by Legalnaija | Sep 11, 2023 | Uncategorized

INTRODUCTION

In Nigeria, aviation services like any other business are regulated and administered by legislation which sets the course for legal and governance frameworks required to legitimately carry on aviation services classified as air transport or air operating services and allied aviation services in Nigeria. This article shall further consider the categories of air operations, registration and licensing requirements spelt out by the Corporate Affairs Commission Checklist 2022, and the Nigerian Civil Aviation Regulation 2022, (Nig. Cars 2022). For the purpose of this article, focus shall be given to Part 18 of Nig Cars 2023, (“IS 18 Nig Cars 2023”) which addresses civil aviation air transport economic activities.

REGULATORY FRAMEWORK

The aviation industry in Nigeria is primarily overseen by the Federal Ministry of Aviation, which is responsible for the formulation of aviation policies. There are also other government bodies governing and regulating other aviation services in Nigeria such as:

- the Nigerian Airspace Management Agency, established under the Nigerian Airspace Management Agency (Establishment, etc) Act 1999 (NAMA), which provides air traffic and navigation services; and

- the Federal Airport Authority of Nigeria, established under the Federal Airports Authority Act 1996 (FAAN), is responsible for the development, provision and maintenance of airports and associated services.

- the Nigerian Civil Aviation Authority (NCAA), established under the Nigerian Civil Aviation Act 2022 (CAA). It is worthy to note that the CAA empowers the NCAA to among other things make Regulations for air operations and issue the required license, permit, and certificate once the air carrier establishes that it has complied with the requirements of the Corporate Affairs Commission, (CAC).

As a matter of fact, while the CAC[1] prescribes the share capital thresholds for carrying out aviation services, the type of authorization issued establishes compliance with the precursory requirements. These thresholds are as follows:

- Air transport (Local): NGN 500 million

- Air transport (Regional): NGN1 Billion

- Air transport (International): NGN 2 Billion

- Air ambulance, fumigation and private jet: NGN 20 Million

- Air transport training institutions: NGN 2 Million

- Aviation (Ground Handling Services): NGN 500 Million

- Agents of foreign Airlines: NGN 1 Million

- Travel/Tours: NGN30 Million.

LICENSING

Having satisfied the registration requirements, authorization for commercial air operations could be in form of a license, permit and/or any other authorization depending on the nature of the aviation services.

IS 18.2 Nig. Cars 2023 prescribes four types of authorisations issued by NCAA for commercial flight operations’ discussed below:

- Air Transport License (ATL).

ATL is obtained and renewed by the grant of written application and compliance with the requirements for grant and renewal respectively. The said license is issued by NCAA for carriage of passengers, mail, and cargo by air. ATL is valid for a period of five (5) years and is subject to renewal every five years on expiration of the initial term. Amongst other things, the ATL holder may be required to demonstrate its ability to continue to meet the terms and conditions set forth in the CAA, otherwise, the NCAA can suspend or revoke an ATL if the holder of the ATL contravenes the terms and conditions set forth in the Act, Nig. Cars, rules and orders made thereunder.

- Air Operating Permit (AoP).

This applies to the permit issued by NCAA for commercial carriage of passengers, mail, and cargo for non-scheduled and charter services, it is usually obtained and renewed by the grant of written application and compliance with the procedures for grant or renewal required by NCAA. The AoP is valid for a period of three years and is subject to renewal every three (3) years. However, the NCAA can suspend or revoke an AoP if the holder contravenes the terms and conditions set forth in the CAA, Nig. Cars, rules and orders made by NCAA.

- Air Travel Organiser License (ATOL).

ATOL is applicable to tour organisers who are engaged in holiday travels, tour packages, special events, and religious pilgrimages, and can be obtained and renewed by the grant of a written application and compliance with the requirements for grant or renewal submitted to NCAA. An ATOL is valid for a period of 2 years and subject to renewal every two years. However, NCAA can suspend or revoke an ATOL, where the holder contravenes the terms and conditions provided by the in the CAA, Nig. Cars, Rules and orders made by the NCAA.

- Permit for Aerial Aviation Services, (PAAS).

PAAS is applicable to aerial work operations, flying club, flying school and such other services as may be designated by the NCAA from time to time. It can be obtained and renewed by the grant of written application and compliance with the requirements for grant or renewal required by NCAA. A PAAS is valid for a period of three (3) years and subject to renewal every three (3) years on expiration of the initial term. NCAA can suspend or revoke a PAAS in the format specified in the Regulations where the holder contravenes the terms and conditions provided by the CAA, Nig Cars, Rules, and order made by the NCAA. An applicant of a PAAS shall not be incorporated under Part C of the Companies and Allied Matters Act and any amendments, thereof. Also, the issuance of a security clearance by the relevant agency should precede the issuance of a PAAS.

On 10 July 2023, the NCAA released a public statement directing all right holders to among other things comply with the following[2]:

- Renew current license/certifications pursuant to Nig.CARs 2023 except for subsisting certificates, licenses, permits, authorisations issued under Nig.CARs 2015, which will remain valid until expiration.

- Submit all applications for variation and renewal of licenses/certificates before the effective date pursuant to Nig.CARs 2023.

- Submit all applications for variation and renewal of licenses/certificates before the effective date which is currently at the document evaluation phase of the licensing/certification process pursuant to the Nig.CARs 2023.

- Ensure all applications for initial issue of licenses/certificates at the document evaluation phase of their licensing/certification are processed from the effective date pursuant to the provisions of the Nig. CARs 2023.

In addition to the above directive, on 11th August 2023, NCAA further directed all air operators to comply with the Nig. CARs 2023 on insurance coverage[3].

Specifically, IS 18.14.1.1 of the Nig. Cars 2023 provides amongst other things that all airlines and other allied aviation service providers must NOT operate without:

- Adequate and valid insurance cover;

- Submit to the NCAA copies of valid insurance certificates, evidence of payment of premium and other policy documents of insurance cover of not less than three (3) months as specified in provision.

- Have adequate insurance documentation which must be renewed before the expiration of the current policy and be submitted to the NCAA as soon as such renewal is effective.

It should further be stated that non-adherence with these obligations will attract immediate sanctions which extends to grounding the specific aircraft and taking enforcement action against any defaulting airline/service provider.

AIR OPERATIONS.

The scope of air operations for the purpose of this article shall be limited to commercial air operations classified into three categories now discussed as follows:

1.Domestic Operations[4]

Generally, commercial domestic operations are classified as scheduled air transport, aerial aviation services, and organized package tours.

Where the operator carries on scheduled air transport between two or more states in Nigeria, such operator is expected to notify the NCAA of its operational routes, the frequency(ies) of operations and the fares to be charged before commencement of operations.

It shall also be required to apply for the relevant applicable license alongside obtaining an Air Operator Certificate (AOC); ensure compliance with the provisions of the CAA, Nig. Cars and other directives made thereunder; show proof of adequate insurance cover for passengers, cargo and third party. However, holders of AOC are not required to obtain flight clearances from the Authority prior to undertaking non-scheduled international operations, however, they are required to depart and enter the country through designated customs aerodromes. In addition, non-scheduled operators shall submit the passenger and cargo manifests, airway bills and client services invoices to the NCAA.

1.1Aerial Aviation Services, (AAS).

AAS are services which include aerial mapping, aerial survey, crop spraying, aerial advertisement, flying club, flying school and such other services as may be designated by the NCAA from time to time. Domestic operators who are holders of Permit Aerial Aviation Services, (PAAS) qualify to carry on AAS and are further required to obtain Safety Certificates from the NCAA before commencing this service. They are also restricted from engaging in any form of carriage of passengers, cargo or mail for hire and reward and any form of operation different from those specified in their Permits.

1.2Self-Handling Services, (SHS).

SHS is a situation in which airport users directly provide one or more categories of ground handling services to the exclusion of contracts with third party providing such services. For the purpose of this regulation, the airport users shall not consider one another as third parties if a private entity holds a majority in another entity and where a single entity has a majority holding in each i.e domestic airlines are considered to operate independently. These operators are required to obtain approval from NCAA after duly fulfilling the statutory requirements as specified by IS 18.12 Nig. Cars 2023 which is applicable to the collection and remittance of all sale and sundry charges.

1.3Organized Package Tour, (OPT)

OPT applies to holders of Air Travel Organiser License (ATOL). OPT are expected to operate within the conditions specified in their license and shall not engage in aircraft operations. They are to have current and adequate bank/insurance bonds to cover their operations.

Before operation commences, license and permit holders must obtain an air operator certificate and meet certain requirements, including providing adequate insurance cover for passengers, cargo and third parties. Permit holders engaged in cargo operations must obtain air operator certificates from the NCAA before operations commence.

2.Regional and International Operations by Nigerian Airlines

An air carrier permit (ACP) is issued by the NCAA to designated Nigerian airlines on regional and international routes, subject to the airline fulfilling the requirements specified in this Regulation. The Nig.Car also mandates all Nigerian airlines designated on regional and international routes to obtain safety certificates to maintain adequate financial standing for their flight operations and show evidence of domestic operations for at least six (6) months.

3.Foreign Airline Operations in and out of Nigeria

IS 18 Nig.Cars 2023 contains specific regulations for commercial air transport by foreign air operators within Nigeria. This regulation sets forth Foreign Carrier Operating Permit (FCOP) as the requisite authorisation issued by the NCAA. A foreign air carrier operating in and out of Nigeria engaging in scheduled international air services, is required to fulfill specified standards i.e desists from operating sale offices and outlets in cities other than the point(s) of entry specified in the subsisting bilateral air services agreement under which a foreign carrier is designated, and shall be limited to the aerodromes and restricted from distributing tickets through banks and other financial institutions as well as engaging in self-handling.

ALLIED AVIATION SERVICES, (AAS).

AAS are services rendered in support of aircraft operations, aerodromes and such support services which enhance the business of air transportation. The regulations[5] provides for the nature ofbusinesses classified as allied aviation services[6] such as: ground handling, agent of foreign airlines, travel agency, cargo agency and air freight forwarding, inflight catering services, aviation fuel supply, air transport training institutions, aircraft sale or leasing and other aviation related services. Nig Cars 2023 further profiles entities qualified to run these businesses[7], prescribes the relevant resources required to discharge actual and potential obligations, and protects service providers from discrimination against or decline of access to any airline, allied service provider in provision of services or facilities at the airport whilst mandating submission of monthly financial obligations to the NCAA.

CONCLUSION.

Compliance with the provisions of IS 18 Nig. Cars 2023 amongst other things establishes consistency and uniformity across the global aviation industry, allowing for seamless operations, in addition to promoting economic growth. It also reflects the strengths and weaknesses of our domestic aviation policy. For instance, due to the global nature of aviation services strong compliance indicates recognition and adherence to international practices, efficiency in harmonising aviation industry laws within our local context and effective enforcement mechanisms through the imposition of sanctions, penalties and fines, which invariably promotes safety and security of investment within the sector. On the other hand, non-compliance reflects inadequate understanding of the industry and inability to compel stakeholders to uphold the law and practices of the industry. The essence of compliance is strongly rooted in predictability, and enforcements, therefore, potential and existing stakeholders are encouraged to adhere to the provisions of the Nig Cars 2023.

Author: AdeolaOsifeko

[1] Corporate Affairs Operations Checklists 2022 pages 19 and 20

[2] Nigeria Civil Aviation Authority Website, ‘Publication & Implementation of Nig. Cars 2023 – Fourth Amendment to Nigeria Civil Aviation Regulations’ 12 July 2023 https://ncaa.gov.ng/media-center/news/publication-and-implementation-of-nig-cars-2023-fourth-amendment-to-nigeria-civil-aviation-regulations/ Accessed on 4 August 2023

[3] Nigeria Civil Aviation Authority Website, ‘ NCAA Demands Compliance with the Civil Aviation Regulation on Insurance Cover 14 August 2023 ‘ https://ncaa.gov.ng/media-center/news/ncaa-demands-compliance-with-civil-aviation-regulation-on-insurance-cover/ Accessed on 14 August 2023

[4] 2023 Nig Cars, Regulations 18.4.2

[5] 2023 Nig. Cars, Part 18.12

[6] 2023 Nig. Cars, Part 18.12.1.2

[7] 2023 Nig. Cars, Part 18.12.1.3

Adeola is an IP lawyer, transactional and corporate governance practitioner with indigenous legal practice experience and global outlook.She curates corporate commercial content on legal advisory and regulatory compliance needs for startups, SMEs and corporate entities seeking to establish,run and scale their businesses in Nigeria. Her contents are customised to provide pragmatic and relevant answers and legal solutions to Nigerian and foreign entrepreneurs/executives seeking corporate-commercial services.

Adeola is an IP lawyer, transactional and corporate governance practitioner with indigenous legal practice experience and global outlook.She curates corporate commercial content on legal advisory and regulatory compliance needs for startups, SMEs and corporate entities seeking to establish,run and scale their businesses in Nigeria. Her contents are customised to provide pragmatic and relevant answers and legal solutions to Nigerian and foreign entrepreneurs/executives seeking corporate-commercial services.

by Legalnaija | Aug 17, 2023 | Uncategorized

Are you a lawyer or a law firm that wants to increase your social media engagement and reach more potential clients? Do you have great content that deserves more attention and exposure? If you answered yes to any of these questions, then you need to subscribe to LegalNaija!

LegalNaija is Nigeria’s leading online platform for legal news, information, and services. We have over 40,000 followers across our social media pages, including Instagram, Facebook, Twitter, and LinkedIn. We also have a website that attracts thousands of visitors every day.

When you subscribe to LegalNaija, alongisde being listed on the Legalnaija Directory, we will push all your content across our pages and website when you tag @legalnaija, giving you the opportunity to showcase your expertise, build your brand, and grow your audience. You will also get access to exclusive benefits such as discounts on legal events, trainings, and publications.

Don’t miss this chance to boost your online presence and reputation with LegalNaija. To subscribe, simply visit our Legalnaija and register. If you also have an existing registration, simply renew your subscription to benefit.

You can also contact us via email or phone for more details. We look forward to working with you! 😊

by Legalnaija | Aug 15, 2023 | Uncategorized

Why Become A Sports Lawyer

Watching sports, rooting for teams, and celebrating successful players are wildly cherished pastimes around the world. As with other industries, that passion equals profit. In fact, the sports industry is now estimated to be worth more than $500 billion!

Some of the top ten largest sports contracts of all time include;

• Lionel Messi: $673,919,105 for a four-year soccer contract with FC Barcelona

• Patrick Mahomes: $503,000,000 for a 12-year football contract with the Kansas City Chiefs

• Mike Trout: $426,500,000 for a 12-year baseball contract with the Los Angeles Angels

• Mookie Betts: $365,000,000 for a 12-year baseball contract with the Los Angeles Dodgers

• Fernando Tatís Jr.: $340,000,000 for a 14-year baseball contract with the San Diego Padres

• Bryce Harper: $330,000,000 for a 13-year baseball contract with the Philadelphia Phillies

When it comes to sports, we often think about the players, the coaches, the team owners, and the fans. However, there is another important player in the world of sports that we often overlook – the sports lawyer. Sports lawyers are attorneys who specialize in sports law and represent athletes, teams, leagues, and organizations in legal matters related to sports.

What do sports lawyers do?

Sports lawyers come into play by ensuring the system of checks and regulations to ensure that fans, players and clubs do not get exploited.

Sports lawyers represent the legal interests of their clients. The clientele can include individual athletes, players, teams and coaching staff. High level sport equates to a high pressure environment, where typically the smallest margins can make a huge difference.

The tasks and responsibilities of sports lawyers can vary depending on their area of specialization and the clients they represent. However, some common tasks and responsibilities of sports lawyers include:

• Negotiating contracts for athletes, coaches, and other sports personnel

• Advising clients on legal issues related to sports, such as intellectual property rights, sponsorship deals, and licensing agreements

• Representing clients in arbitration or litigation related to sports disputes

• Drafting legal documents such as contracts, sponsorship agreements, and licensing agreements

• Providing legal guidance to sports teams, leagues, and organizations on issues such as labor law and antitrust law

The main priority of a sports lawyer is to make sure that athletes are given a good deal. For example, they help secure and negotiate contracts, sponsorship deals, mediate any disputes that these individuals might have and fight their corners.

So you have got your law degree and are thinking about becoming a sports lawyer but how do you do it? The first step is experience. Don’t worry it doesn’t have to be directly in sports law.

By participating in the Entertainment Law Mastery class, you will learn not only about Sports Law, and how to excel as a Sports Lawyer but you will learn other areas of Entertainment law as well.

Register via this link https://linktr.ee/Lawlexis

You can also read more about the training here; https://legalnaija.com/career-training-for-lawyers-entertainment-law-mastery-2-0/adedunmade/

by Legalnaija | Aug 7, 2023 | Uncategorized

In a bid to foster mutual growth and cooperation, the Attorney-General of Osun State, Hon. Oluwole Jimi-Bada paid a courtesy visit to the revered Ooni of Ile-Ife, His Imperial Majesty, Oba (Dr.) Adeyeye Ogunwusi, Ojaja II, CFR, at his palace in Ile-Ife on 6th August, 2023. The meeting was a significant step towards forging stronger developmental ties between Ile-Ife and the Osun State Government.

During the meeting, both parties emphasized the importance of unity and collaboration in advancing the socio-economic development of the State, in a bid to ensure the quick actualization of the five-point agenda of His Excellency, Senator Ademola Adeleke, the indefatigable, forward thinking and cosmopolitan Governor of Osun State. They acknowledged the historical significance of Ile-Ife, as the cradle of the Yoruba race and recognized the vital role it plays in the cultural and economic landscape of Osun State.

The Attorney-General expressed the Osun State Government’s commitment to inclusive development that benefits all citizens, regardless of their class, background or status in the society. He harped on several key areas of focus dear to the heart of His Excellency, Senator Ademola Adeleke, including but not limited to infrastructure development, education, healthcare, tourism, and youth empowerment.

In response, the Ooni of Ile-Ife commended the Government’s unwavering dedication to the progress of Osun State and emphasized the need for the preservation and promotion of the State’s cultural heritage. His Imperial Majesty stressed that by maintaining a delicate balance between modernization and cultural preservation, the development process can be more harmonious and sustainable. Both parties agreed on the importance of fostering public-private partnerships to attract investments and encourage homegrown entrepreneurship, which would lead to job creation and economic growth in the State.

Additionally, parties discussed the significance of sustainable development practices, with a focus on environmental preservation and renewable energy initiatives. The meeting concluded with a renewed commitment to work together towards the collective advancement of Ile-Ife in particular and Osun State in general. The visit marked a significant milestone in the quest to strengthen the bond between the people of Ile-Ife and the Osun State Government, highlighting the shared vision of a prosperous State. By leveraging each other’s strengths and resources, both parties are poised to chart a path of sustainable development that would benefit the people and create a brighter future for generations to come.

Signed:

Debo Oladinni, Esq.

Senior Legal Adviser to the Hon. Attorney-General & Commissioner of Justice, Osun State

by Legalnaija | Aug 5, 2023 | Uncategorized

Energy laws govern the use and taxation of energy, both renewable and non-renewable. Also, Energy lawyers work on a variety of concepts relating to energy. They also work in multiple sectors, including clean energy, nuclear power, oil, and gas.

If you want to perfect your skill in Nigerian Energy Law, here are 6 books available on Legalnaija you should add to your law library.

1. Oil and Gas Law In Nigeria

This includes the ff laws;

– Nigerian Oil and Gas Industry Content Development Act, 2020

-Oil Spill and Oilly Waste Management Regulation

-.Oil Spill Recovery, Clean – Up Remediation And Damage Assessment Regulations, 2011

Available here; https://legalnaija.com/product/oil-gas-laws-in-nigeria/

2. Essays On Nigerian Electricity Law

This book is a collection of articles on the various issues or aspects of electricity law and regulation in Nigeria. It covers various peer-reviewed articles on the subject such as: “The Pathway to Energy Liberation in Nigeria: Lessons for Namibia”; “Manitoba Hydro and Electricity Undertakings In Developing Countries: The Case of Nigeria”; “Regulation of the Captive Power Generation and Rural Electrification”; “Implications and Challenges of a Privatized Power Sector In Nigeria: Perspectives to Host Community Concerns”; “Comparative Appraisal of Renewable Energy Laws and Policies” (2014); “Challenges and Developments in the Nigerian Power Industry”; “Compulsory Purchase as an Alternative to Revocation of Title to Land for Electricity Purpose in Nigeria”; “Beyond Power Sector Reforms: The Need for Decentralised Energy Options (‘DEOPs’) for Electricity Governance in Nigeria”; “Electricity Regulation and the Protection of Rights of Electricity Consumers In Nigeria: Revisiting Amadi Vs. Essein; “Prospects and Challenges of Expert Determination and Other Dispute Resolutions Mechanism of the Nigerian Electricity Sector” and other essays on the subject of electricity law and regulation.

You can order your copy here https://legalnaija.com/product/essays-on-nigerian-electricity-law/

3. Nigerian Petroleum, Energy and Gas Resources Law

This book explores the topical and contentious issues of the Nigerian Petroleum, Energy and Gas Resources Law, and the transition to low carbon energy in Nigeria. The legal and business risks confronting financing of oil and gas investments and renewable energy development drive in Nigeria and the way forward.

You can order your copy here https://legalnaija.com/product/nigerian-petroleum-energy-and-gas-resources-law/

4. Nigerian Energy Resources Law and Practice

https://legalnaija.com/product/nigerian-energy-resources-law-and-practice/

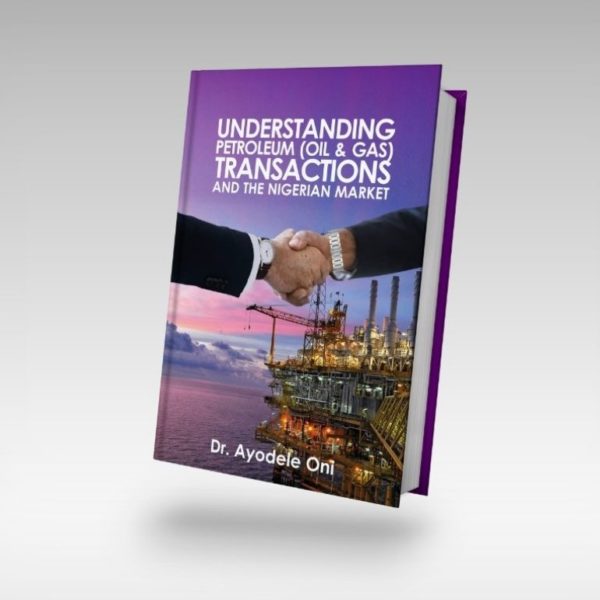

5. Understanding Petroleum (Oil & Gas) Transactions and the Nigerian Market

There have been several policies in the Petroleum industry such as those related to local content and domestic gas supply obligations. This book provides a clear Insight about executing transactions, obtaining licenses and other complex issues industry participants encounter

This book is available here; https://legalnaija.com/product/understanding-petroleum-oil-gas-transactions-and-the-nigerian-market/

6. The Nigerian Electricity Market; Understanding The Transactional, Legal & Policy Issues

The books aims at giving industry participants all the necessary negotiating tools as they engage in the complexities within the power sector in Nigeria. The books discusses licenses, agreements, and regulations that operate within the power industry space.

You can order a copy here; https://legalnaija.com/product/the-nigerian-electricity-market-understanding-the-transactional-legal-policy-issues/

If you are in search of other law textbooks, you can browse through our bookstore here legalnaija.com/shop

Have a pleasant weekend!.

@legalnaija

+2349029755663

www.legalnaija.com

by Legalnaija | Jul 29, 2023 | Uncategorized

Data privacy is about who has access to (your) data, while data protection provides tools and policies to actually restrict access to the (your) data.Here is a list of 5 books for Privacy & Data Protection Practitioners.

1. Casebook On Data Protection – ₦20000

The book is divided into fourteen chapters. After an introduction that traces the brief history of data protection in Nigeria, separate chapters are devoted to Definitions, Relationship with other rights; Principles of Data Protection; Exceptions and Derogation; Employment Data; Sensitive Data; Transfer of Data to a Foreign Country; Liability of Data Controllers; Data Subject’s Rights; Data Breach; Remedies; Data Property Rights; Supervisory Authority and Appendices that feature the Nigeria Data Protection Regulation and the NDPR Implementation Framework.

You can order the book here; https://legalnaija.com/product/casebook-on-data-protection/

2. Privacy And Data Protection In Nigeria

-₦10000

Privacy and Data Protection Law in Nigeria is a book written by Olumide Babalola and published in 2021 by Noetico Repertum Inc. The first part of the book deals with one of the two major themes of the book- privacy. This part consists of chapters 1-5. Chapter 1 covers the Definition of Privacy and chapter 2 deals with The Taxonomy and Typology of Privacy.

Part 2 covers data protection and consists of 3 chapters. Chapter 6 covers the Evolution of Data Protection in Nigeria and chapter 7 explores The Sources of Data Protection Law in Nigeria. The part concludes with chapter 8, which considers The Relationship between Data Protection and other Rights.

Part 3 broadly covers the Nigeria Data Protection Regulation (NDPR): Introduction, Scope and Definitions.

You can order the book here; https://legalnaija.com/product/privacy-and-data-protection-in-nigeria/

3. European Data Protection Law And Practice ₦40000

European Data Protection: Law and Practice,” which will serve as the textbook for the CIPP/E certification. While the General Data Protection Regulation (GDPR) promises to unify the approaches of the EU member states, it brings forth challenges as organisations work toward compliance with this robust and comprehensive regulation. Based on the body of knowledge for the Certified Information Privacy Professional/Europe (CIPP/E) certification (ANSI accredited under ISO 17024:2012), European Data Protection is the essential text on the GDPR, pan-European, and national data protection laws. European Data Protection reviews concepts, criteria and obligations of the GDPR and related laws, examines the territorial and material scope of the GDPR, legitimate processing criteria, information provision obligations, data subjects’ rights, security of processing, accountability. You can order the book here https://legalnaija.com/product/european-data-protection-law-and-practice/

4. Emerging Jurisprudence On Privacy And Data Protection In Nigeria ₦10000

You can order the book here; https://legalnaija.com/product/emerging-jurisprudence-on-privacy-and-date-protection-in-nigeria/

5. Information and Communication Technology Law in Nigeria

₦5500

This book is the first comprehensive discussion of legal issues relating to the information and communications technology (ICT) in Nigeria, with particular reference to English, European, Canadian, and American data.

You can order the book here; https://legalnaija.com/product/information-and-communication-technology-law-in-nigeria/

Check out other law books on the Legalnaija bookstore www.legalnaija.com/shop

@Legalnaija

+2349029755663

by Legalnaija | Jul 19, 2023 | Uncategorized

Dissolve NBA Women Forum to ensure Gender Equality in law profession – Tolu Aderemi

The Chairman, Arbitration Commission of the International Law Association (ILA) Mr Tolu Aderemi has charged the legal profession to promote gender diversity in every facet of legal practice.

Aderemi equally advocated the dissolution of the NBA Women Forum, saying that there is no NBA Men’s Forum .

He stated this at the Nigerian Bar Association Women Forum (NBAWF) Lagos State Chapter webinar titled ‘Work-Life balance and the legal profession: A social responsibility or a competitive advantage’ held on Tuesday.

Speaking at the Forum as a keynote speaker, Aderemi, who is also a partner at the leading law firm of Perchstone & Graeys LP, said, “it is disconcerting that of the 732 Senior Advocates of Nigeria, only a 4% fraction are ladies.

“ Out of the 37 Attorneys General in Nigeria, only 4 are female. There has been only 1 female Chief Justice of Nigeria whilst, there has been only 6 Justices of the Supreme Court so far,” he explained.

Aderemi also noted that since 1960, there has been only 1 female president of the Nigerian Bar Association whilst the Court of Appeal can only boast of 2 female presidents.

In his further analysis, he stressed

‘it will appear to me (and from statistics) the only 40% of Nigerian lawyers are females. However, we are seeing increasing 61% in public sector roles, 55% in corporate sector, 33% on the bench, 31% as partners in sized law firms and only about 15% are founders of their own law firm’.

,Aderemi advocated that to demonstrate that female lawyers are prepared for gender equality, they should promote the dissolution of the NBA Women Forum, for according to him, there is no NBA Men’s Forum.

This, in his view, should also extend to the dissolution of the Ministry of Women Affairs and Social Development, Nigeria For Women Project and those other Associations established solely for women ostensibly to advocate for women empowerment.

He concluded by saying that unless this is done, their male counterparts will continue to believe the legal profession is exclusively for men and special provision has been made for women. In its stead, Aderemi charged the women participants to jointly move to re-submit the Gender and Equal Opportunities Bill, which sadly the 9th Assembly rejected.

Another keynote speaker who is also very senior lawyer, Mrs Abimbola Akeredolu, SAN, a former Attorney General of Ogun State, a partner at the firm of Banwo & Ighodalo and the chairperson of LASIAC similarly advocated for the dissolution of women-focused empowerment Associations.

Although the learned Silk slightly disagreed with Mr Aderemi by suggesting that the government’s 35% affirmative action be sustained as this goes a long way to support women’s growth.

The third keynote , Dr Amina Ahmed, a Consultant Gynecologist at the Federal Medical Center, Abeokuta, Ogun State charged female lawyers to always conduct health checks periodically to live a cancer-free life.

According to Dr Ahmed, early detection of any cancerous cell(s) in the cervical goes a long way to determining the success of treatment of cervical cancer.

Dr Ahmed therefore charged the women lawyers of the Nigerian Bar Association to take the lead in the advocacy of early detection.

Other prominent participants included Mrs Funke Adekoya, SAN, Dr Dorcas Abah (who served as the Moderator) and a host of other distinguished female lawyers.

by Legalnaija | Jun 15, 2023 | Uncategorized

In the first part of the series, we talked about Marketing in Real estate and the importance of knowing the right marketing technique to employ for your real estate company for the company and business to do well in the market. Marketing is the sole sustenance of every business, be it small or large business.

However, there is a popular saying that when you are in Rome, you behave like a Roman and when you are in Italy, you behave like an Italian. Having the capital, and marketing knowledge of the real estate sector is not as important as having an idea of the needed laws governing that sector. Not being aware of the laws governing Real estate in your country and venturing into it is like a blind man walking on a busy road with no walking stick or anybody holding his hand, he will surely meet his misfortune. Lord Denning in Benjamin Leonard MacFoy v. United Africa Company Ltd. 3 All ER 1169 at 1172 (1961) said putting something on nothing will surely fail.

This part of Running a Profitable Real Estate Business examines some of the vital laws that are required for most real estate transactions. This part will also discuss the different legal documents needed for a perfect real estate transaction. While discussing the laws, the focus shall mainly be on Nigerian laws because the writer is domiciled in Nigeria. However, readers outside the jurisdiction can pick laws similar to the ones that will be discussed here for their perusal. It should however be noted that knowing these laws is not adequate than engaging the services of someone good in them. You can do that either by retaining the service of a Lawyer or employing a Lawyer to work in your Legal Department.

RELEVANT LAWS

- LAND LAW

Signed into law in the year 1978. The law governs the ownership, purchase, administration, management, and management of land in Nigeria’s states and Federal Capital Territory, including land allotment, title registration, etc. Section 1 of the law states that every land is vested upon the Governor and he has the power to grant ownership of any portion of the land to anybody and he also has the liberty to withdraw such grant.

All lands comprised in the territory of each state in the Federation are vested in the Governor of that State and such land shall be held in trust and administered for the use and common benefit of all Nigerian in accordance with the provisions of the Act.

Such land granted to an individual by the Governor is only for 99 years, after which the said land reverts to the Governor.

- COMPANIES AND ALLIED MATTERS ACT

After determining to go into Real Estate, the next thing an individual needs to consider is the Incorporation of a company or registration of a business name, both of which are guided and provided for under the Companies and Allied Matters Act 2020. This aspect requires the service of an accredited Corporate Affairs Commission Agent. Registration of a business name is good if you have an ideal name you want to use for business and you want to secure the name before deciding to start a company using the name. You can also use it to run a business.

However, the mere registration of a business name has its limitation compared to the incorporation of a company. When you incorporate a company, you have more advantage as most loan, grant organizations, and business angels tend to deal with incorporated companies than business names. The CAMA amongst other things states that a single person can be the sole shareholder of a private company, so you do not have to bring too many hands into the leadership of your organization.

- MORTGAGE LAWS

It should however be noted here that presently in Nigeria, there are different mortgage laws governing the administration of mortgages in the different parts of the country. There are two types of mortgages in Nigeria, namely legal mortgages and equitable mortgages. The mode of creating a legal mortgage in Nigeria is determined by the law applicable in the State where the property is situated. Given that it grants the mortgagee legal title to an item, a legal mortgage is the most secure and complete type of security interest. In contrast, an equitable mortgage entails the transfer of the mortgagor’s beneficial interest in a property to the mortgagee as collateral for the fulfillment of debts.

Legal Mortgage

The most secure and complete type of security interest is a legal mortgage, which gives the mortgagee legal title to the collateral and forbids the mortgagor from dealing with the mortgaged property while it is still secured by the mortgage.

Equitable mortgage

The transfer of the borrower’s beneficial interest in a property to the lender as security for the fulfillment of specific obligations constitutes an equitable mortgage. This transfer is made with the express or implied understanding that the beneficial interest will be returned to the borrower once the secured obligations have been satisfied.

It should however be noted that there are three (3) laws governing the administration of mortgages in Nigeria.

The Conveyance Act, of 1881 (CA)

Under the Conveyancing Act, there are two methods of creating a legal mortgage:

- By assignment of the entire and unexpired residue of the mortgagor’s leasehold interest to the mortgagee (under the Land Use Act) with a proviso for cesser upon redemption.

- Sub-demise (sub-lease) of the unexpired residue less few days with a proviso for cesser upon redemption (could even be less one day)

Property & Conveyancing Law (PCL) is applicable in States in the old Western and Midwestern regions namely Ondo, Osun, Oyo, Ogun, Edo, Ekiti, and Delta except for Lagos.

Under the PCL, there are two methods of creating a legal mortgage:

- The demise of a freehold for a term of years absolute subject to cesser on redemption.

- Sub demise (sublease) for a term of years absolute, less at least one day than the term vested in the mortgagor and subject to provision for cesser on redemption.

- A legal charge by Deed expressed to be by way of a legal mortgage

Creation of Legal Mortgage in Lagos State

The law regulating all mortgage transactions in Lagos State is the Mortgage and Property Law (M&PL) of Lagos State, 2010 which abolished the Property and Conveyancing Law. Under the M&PL, a mortgage can only be created in the following ways

- A demise (the conveyance or transfer of property) of a term of years absolute, subject to a cesser on redemption.

- A charge by deed is expressed to be by way of a legal mortgage.

- A charge by deed is expressed to be by way of statutory mortgages in the forms provided under this law.

- TENANCY LAW

Whether you are starting big or small, not all the places you use for professional and residential transactions will be yours, you will either rent or lease some. Each State of Nigeria has its tenancy law which governs the service of notices, rights of a landlord, rights of tenants, increment of rent, peaceful possession of the property, etc.

- PERSONAL INCOME TAX (AMENDMENT) ACT 2011 AND COMPANY INCOME TAX ACT 2011

Also known as PITA and CITA. It is a general knowledge that citizens are expected to pay tax which in return helps the government in the dispensation of their duties to the general citizenry. Also, up-to-date payment of tax as a business owner and a business entity is part of the things you will be expected to submit while applying for loans and/or grants from both local and international financial organizations and government financial institutions like the Bank of Industry. The latest Tax Regulation 2018 also states that your Special Purpose Vehicles may be taxed.

- FINANCE ACT 2023

This was signed into law by the former president, Mohammed Buhari while he was about to leave office. The Act makes some amendments to Capital Gains Tax Act, Companies Income Tax Act, Personal Income Tax Act, Petroleum Profit Tax Act, Value Added Tax Act, Tertiary Education Trust Fund Act, Customs, Excise, Tariff Act, Stamp Duties Act, Public Procurement Act, Corrupt Practices and other Related Offences Act and Ministry of Finance (Incorporated) Act.

LEGAL DOCUMENTS

- SALES AGREEMENT

After the declaration of interest to purchase a plot of land or landed property, due diligence is carried out, and the Sales Agreement is put in place between the Vendor and the Purchaser stipulating the amount the property will be sold and any other conditions that would be fulfilled before total alienation takes place.

- DEED OF ASSIGNMENT

This is the document that perfects the alienation of the property. It is the final document that exchanges the hands of the parties to the transaction.

- POWER OF ATTORNEY

It should be noted that this document in particular is not only used in the alienation of a property or property transactions. It is a document bestowing power and responsibilities from the Donor to the Donee.

However, when it is used in property transactions, it is bestowing the rights, duties, and obligations expected of the Donor to Donee either for a period certain or forever which must be explicitly stated in the Power of Attorney.

- PARTNERSHIP AGREEMENT

This is an Agreement that spells out the terms of a Partnership. The Partnership might be Sponsoring Partnership, i.e. A wants to purchase a property worth N4,000,000,000.0 (Four Billion Naira Only) but A does not have up to that amount at the present but he knows in a couple of months he would get the amount. If A decides to wait till then before purchasing the property, he would miss purchasing it. On the other hand, B has more than N4,000,000,000.0 that he is not using presently. A and B can enter into a Partnership whereby B will give A the amount of money he needs with an agreement to pay back N4,500,000,000.0 after some months. After the payment, A takes full possession of the property.

All other terms and conditions of this Partnership would be expressly stated in the Agreement.

- SPV DOCUMENTS

Special Purpose Vehicles or Entity is a type of Project Finance under Corporate Finance. Whenever Companies or entities want to embark on a new project in which they do not want the mother company to be involved or hide some finances or raise capital for a project, Special Purpose Vehicles or Entities are created. They are created to carry out a particular function, they have Directors and Shareholders just like a normal company. For example, HH Holdings, a Special Purpose Vehicle created by Tony Elumelu’s Heirs Holding purchased about 9 Billion Transcorp shares. So also, Sowami of Ardova Plc’s Special Purpose Vehicle, Ignite Investment and Commercial Limited (IICL). So as a Real Estate company carrying out different projects and desires to isolate the risk of that project from your company, you need a Special Purpose Vehicle.

- JOINT VENTURE AGREEMENT

The coming together of a person and an estate company or two estate companies to jointly execute a particular project. The Agreement amongst other things must spell out the input of each party to the project and also state the profit-sharing formula. It is pertinent to be agreed before signing if the Joint Venture Agreement will include any reversionary clause.

- LOAN AGREEMENT

Funny enough this is the Agreement I was told to draft when I went for the Interview at my present place of work. The Agreement must disclose the amount sought, the duration, repayment plan and also state if it is a security-based loan or not.

- TENANCY AND LEASE AGREEMENT

For those that are basically into Property Management, virtually all their transaction revolves around these 2 documents. It must spell out the duties and rights of both parties, the duration of the rent or lease, the rent review clause, and the rate.

- SEARCH REPORT

At the preliminary stage of every land and landed property transaction, it is advised that after the exchange of details about the property, the party intending to purchase the said property should carry out searches to verify the authenticity of what the intending Vendor has and is saying about the property. Searches about a property should be carried out at the Land Registry of that particular jurisdiction and also the court registry to know if there is an existing court case on the said property before purchasing the property.

In a nutshell, we have discussed some of the vital laws and documents needed for a perfect real estate transaction. It is advised that you engage the services of a Lawyer for this aspect of your real estate business.

Adebola Valentine Adeleye Esq. is a Real Estate Lawyer and has keen passion and interest in Corporate and Commercial practice. He is based in Abuja and can be reached through adeleyebola93@gmail.com or 08108173996

Adebola Valentine Adeleye Esq. is a Real Estate Lawyer and has keen passion and interest in Corporate and Commercial practice. He is based in Abuja and can be reached through adeleyebola93@gmail.com or 08108173996

by Legalnaija | Jun 12, 2023 | Uncategorized

Consider the wonderful purpose of subsidies, a kind gesture that allows individuals and businesses access to petrol, an essential treasure, despite limited resources. However, in this tale, the small and medium enterprises (SMEs) in Nigeria have been dealt a huge misfortune by the subsidy removal, casting a shadow of uncertainty on their growth trajectory.

Nigeria, which is a country endowed with an abundance of 2.4 million barrels of crude oil every day, sadly sees its wealth sent abroad. This was made possible by a history of corruption and neglect which rendered our local refineries inactive, leaving the country to rely heavily on imports for more than 70% of its petrol consumption.

Recent realities demonstrate this. The elimination of subsidies has put small-scale business owners in a tough position only three days after a new government took office. These entrepreneurs, like battling fires without air, feel their profits dwindling and their survival threatened by this harsh approach.

In its most basic form, the fuel subsidy acts as a buffer, restricting the price of this petrol and insulating buyers from its true cost. The government, to its credit, bridged the gap between market pricing and regulated value per litre.

Now picture, if you will, the bustling streets that were once packed with the goals and aspirations of courageous entrepreneurs. These spirits forged ahead, inspired by the promise of financial relief, under the soothing shade of the subsidy tree. However, the withdrawal of this crucial lifeline has cast a dark cloud over the Nigerian business landscape, plunging SMEs into a maze of unparalleled difficulties.

Transport costs, like a raging fire, now eat their budgets. Entrepreneurs, who were previously helped by subsidised fuel, now face the hard reality of dedicating a considerable percentage of their cash to sustain operations. These additional expenses will eventually descend, like predatory birds in the sky, impacting consumer purchasing power and casting a shadow over economic growth.

According to a World Bank analysis, MSMEs account for up to 45% of total employment and up to 33% of national income in emerging economies. As noted by the Financial System Surveillance 2020 (FSS2020), the MSME sector is considered strategic for the development of the Nigerian economy due to its enormous potential and contributions.

In this difficult environment, the difficulties encountered by businesses attempting to manage high petroleum operating costs, which are critical to their operations, are worrying. Because of the costs imposed by the elimination of subsidies, small-scale business owners may be forced to lay off staff, dramatically raising the unemployment rate.

A worldwide consulting group predicted that Nigeria’s jobless rate will reach 49.6% in 2023 by December 2022. As of the fourth quarter of 2020, the country’s unemployment rate was 33.3%, according to the National Bureau of Statistics.

The statistics office produced an inflation report in February, revealing a considerable increase in the country’s inflation rate to 21.91%. Unfortunately, this percentage is expected to increase much higher in 2022, reaching 37.7%. and 40.6% in 2023.

Furthermore, the Bureau of Statistics had earlier predicted that the elimination of fuel subsidies and the adoption of the 2023 Fiscal Bill would exert additional pressure on domestic prices in 2023.

The headline inflation rate increased to 22.04% in March 2023, up from 21.91% the previous month, further exacerbating the problem. Nigeria’s annual inflation rate resumed its continuous rise in April 2023, reaching an alarming 22.22%. This statistic was the highest in over 18 years.

This problem has a particularly negative impact on food prices, which have risen dramatically. Food inflation rose to 24.61% in March, exceeding the previous month’s figure of 24.45%. Essential commodities like oil and fat, bread and grains, fish, potatoes, yams, fruits, meat, vegetables, and spirits all contributed to the population’s load.

With the elimination of subsidies, providers of vital products are now confronted with the new problem of deteriorating infrastructure. Nigeria, once brimming with opportunity, today struggles with decaying roads and intermittent power supplies, both of which have a significant impact on small-scale business owners. These challenges stifle ambitions and inhibit growth.

Transportation bottlenecks and power outages have become common occurrences in this turbulent environment. Entrepreneurs face logistical challenges that limit their ability to meet market demands efficiently. In an era when success is measured in millimetres, the lack of dependable infrastructure stifles productivity and creates uncertainty for countless SMEs.

In this absence of subsidies, the country is plagued by rising unemployment and soaring inflation. High food prices alienate the public, while the dreams of small-scale businesses, which are critical to economic growth, are jeopardised.

As we reflect on the plight of Nigeria’s SMEs, it is evident that this enormous problem will necessitate more than just government intervention. It is critical to create a collaborative ecosystem that encourages inter-SME collaboration. Business associations, industry experts, and experienced entrepreneurs have the ability to steer the path forward. These guiding lights can provide support, resilience, and prosperity by sharing knowledge, promoting best practices, and mentoring. This collaborative endeavour will unlock entrepreneurs’ true potential, reviving the nation’s spirit and ushering in a new period of limitless prosperity.

Omojo Wada, a serial entrepreneur, is the founder of Solohan & Co, Africa’s premier legal outfit company. Since its beginnings, the firm has outfitted over 12,000 lawyers and justices throughout the world.

Omojo Wada, a serial entrepreneur, is the founder of Solohan & Co, Africa’s premier legal outfit company. Since its beginnings, the firm has outfitted over 12,000 lawyers and justices throughout the world.

by Legalnaija | Jun 1, 2023 | Uncategorized

Every successful lawyer has a rich and up to date law library; it’s one of the requirements for success, whether you are in private or in-house practice. Below, we have a provided a list of over 100 books you can add to your library, all specially curated from diverse areas of practice and are available on the legalnaija bookstore for delivery to you anywhere in and out of Nigeria.

Place your order directly on the website or contact us on 09029755663 or hello@legalnaija.com . If you are shopping on the bookstore, you can access a 10% discount when you use the voucher code: ILOVELAW.

Here is the list; @Legalnaija|09029755663

List of books on Legalnaija Bookstore

- A – Z Of Sports Law by Olisa Agbakoba Legal (₦2,500)

- A Compedium Of Practice Notes ₦17500

- A Force of Justice (A collection of law articles published in honour of Hon. Justice Oguntade JSC Rtd)(₦30,000)

- A Hand Book Of Criminal Law And Procedure Through Cases (Hard Cover) ₦15000

- Administration of Criminal Justice Act Annotated ₦10500

- ADR and Arbitration In Nigeria by Abdulsalam O. Ajetunmobi (N8500)

- ADR Proceedings (N3500)

- Anatomy of Crime of Corruption in Nigeria (Vol. 1) ₦9500

- Anatomy of Crime of Corruption in Nigeria (Vol. 1) ₦9500

- Annotated Nigeria Data Protection Act, 2023 ₦20000

- Aviation Law An Practice In Nigeria by Ugo Ezeugwa (N21,500)

- Babalola’s Law Dictionary Of Judicially Defined Words And Phrases (2nd Edition)(₦5,000)

- Bhadmus on Corporate Law (N13000)

- Board Committees: Directors Guide for Effectiveness ₦23000

- Business Law And Practice 1 (N13500)

- Business Law And Practice 2 (N13500)

- Carriage Of Goods By Sea ₦19000

- Casebook On Data Protection (₦20,000)

- Casebook On Human Rights Litigation In Nigeria (₦20,000)

- Cases & Materials On Nigerian Legal System (N8,000)

- Child’s Right Act, 2003 ₦3650

- Civil and Criminal Litigation In Nigeria (N10,000)

- Civil Litigation In Nigeria (N10,000)

- Commercial Law And Practice by Eni EjaAlobo (₦10000)

- Company Law And Practice In Nigeria (N13,500)

- Company Secretary’s Guide On Corporate Governance ₦19000

- Compendium Of Consumer Protection Law In Nigeria (N13,500)

- Competition Law, Local Content, and Capital Market (₦6000)

- Contemporary Issues In Nigerian Constitutional Law (₦8000)

- Corporate Finance and Investment by Joseph Ezenwa (N5500)

- Corporate Governance and Sustainable Reporting in Nigeria ₦16500

- Corporate Governance by Richard Adepeju& Felix OjemhedeAkahome (₦7500).

- Court Of Appeal Rules 2021 (N3500).

- Criminal Evidence in Nigeria (N11000)

- Criminal Litigation In Nigeria (3rd Edition) by Afolayan (N13,000)

- Customary Land Law In Nigeria (N13,500)

- Dark Hearts (Hard Cover)(₦6,500)

- Debt Recovery In Nigeria by Emeka Odikpo (₦7000)

- Directors Handbook On Corporate Governance ₦16000

- Electoral Act 2022 (₦3000)

- Electronic Evidence And Digital Transaction Law ₦17000

- Enforcement of Fundamental Rights In Nigeria ₦9000

- Enforcement of Income Taxes ₦5500

- Entertainment Law In Nigeria by Michael Dugeri (₦25000)

- Essays on Nigerian Electricity Law (N6500)

- Family Law And Succession In Nigeria (N8000)

- Fatal Blunders And Considerations In Criminal Trial ₦17000

- Final Decisions In Criminal Laws And Practices In Nigeria ₦17500

- Guidelines for the Assessment of General Damages In Personal Injury Cases ₦16000

- Hints On Land Documentation And Litigation In Nigeria (Paperback) by LayiBabatunde SAN (N9000)

- Hire Purchase And Sales Of Goods Act (N3500).

- Human Right and Enforcement Clinic ₦8500

- Human Rights And Civil Liberties In Nigeria (N5500)

- Human Rights Legal Protection of Children in Nigeria by Yinka Olomojobi (N13,000)

- Human Rights Litigation In Nigeria: Law, Practice And Procedure by Frank Agbedo (₦8,000)

- Human Rights On Gender, Sex And The Law In Nigeria (N7500).

- Impeaching Witness Credit In Nigeria (₦6000)

- Information & Communications Technology Law in Nigeria (N5000)

- Insurance Law In Nigeria (N5500)

- Interlocutory Applications (Trial And Appellate Practice) (₦8000)

- Internal Security, Criminal Justice And The Police (₦12000)

- International Arbitration Law And Practice: The Practitioners Perspective by Tolu Aderemi (₦10,000).

- Introduction To Nigerian Labour Law (N8500)

- Islamic Law of Evidence by Hanafi A. Hammed (N5000)

- Journal Of Current Law And Arbitration Practice (Vol 1, No.1)(₦5,000)

- Journal Of Current Law And Arbitration Practice (Vol 1, No.2)(₦5,000)

- Journal Of Current Law And Arbitration Practice (Vol 2, No.1)(₦5,000)

- Journal Of Current Law And Arbitration Practice (Vol 2, No.2)(₦5,000)

- Jurisprudence And Legal Theory (N6500)

- Jurisprudence And Legal Theory In Nigeria ₦8500

- Keaton On Building Contracts ₦250000

- Know Your Rights: Legal Guide For Everyday Life ₦10000

- Land Law In Nigeria ₦12500

- Law And Medical Ethics ₦65000

- Law And Practice Of Extra – Judicial And Confessional Statements ₦14000

- Law For The Layman(₦3,000)

- Law In Practice In Nigeria (N7000)

- Law In Practice in Nigeria ₦12000

- Law of Armed Conflict: Principles and Concepts by Hagler Okorie (N5000)

- Law Of Contract (N6500)

- Law of Evidence in Nigeria (N8500)

- Law of Succession ₦15500

- Law Of Tort (N7500)

- Legal Research And Writing In Nigeria by Adewale Taiwo (N4500)

- Legal Rights And Obligations Under Nigerian Laws (Ebook) (₦1500)

- Legal Rights And Obligations Under Nigerian Laws (Hard cover) (₦3000)

- LISTENEVERYHOW – How Negotiations Work by JemideAyuli (₦9800)

- Market Abuse Regulation ₦25000

- Mass Media Law by Ese Malami (N5500)

- Metamorphosis; Tales By A Lawyer Girl by AdeolaOsifeko (₦2800)

- Modern Appellate Procedures ₦15500

- Modern Approach To Intellectual Property Laws In Nigeria (N8,500)

- Money Laundering Act 2022 (N3000)

- Motions And Applications In Criminal Law Practice ₦11500

- New Developments In Law And Practice In Nigeria(Essays In Honour Of Dele Adesina SAN) (₦20,000)

- Nigeria Immigration Law And Practice ₦18500

- Nigerian Conservation Law And International Environmental Treaties by Amari Omaka (₦9000)

- Nigerian Energy And Natural Resources Law ₦6500

- Nigerian Energy And Petroleum Industry Law ₦25000

- Nigerian Energy Resources Law And Practice by Yemi Oke (₦10,500) – Unavailable.

- Nigerian Petroleum, Energy and Gas Resources Law by Olusola Joshua Olujobi (N20,000)

- Nigerian Tax Law And Administration (₦7000)

- Overturned Criminal Convictions In Nigeria (₦8000)

- Practical Approach To Chieftaincy Matters In Nigeria (N7500)

- Practical Approach To Civil And Criminal Liigation In Nigeria by A.O. Oluwadayisi, O.S. Akinwumi& A.F. OLorunyomi (N9500)

- Practical Approach To Effective Cross Examination (N6500)

- Practice Of Muslim Family Law In Nigeria ₦6750

- Precedents, Drafts and Forms for Lawyers ₦20000

- Principles & Practice Of Law Of Contract In Nigeria (N6000)

- Principles And Practice Of Plea Bargain (₦10000)

- Principles Of Bail In Nigeria by EkeminiUdim (₦5500)

- Principles Of Clinical Ethics And Their Legal Dimensions In Nigeria (Paper Back) by Prof. ShimaGyoh and LayiBabatunde SAN ₦5000

- Principles Of Formulation And Classification Of Grounds Of Appeal (N6500).

- Principles Of Formulation And Classification Of Grounds Of Appeal (₦6500).

- Principles Of Land Law In Nigeria ₦15500

- Privacy And Data Protection In Nigeria by Olumide Babalola (₦10,000)

- Probate And Letters Of Administration Made Easy (₦5500)

- Probate Practitioner’s Handbook ₦42000

- Property Law Practice In Nigeria (N7000)

- Public Health Law and Policy in Nigeria by Simon Uchenna Ortuanya (N13,000)

- Questions And Answers by Oluwadayisi (N8000)

- Revenue Law – Principles and Practice ₦57000

- Rights Of Suspects And Accused Persons Under Nigerian Criminal Law(₦6000).

- E.T Guide On Entertainment Law (N4000)

- Sexual Harassment And The Law (N2500)

- Social Media For Lawyers by Adedunmade Onibokun (Ebook) (₦1500).

- Social Media For Lawyers by Adedunmade Onibokun (Hard Cover) (₦3000).

- Sports Law And Practice ₦25000

- Studying And Practicing Law In Nigeria (N4,500)

- Tax Laws in Nigeria 2022 (N9000)

- The Bankers Remedy For Set-off ₦30000

- The Business of Running Your Business (N5000)

- The Criminal Law Library Stone & Johnson On Forensic Medicine ₦30000

- The Dialectics Of Alternative Dispute Resolution ₦35000

- The Employment Law Handbook by Jamiu Akolade(₦15000)

- The Law Of Affidavit Evidence (₦9500)

- The Law Of Evidence In Nigeria (N9500)

- The Law Of Succession In Nigeria ₦18500

- The Lawyer’s Companion – Paper Back by LayiBabatunde SAN (₦15000)

- The Nigerian Electricity Market; Understanding The Transactional, Legal & Policy Issues by Dr. Ayodele Oni (₦35,000)

- The Nigerian Land Law (N5500)

- The Nigerian Legal Method by Ese Malemi (₦5000)

- The Shipping Law Review ₦85000

- Tourism, Travels, Entertainment And Hospitality Law by Olufemi Abifarin (₦3500)

- Trial within Trial In Criminal Proceedings by Ekemini Udim (N5500)

- Understanding Equitable Principles And The Law Of Torts (N9000).

- Understanding Petroleum (Oil & Gas) Transactions and the Nigerian Market by Dr. Ayodele Oni (₦50,000).

- White Book (₦165,000).

Visit www.legalnaija.com/store to place your order and if you want to speak to a service rep, please email hello@legalnaija.com or Whatsapp 09029755663.

PRICES ARE SUBJECT TO CONFIRMATION

hello@legalnaija.com

Adeola is an IP lawyer, transactional and corporate governance practitioner with indigenous legal practice experience and global outlook.She curates corporate commercial content on legal advisory and regulatory compliance needs for startups, SMEs and corporate entities seeking to establish,run and scale their businesses in Nigeria. Her contents are customised to provide pragmatic and relevant answers and legal solutions to Nigerian and foreign entrepreneurs/executives seeking corporate-commercial services.

Adeola is an IP lawyer, transactional and corporate governance practitioner with indigenous legal practice experience and global outlook.She curates corporate commercial content on legal advisory and regulatory compliance needs for startups, SMEs and corporate entities seeking to establish,run and scale their businesses in Nigeria. Her contents are customised to provide pragmatic and relevant answers and legal solutions to Nigerian and foreign entrepreneurs/executives seeking corporate-commercial services.

Adebola Valentine Adeleye Esq. is a Real Estate Lawyer and has keen passion and interest in Corporate and Commercial practice. He is based in Abuja and can be reached through adeleyebola93@gmail.com or 08108173996

Adebola Valentine Adeleye Esq. is a Real Estate Lawyer and has keen passion and interest in Corporate and Commercial practice. He is based in Abuja and can be reached through adeleyebola93@gmail.com or 08108173996

Omojo Wada, a serial entrepreneur, is the founder of Solohan & Co, Africa’s premier legal outfit company. Since its beginnings, the firm has outfitted over 12,000 lawyers and justices throughout the world.

Omojo Wada, a serial entrepreneur, is the founder of Solohan & Co, Africa’s premier legal outfit company. Since its beginnings, the firm has outfitted over 12,000 lawyers and justices throughout the world.