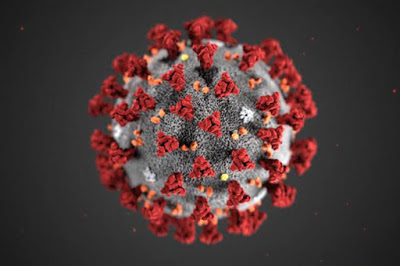

The rapid outbreak of the coronavirus is alarming and the world is grappling with it. The virus has adverse effects on the health sector and its implications on commercial transactions are reshaping the global economy.

The virus knows no border, health-wise, commercially and economically. There are several disruptions caused by COVID-19 in the international sphere. The virus leaves no one and no sector unaffected. It has become a global phenomenon impacting family life, businesses and economies across the globe. Taxation cannot escape the disruption of the deadly COVID-19. Logically, tax is an important part of the economy. Corona Virus disrupts the economy.

Therefore, taxation is also disrupted. It is no longer news that tax policies are experiencing changes in the world. Countries affected by the virus are implementing tax relief for persons, businesses and households affected by this health crisis. This article will discuss the tax relief implemented by countries and the position of African countries in the practice of tax during this global outbreak of COVID-19.

CHINA

China reduced its Value-added Tax (VAT) from 3 percent to 1 percent for the cash accounting for small businesses. Also, VAT on medical, catering, accommodations, laundry services, masks and protective clothing has been cut off. The state taxation administration extended the period of tax declaration and deadline for tax payments. Subject to certain provisions and policies, enterprises producing important supplies and materials can receive a deduction on their corporate income tax on facilities payments. In the quest to encourage medical personnel and other public health workers, allowances and payments obtained by these set of people are exempted from Personal Income Tax. However, the fiscal and tax policies are subject to the rate of the epidemic.

FRANCE

The government is allowing companies to suspend payments of some social charges and taxes and also activating short-time work scheme. Businesses affected by the virus in activity can delay their tax payments and these companies can also refer taxes due during the epidemic without justification or penalty. In addition to the tax suspension and deferment policies, loans are available for any small or medium-sized businesses in difficulty.

GERMANY

Germany had a plan to implement a reform of the solidarity tax (a 5.5% surcharge on high-income earners) in 2021, however, due to the outbreak of Corona virus, the reform now applies in 2020, this present year. The Germany government has made it easier for companies to claim subsidies to support workers on reduced working hours to counter the effects of the pandemic.

ITALY

In Italy, tax deadlines have been extended for residents and companies in the areas where there is an outbreak of the virus. Also, all tax payments are extended until May(with the hope that the outbreak would have succumbed) without any penalty or restriction. Policies are in place to ensure that tax credits are granted to companies that suffer a 25 percent drop in revenue.

JAPAN

Tax filing deadlines and payments are delayed by a month in Japan, however, there are no tax policies considered on how the situation evolves. But, strong measures to protect the economy and proper consideration on reducing the sales tax are being considered. Options on tax, fiscal policy and deregulation are pertinent to be considered.

SPAIN

Spain government implemented a tax relief for small and medium-sized companies, without the exclusion of self-employed persons. Those businesses will be able to defer their tax obligations for six months without interest. The exempted taxes are: Income Tax, Corporate tax, and Value Added Tax (VAT).

United Kingdom

The UK government announced reductions on taxes to reduce the economic impact of the coronavirus. The personal income tax is not very much affected, but business property taxes for retail, leisure and tourism have been reduced due to the outbreak of COVID-19.

USA

In the US, taxpayers have been given the privilege to delay the filing of taxes due to the economic effects of the coronavirus. However, the categories to get a filing extension are not listed. The US delay tax payments without interests or penalities for individuals and businesses affected negatively by the virus.

What’s the narrative for African countries?

African countries have weak tax system and a heavy reliance on commodity revenue. The virus may not have as much effect on the tax system, because tax is still a striving part of the economy. In most African countries, tax evasion is the reality of the tax system, which renders the effect of COVID-19 a minimal disruption.

However, it wouldn’t be a big deal if African countries start to implement tax relief policies as an effect of the virus. The tax administration capacity in Africa is still needed to help spur development in Africa. Tax relief might seem like an odd proposition to the tax system in this part of the world, because the tax system does not have proper structure in place to comply tax payment.

CONCLUSION

Tax measures are important because the health issue is creating a substantial economic shock, and tax relief is means of minimizing the economic impact on medium-sized enterprises.

It is pertinent to note that only countries with a good and effective tax structure could implement policies to relief companies and individuals of tax payment. Companies in developed countries, including countries with effective tax systems have high tax burden on them, and this global outbreak will definitely have an enormous effect on tax compliance, payment and filing.

The policies to relieve these companies of their tax obligations during this outbreak will be of good effect than companies in African countries. This is an attestation to the proposition that Tax systems and policies in African countries are as good as nonexistent. The COVID-19 outbreak will determine the truth of this assertion. However, this is a call to African countries to implement policies and put in place structures that will aid tax compliance in the region and be of global standard.

KOFOWOROLA OMOWALE Q.

Kofoworola Omowale is a 3rd year law student at the University of Ibadan. She is a goal-oriented and purpose driven lady. She has keen interest in finance, taxation and the fintech space. She has authored several articles on Fintech, taxation and career development. She is currently a chapter member of Young Accomplished African Women (YAAW), West Africa’s first finance and technology talent accelerator for women.

She is also the Media Executive of Streetlaw Advocacy Network, an organization that proffers legal services to the vulnerable people in the society. She ardently believes that “whatever worth doing is worth doing well”.

REFERENCE

m.oecdobserver.org/ws/fullstory.php/aid/3510/Africa_s_tax_system:_A_survey.html

https://issafrica.org/iss-today/will-africas-economies-buckle-under-the-coronavirus

https://www.google.com/amp/s/amp.usatoday.com/amp/5019351002

https://www.japantimes.co.jp/news/2020/03/17/business/economy-business/tax-cut-japan-combat-covid-19/#.XnJQOh4o8ex

https://www.connexionfrance.com/French-news/Coronavirus-Covid-19-in-France-What-impact-on-work-workplaces-finance-economy-money-childcare

https://home.kpmg/us/en/home/insights/2020/03/tnf-france-tax-relief-available-for-businesses-affected-by-coronavirus.html

https://taxfoundation.org/coronavirus-covid-19-outbreak-fiscal-tax-measures/