible and easy to understand and that delivers what people need. We aim that by 2030, 150 million people will be able to prevent or resolve their most pressing justice problems. We help develop people-centred justice programmes: a data-driven, evidence-based, and innovation-focused way of working, focused on system change to ensure better delivery of justice services for more people. HiiL is an equal opportunity, international employer. We are based in the Netherlands, in the City of Peace and Justice, The Hague.