‘FINANCIAL Literacy’, according to the Organisation for Economic

Co-operation and Development, financial literacy is defined as:

“Knowledge and understanding of financial concepts, and the skills,

motivation and confidence to apply such knowledge and understanding in

order to make effective decisions across a range of financial contexts,

to improve the financial well-being of individuals and society, and to

enable participation in economic life.” With this definition, I will

explore the different methods of using local languages to promote

financial literacy in Nigeria. I believe that the main purpose of

financial literacy is to ameliorate the economy in Nigeria.

Co-operation and Development, financial literacy is defined as:

“Knowledge and understanding of financial concepts, and the skills,

motivation and confidence to apply such knowledge and understanding in

order to make effective decisions across a range of financial contexts,

to improve the financial well-being of individuals and society, and to

enable participation in economic life.” With this definition, I will

explore the different methods of using local languages to promote

financial literacy in Nigeria. I believe that the main purpose of

financial literacy is to ameliorate the economy in Nigeria.

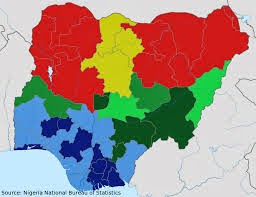

There are hundreds of local languages spoken throughout Nigeria, the

eight most widely spoken being English, Yoruba, Hausa, Igbo, Ibibio,

Kanuri, Edo and Fulfulde. Considering how Nigeria was formed of these

different tribes, there are subtle cultural differences between them.

These differences must be taken into consideration as they would reflect

on the attitudes of the people and their way of communicating. This

then poses the question: “Should we use local languages in the first

place, or use a universal language to educate the people?” This is an

interesting question as there are multiple sides to this metaphoric

coin. Although, the use of a universal language i.e. English, would mean

that educating the masses would be far simpler as there could be

seminars held in a location that is suitable for all people to attend;

the person leading the seminar would also only need to be able to speak

English in order to communicate with the entire audience.

eight most widely spoken being English, Yoruba, Hausa, Igbo, Ibibio,

Kanuri, Edo and Fulfulde. Considering how Nigeria was formed of these

different tribes, there are subtle cultural differences between them.

These differences must be taken into consideration as they would reflect

on the attitudes of the people and their way of communicating. This

then poses the question: “Should we use local languages in the first

place, or use a universal language to educate the people?” This is an

interesting question as there are multiple sides to this metaphoric

coin. Although, the use of a universal language i.e. English, would mean

that educating the masses would be far simpler as there could be

seminars held in a location that is suitable for all people to attend;

the person leading the seminar would also only need to be able to speak

English in order to communicate with the entire audience.

However, this method may not necessarily work. Using a generic language

requires those who are not familiar with this language to have to learn

it and be educated in it. This is a sufficient method for young

children, provided they have suitable teachers; however it does not

cater for adults. One’s ability to learn a language diminishes as one

grows older. The technical terms that are used in such a matter are far

more difficult for a non-native speaker to have to learn.

requires those who are not familiar with this language to have to learn

it and be educated in it. This is a sufficient method for young

children, provided they have suitable teachers; however it does not

cater for adults. One’s ability to learn a language diminishes as one

grows older. The technical terms that are used in such a matter are far

more difficult for a non-native speaker to have to learn.

We must

not assume that those who are educated are financially literate. There

may well be people that have fantastic jobs that are not aware of how to

maintain their income and how to save properly. Being financially

literate is not only understanding how the economy works, but also

knowing how to manage one’s own personal finance.

not assume that those who are educated are financially literate. There

may well be people that have fantastic jobs that are not aware of how to

maintain their income and how to save properly. Being financially

literate is not only understanding how the economy works, but also

knowing how to manage one’s own personal finance.

There is a

correlation between financial literacy and financial inclusion: those

who are financially illiterate would also be financially excluded. As of

2010, 46.3 per cent of Nigerian adults were financially excluded. This

is almost half of Nigeria’s adult population; as a result, the

percentage of financially literate adults is bound to be low. In order

to promote financial literacy, we must first address those who are

financially excluded. It is my belief that the majority of those who are

financially excluded live in the more rural parts of the country. Out

of Nigeria’s 163 million people, 49 per cent of them are living in rural

parts of the country.

correlation between financial literacy and financial inclusion: those

who are financially illiterate would also be financially excluded. As of

2010, 46.3 per cent of Nigerian adults were financially excluded. This

is almost half of Nigeria’s adult population; as a result, the

percentage of financially literate adults is bound to be low. In order

to promote financial literacy, we must first address those who are

financially excluded. It is my belief that the majority of those who are

financially excluded live in the more rural parts of the country. Out

of Nigeria’s 163 million people, 49 per cent of them are living in rural

parts of the country.

The majority of these people would be

uneducated and are either not aware of the support that a bank can

provide them with; or simply live too far away from the nearest bank. A

way to tackle this would be to create small branches in nearby towns

and subsequently send teams to the individual villages where the

majority of the financially excluded live.

uneducated and are either not aware of the support that a bank can

provide them with; or simply live too far away from the nearest bank. A

way to tackle this would be to create small branches in nearby towns

and subsequently send teams to the individual villages where the

majority of the financially excluded live.

Using local

languages puts the people at an advantage. The topic specific words are

far simpler to comprehend in one’s own language, as it does not require

one to have already mastered the foreign language. The main goal is to

make the people financially literate; therefore using their local

languages would be the most sensible method of doing so in this

instance.

languages puts the people at an advantage. The topic specific words are

far simpler to comprehend in one’s own language, as it does not require

one to have already mastered the foreign language. The main goal is to

make the people financially literate; therefore using their local

languages would be the most sensible method of doing so in this

instance.

By holding seminars in rural towns and

villages, we will be able to create awareness for the inhabitants whilst

communicating with them in their own regional dialects. A new form of

education could be instated by Central Bank. As teenagers are going to

be the next generation of people who impact the economy, making them

financially literate would have a great effect. The communications

department could create a team of teachers to travel to local village

schools, where they can educate the pupils in their own language.

Bearing in mind that many students will not necessarily see the need for

financial literacy at their age, there are particular methods that

should be used, which teenagers will find relevant and engaging. Visual

presentations could be developed to give them a basic understanding of

financial education. Board games similar to the likes of Monopoly, that

teach the value of saving, could be introduced in order to provide the

children with an understanding that they could then translate into their

own financial standings when they become young adults.

villages, we will be able to create awareness for the inhabitants whilst

communicating with them in their own regional dialects. A new form of

education could be instated by Central Bank. As teenagers are going to

be the next generation of people who impact the economy, making them

financially literate would have a great effect. The communications

department could create a team of teachers to travel to local village

schools, where they can educate the pupils in their own language.

Bearing in mind that many students will not necessarily see the need for

financial literacy at their age, there are particular methods that

should be used, which teenagers will find relevant and engaging. Visual

presentations could be developed to give them a basic understanding of

financial education. Board games similar to the likes of Monopoly, that

teach the value of saving, could be introduced in order to provide the

children with an understanding that they could then translate into their

own financial standings when they become young adults.

The

largest part of Nigeria’s exports, aside from oil, is Nigeria’s

agricultural products. Therefore, it is essential that the farmers are

aware of how to manage their finances properly. However, many farmers

are financially excluded and are not utilising their assets properly.

The Central Bank could set up miniature farmer’s business schools that

teach farmers more agronomic methods on how to grow their crops. The

cost needed to train a farmer on how to manage their finances and how to

harvest in the most efficient manner is a mere N3000 per farmer.

Alternatively, CBN could host an outreach programme in which they have

several teams that accumulate farmers in the local areas and run

workshops and hold lectures on how to become financially literate. As

most farmers that live in the rural areas of Nigeria would not have a

grasp of the English language, the best alternative is for these teams

to be fluent in the local language of the area. The benefits of this

method are that the farmers would feel far more comfortable being able

to relate with the CBN staff in their own language; moreover, as there

would be a group of farmers from the same area, there would be a level

of understanding amongst them which would enable them to learn more

effectively.

largest part of Nigeria’s exports, aside from oil, is Nigeria’s

agricultural products. Therefore, it is essential that the farmers are

aware of how to manage their finances properly. However, many farmers

are financially excluded and are not utilising their assets properly.

The Central Bank could set up miniature farmer’s business schools that

teach farmers more agronomic methods on how to grow their crops. The

cost needed to train a farmer on how to manage their finances and how to

harvest in the most efficient manner is a mere N3000 per farmer.

Alternatively, CBN could host an outreach programme in which they have

several teams that accumulate farmers in the local areas and run

workshops and hold lectures on how to become financially literate. As

most farmers that live in the rural areas of Nigeria would not have a

grasp of the English language, the best alternative is for these teams

to be fluent in the local language of the area. The benefits of this

method are that the farmers would feel far more comfortable being able

to relate with the CBN staff in their own language; moreover, as there

would be a group of farmers from the same area, there would be a level

of understanding amongst them which would enable them to learn more

effectively.

According to Africa Finance Forum, the most

financially excluded people in Africa are the women. In order to tackle

this issue, we could create workshops in the markets of more rural towns

in order to develop the financial literacy of the women. Nigeria is

primarily a cash based economy. If CBN were able to create small teams

to promote the use of debit and credit cards, this would automatically

increase financial literacy, as the people would have to know how to use

their accounts, and in turn financial inclusion. The small scale

seminars would have to be held by someone who has a strong grasp on the

native language of the area in order to ensure that all of the women

receive the valid information necessary to become more financially

literate. Giving women a sense of financial importance within our modern

society promotes their sense of financial confidence, thus including

more women along with their personal, as well as business ventures and

projects, within the financially literate sector of our nation.

financially excluded people in Africa are the women. In order to tackle

this issue, we could create workshops in the markets of more rural towns

in order to develop the financial literacy of the women. Nigeria is

primarily a cash based economy. If CBN were able to create small teams

to promote the use of debit and credit cards, this would automatically

increase financial literacy, as the people would have to know how to use

their accounts, and in turn financial inclusion. The small scale

seminars would have to be held by someone who has a strong grasp on the

native language of the area in order to ensure that all of the women

receive the valid information necessary to become more financially

literate. Giving women a sense of financial importance within our modern

society promotes their sense of financial confidence, thus including

more women along with their personal, as well as business ventures and

projects, within the financially literate sector of our nation.

In conclusion, it is evident that there is a lack of financial literacy

amongst a large proportion of the Nigerian population. But the CBN is

in a position to create awareness of the issue to those most affected.

To do this, one must address the aforementioned parts of society in the

local language, in order to ensure that the target group feel

comfortable and do not feel that they are being oppressed by a foreign

language. This contributes to the elimination of financial illiteracy,

and promotes a more healthy and profitable relationship between the

marginalised, and the financial sector of this nation.

amongst a large proportion of the Nigerian population. But the CBN is

in a position to create awareness of the issue to those most affected.

To do this, one must address the aforementioned parts of society in the

local language, in order to ensure that the target group feel

comfortable and do not feel that they are being oppressed by a foreign

language. This contributes to the elimination of financial illiteracy,

and promotes a more healthy and profitable relationship between the

marginalised, and the financial sector of this nation.

•

Akindele is a 16 year-old student at African Leadership Academy. He

recently won the Sylvia Trott Prize for Languages for his achievements

in foreign languages, gaining A*A*A*A in Japanese, French, Spanish and

Mandarin respectively. He has been nominated to receive the Lord Lexden

Academic Achievement Award at the House of Lords in March 2014.

Akindele is a 16 year-old student at African Leadership Academy. He

recently won the Sylvia Trott Prize for Languages for his achievements

in foreign languages, gaining A*A*A*A in Japanese, French, Spanish and

Mandarin respectively. He has been nominated to receive the Lord Lexden

Academic Achievement Award at the House of Lords in March 2014.