by Legalnaija | Feb 2, 2024 | Blawg

As a lawyer, you know how important contracts are for your clients and your practice. Contracts are the foundation of any legal relationship, and they can protect your clients’ rights, interests, and obligations.

But drafting a contract can be a daunting and time-consuming task. You have to make sure that the contract is clear, accurate, and enforceable, and that it covers all the essential terms and conditions.

That’s why I want to share with you some practical tips and best practices on how to draft a contract in 5 easy steps. These steps will help you create a contract that is effective and professional, and that meets your clients’ needs and expectations.

Step 1: Identify the parties and the purpose of the contract. The first step is to clearly state who the parties are and what the contract is about. You should use the full names and addresses of the parties, and avoid using ambiguous terms like “seller” or “buyer”. You should also describe the main purpose and scope of the contract, and the benefits and obligations of each party.

Step 2: Define the key terms and conditions of the contract. The second step is to define the key terms and conditions of the contract, such as the price, payment, delivery, performance, quality, warranty, liability, and termination. You should use simple and precise language, and avoid jargon and legalese. You should also avoid vague or ambiguous terms, such as “reasonable”, “as soon as possible”, or “best efforts”. You should also specify how any disputes or changes will be handled, and what the governing law and jurisdiction will be.

Step 3: Draft the contract clauses and structure the contract. The third step is to draft the contract clauses and structure the contract. You should use headings and subheadings to organize the contract into sections and subsections, and use numbers and bullets to list the items and points. You should also use consistent and logical formatting, such as fonts, spacing, and indentation. You should also use transitions and connectors, such as “therefore”, “however”, or “in addition”, to link the clauses and sentences.

Step 4: Review and edit the contract. The fourth step is to review and edit the contract. You should check the contract for any errors, inconsistencies, or gaps, and make sure that the contract reflects the parties’ intentions and agreements. You should also check the contract for any grammar, spelling, or punctuation mistakes, and use a proofreading tool or service to help you. You should also ask a colleague or a friend to review the contract and give you feedback.

Step 5: Sign and execute the contract. The final step is to sign and execute the contract. You should make sure that the parties sign the contract in the presence of a witness or a notary, and that they use their full names and titles. You should also make sure that the parties date the contract and keep a copy of the contract for their records. You should also follow up with the parties and monitor the performance and compliance of the contract.

As you can see, drafting a contract can be a simple and straightforward process if you follow these 5 steps. But if you want to save even more time and effort, I have a special offer for you.

I have created a free contract template that you can use for your next contract. This template is based on the best practices and standards of contract drafting, and it covers all the essential elements and clauses of a contract. You can customize and modify this template to suit your specific needs and preferences.

To get your free contract template, all you have to do is log into your dashboard on www.legalnaija.com

Don’t forget to share this with your friends and colleagues.

by Legalnaija | Feb 1, 2024 | Blawg

Aviation law concept. Judge gavel and airplane on blue background. Flight cancellation

Disputes are inevitable in our day to day life especially in business and in the social strata of the society. It is pertinent to state that there are numerous benefits of using an arbitrator in handling civil aviation disputes which allows the disputing parties to make a choice on having a neutral third party to hear their case and pass an award. exploring this mechanism is helpful where the parties have a history of conflict or a risk of bias.

The aviation sector is a sensitive sector of any nation, it is very sensitive because of the high cost of running the sector. arbitration can be used to resolve complex or technical disputes. disputes in aviation are complex and technical in nature. the areas where the disputes mainly spring from aircraft design or maintenance. when legal disputes arise in this areas mentioned, it is important to understand that merely proving that the aircraft design was the probable reason for the accident/injury is not adequate as there are factors to consider like that of the misuse of the aircraft by the pilot, the preliminary presentation of risk by the aircraft design, and other similar factors.

The factors which are to be taken into consideration regarding disputes in the civil aviation sector vary completely. In respect of the issue of maintenance in a legal dispute it is worthy to mention that to comprehend that maintenance becomes necessary to ensure that the novel structure and materials employed for the better operation of the aircraft are carried out smoothly and are not incurring losses if the structure, parts are always malfunctioning. The following are inspections, repair processes and various maintenance programs. the manufacturers of these parts of the aircraft and the companies buying these aircraft are regarded as the same. The result of this is that disputes are bound to arise in the case of malfunctioning of the aircraft/parts of the aircraft.

On the issue of handling aviation disputes by arbitration, an arbitrator who is considered to handle civil aviation dispute resolution and passing an award when he or she has been selected, several factors should be considered when choosing. The main point to consider in choosing is to select an arbitrator who is familiar with the civil aviation sector. The reason is because the arbitrator will need to be able to understand the complex issue that may be involved in the dispute. again, it is adequate to choose an arbitrator who is neutral and impartial. the arbitrator must not have any personal interest in the outcome of the case. and finally, in the choice of an arbitrator the point is that the arbitrator should have experience in arbitration. This is because the arbitrator will need to be able to handle the complex legal issue that may arise during the arbitration. Apart from the arbitrator, all related persons have roles to play in the Civil Aviation process such as, mediators, parties, lawyers and experts.

In conclusion, the role of civil aviation arbitration in resolving disputes in the aviation sector is crucial, it provides a forum for the parties to resolve their differences without resorting to litigation. this is also important for promoting industry wise stability and growth.

by Legalnaija | Dec 22, 2023 | Blawg

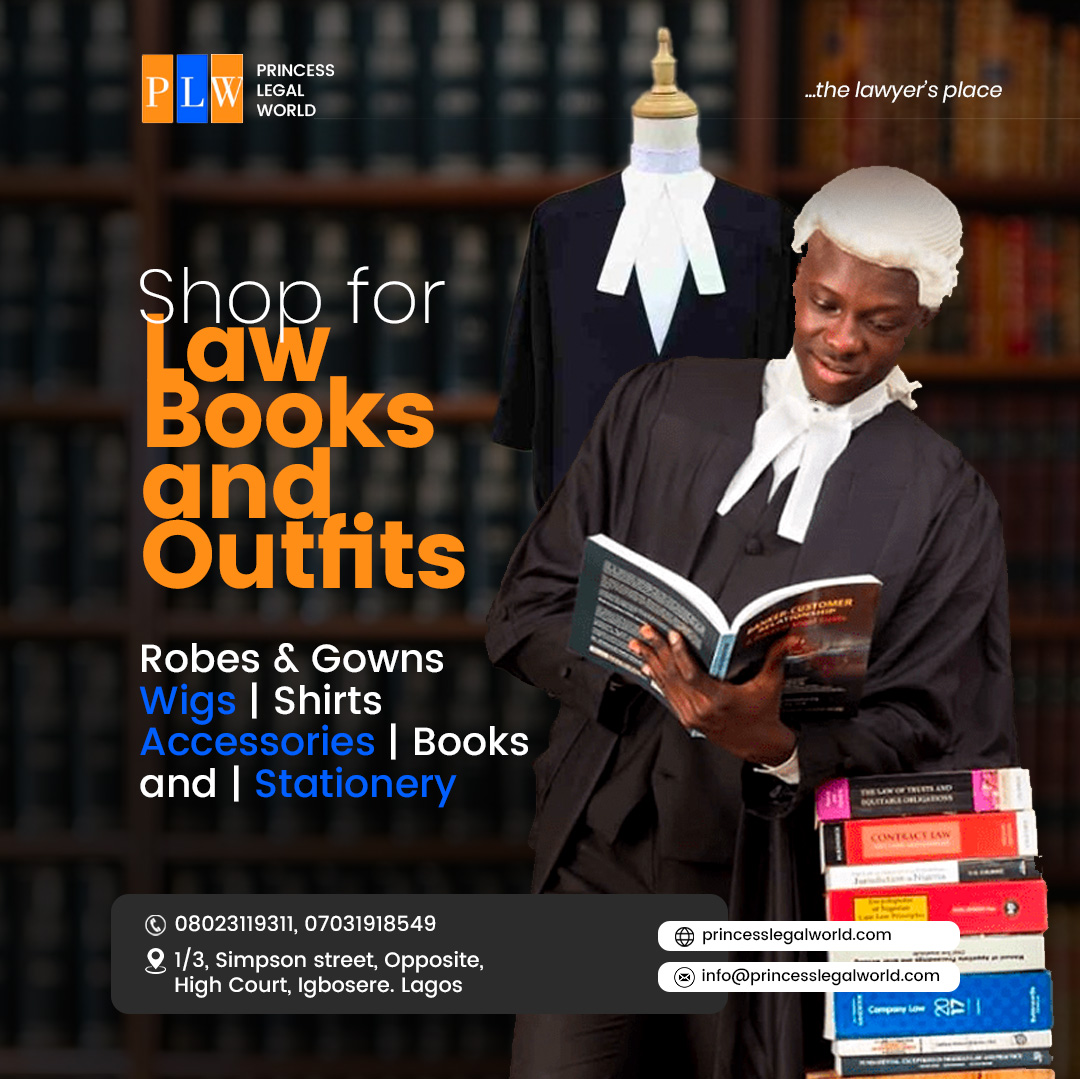

Are you looking for the best books and accessories for lawyers? Do you want to publish your own legal book and get it marketed by experts? Do you need to buy outfits that suit your professional style and budget?

If you answered yes to any of these questions, then you need to check out Princess Legal World!

Princess Legal World is a one-stop shop for all your legal needs. We offer a wide range of books, from textbooks and case studies to biographies and novels, all written by renowned authors and experts in the field. Whether you are a student, a practitioner, or a enthusiast, you will find something that interests you in our collection.

We also sell high-quality accessories for lawyers, such as pens, notebooks, briefcases, mugs, and more. These items are designed to make your work easier and more enjoyable. You can also personalize them with your name, logo, or motto.

But that’s not all. Princess Legal World also helps aspiring authors to publish and market their own legal books. We finance the production of new books and provide editorial and promotional support. We have a network of distributors and retailers who can help you reach a wide audience and earn royalties.

And if you are looking for outfits that match your professional image, you will love our clothing line. We have suits, dresses, shirts, skirts, and more, all made from high-quality fabrics and tailored to fit you perfectly. You can also choose from different colors, patterns, and styles. And the best part is, we offer bulk sales of our outfits at a highly discounted rates.

So what are you waiting for? Visit Princess Legal World today and discover the amazing products and services we have for you. You will be glad you did!

See flyer for more details!

by Legalnaija | Dec 6, 2023 | Blawg

In Nigeria, it is a statutory requirement for all businesses, private limited companies, and trustee organisations to file annual returns every year. This is in accordance with the Companies and Allied Matters Act (CAMA) 2020, which states in Chapter 16 that all companies in Nigeria must submit the prescribed form with the necessary information to the Corporate Affairs Commission (CAC).

The only exception is companies with one member, which are exempted from filing annual returns according to Section 421 (2) of CAMA 2020. Newly incorporated companies have 18 months from incorporation to submit their first annual returns, while established companies must file their returns within 42 days of their annual general meetings. Therefore, it is necessary for companies in Nigeria to file their annual returns on a yearly basis.

Importance of filing annual returns

The filing of Annual Returns is an essential part of business operations. It is necessary for companies to stay current with their post-incorporation services from the CAC such as filing for Certified True Copies (CTC) of Incorporation documents, increasing share capital, making changes to business objects or registered addresses, and changes to directors, partners, or trustees. Filing Annual Returns on time and paying any applicable penalties in full is required to receive any post-incorporation service from the CAC.

Furthermore, the majority of contractual bids in public or private sectors usually require an up-to-date yearly report from the entity as a major pre-requisite for compliance. It is essential for companies to keep their records updated in order to satisfy this obligation.

Annual Returns also serve to inform the Commission of a company’s ongoing existence, referred to as a ‘going concern’, and keep the company’s name on the CAC register. Additionally, a business that is fully compliant and up to date with its Annual Returns will be able to demonstrate trustworthiness during due diligence checks with CAC, allowing investors to quickly and confidently obtain information about the company.

In conclusion, filing Annual Returns is a vital factor in ensuring a company’s post-incorporation services are processed in a timely manner and that the company is seen as a reputable entity.

Implications of failing to file your annual returns

The implications of not following the law when it comes to filing annual returns are outlined in Section 425 of CAMA 2020. This provision stipulates that companies and their directors or officers may face a penalty at the discretion of the Commission. In addition, the Commission is empowered to delist a company from the Register of Companies if it fails to file yearly returns for a period of ten years. This is based on the presumption that the company is inactive.

Those who disagree with the removal of the company’s name from the register may appeal to the court at any time before the expiration of 20 years from the date of the notice of removal, on the condition that the court is convinced that the company was indeed operating at the time of the striking off. To make such an appeal, a formal letter must be written to the CAC’s Registrar General (RG), detailing the reasons why the annual return was not filed on time. Supporting documents such as all payable dues and updated company records must also be provided. If the application is accepted, a relisting certificate will be issued to the company.

Olamide Oyetayo

Olamide Oyetayo

The information provided in this article aims solely to educate readers generally. It does not establish an attorney-client relationship with our law firm or constitute legal counsel. Please contact us directly for any specific legal assistance required.

by Legalnaija | Nov 7, 2023 | Blawg, Book

Hey Counsel! We’re excited to announce our latest campaign where you get a free mobile accessory by buying books worth N45,000 or more on the Legalnaija Bookstore.This is a great opportunity to get your hands on some of the latest accessories for your mobile device.

To participate, all you have to do is make a purchase of N45,000 or more on the Legalnaija Lawyers. Once you’ve made your purchase, you’ll automatically receive a free mobile accessory alongside your books. It’s that simple!

Accessories include chargers, phone stands, Bluetooth keyboards, earphones and more. This campaign will end on November 31st, 2023, so don’t miss out.

So what are you waiting for? Head over to Legalnaija.com/store today, where we have over 150 lawbooks in different areas of law, and start shopping. Not only do you get to update your law library with the latest books but you also get a brand new mobile accessory!

www.legalnaija.com/store

@Legalnaija

+2349029755663

#lawbooks #legalnaija #mobileaccessories #kakusiga #lawbooks #lawaccessories #legal #lawyers #nigerianlawyers #legalnaijabookstore #instagramlawyers #lawyersbookstores

by Legalnaija | Nov 7, 2023 | Blawg

The decision of the London Commercial Court in the case of Process & Industrial Development (P&ID) v Federal Republic of Nigeria, coram Knowles J, handed down on October 2023, has garnered significant global attention within the legal and international business communities. Its consequences have questioned the seeming usefulness of arbitration as a dispute resolution mechanism casting a shadow on the potential corruption of arbitrators, deliberating the various perspectives surrounding this case.

The judgment has been welcomed by several distinguished arbitration practitioners (particularly from Nigeria) and even non-practitioners. Whilst the delight may be in order, sight must not be lost of the lessons to be learned from some key pronouncements (which may be obiter dictum) made by the court, which must necessarily generate a retrospection.

Background

In the year 2010, P&ID executed a Gas Supply and Processing Agreement (GSPA) with Nigeria’s Ministry of Petroleum Resources. This agreement required Nigeria, via the Ministry of Petroleum Resources, to deliver natural gas (“wet gas”) to P&ID, which would process it into “lean gas” at no cost to Nigeria. The crux of the matter began to unfold when Nigeria failed to supply the wet gas in breach of its obligations under the GSPA and P&ID also, consequently, failed to perform its corresponding obligations.

In August 2012, P&ID initiated the arbitration process per the terms of the GSPA, claiming damages resulting from Nigeria’s alleged breach. The arbitration, conducted under the rules of the (then) Nigerian Arbitration and Conciliation Act, comprised Sir Anthony Evans, Chief Bayo Ojo, SAN, and Lord Hoffmann (as Chairman)-two highly respected English jurists and an Attorney General of Nigeria. It was held in Nigeria and adhered to Nigerian law.

The tribunal sat for over three years, and in January 2017, awarded P&ID damages proposed to be $6.597 billion, calculated based on the commercial expectation of P&ID, over the twenty-year lifespan of the GSPA. This figure, however, escalated considerably due to the application of the English pre-and post-judgment interest rates, thereby accruing to an immense sum of $9.6 billion by the summer of 2019.

In a move to enforce the terms of the arbitral award, the company sought to enforce the arbitration award in a London Commercial Court. This made Nigeria challenge the award on the grounds of fraud and corruption surrounding the contract’s creation and performance and the impartiality of the tribunal. In September 2019, the UK court granted Nigeria permission to appeal the award.

As far as the Nigerian government was concerned, the Tribunal’s decision was an ‘economic warfare’ that influenced foreign direct investment, and the international perception of doing business in Nigeria, and cast a shadow over the image of contractual fairness in Nigerian commercial sectors.

In confirming the initial award of $6.6 billion, followed by a later increment to an outstanding $10 billion in favor of P&ID, Justice Butcher placed Nigeria in a precarious financial situation. This seismic judgment sent shockwaves throughout the Nigerian state, already grappling with enormous economic challenges. This is due to its enormous financial implications accruing heavy interests per day and also questioning the sincerity and transparency of public officials in contract negotiations and enforcement.

In light of such overwhelming fiscal implications, Nigeria appealed the judgment. Justice Knowles of the English Commercial Court was charged with sitting over the appeal. In this case, Justice Knowles permitted Nigeria to extend the time to bring its challenge against the arbitral award. His decision was fundamentally based on the prima facie evidence presented concerning fraudulent and corrupt practices during the contract signing and execution, which implies that the contract should be nullified or reconsidered. This precedent-setting ruling necessitates a recalculation of how arbitration cases involving states and corporations are adjudicated in the international legal community.

To Nigeria, Justice Knowles’ ruling is a significant lifeline. Considering Nigeria’s current economic condition, amidst recovering from the 2020 global economic downturn and a dwindling oil market, a $10 billion payout would undoubtedly strain the nation’s budget vastly.

Simultaneously, Justice Knowles’ judgment carries multilayered implications for the international arbitration community. While serving as a sobering reminder to ensure strict adherence to ethical guidelines in contract negotiations, his ruling insinuates a possible shift in arbitration norms within the legal fraternity. The emphasis on fraud and corruption as key considerations in arbitral decisions could impact future arbitration rulings, sparking a pivoting focus on transparency and corporate governance; particularly now that Nigeria’s Arbitration and Mediation Act, has deleted the reference to misconduct, as a ground for setting aside an award.

However, the ruling also raises questions about the sanctity of arbitral awards and predictability in international arbitration. It prompts the query if award creditors can rely on arbitration awards, especially when there is a suspicion of fraud or corruption that was not initially uncovered during the process of arbitration. Moreover, it places an additional burden on arbitral tribunals to investigate and consider allegations of corruption during arbitrations.

In sum, Justice Knowles’ judgment is historic. Its repercussions ripple throughout the Nigerian state and beyond, fundamentally shaking the arbitration community with its new approach. While offering Nigeria an opportunity to contest an overwhelmingly high penalty, it also ushers in a meticulous debate on the nature of arbitration norms and the sanctity of arbitration awards.

Implications of the Judgment on Arbitration

The implications of the P&ID judgment significantly impact the global perception of arbitration. The severe allegations concerning the corruption of arbitrators potently taint the sanctity and credibility of the arbitration process. The significance of ensuring not just the fairness of the arbitration process but its clear perception of being fair, cannot be understated. This is not without reason- it needs to be borne in mind that arbitrators are typically granted considerable powers, facilitating them to essentially ‘write the law’ in significant points of the dispute. Further, the opacity of arbitration proceedings potentially enables and conceals corrupt practices, encouraging distrust and apprehension in the institutional process of arbitration.

Learning Outcomes

The Justice Knowles’ judgment document is fast becoming a training document for many. It has also come with its learning outcomes many of which both the Nigerian State, Commercial lawyers, and the arbitration community must take a cue from. Some of them are as follows:

- Robust Due Diligence: Contracting parties must conduct thorough due diligence to assess the financial, legal, and technical capabilities of potential partners. This includes verifying the authenticity of documents and ensuring compliance with regulatory frameworks to minimize the risk of entering into agreements with unreliable or fraudulent entities. It is interesting to know that the promoters of P&ID have been doing business since the ’90s’ and no one profiled them against their acclaimed professional background.

- Anti-Corruption Measures: Governments and organizations should implement stringent anti-corruption policies and procedures to prevent corrupt practices in contract procurement. This involves promoting transparency, conducting regular audits, and enforcing penalties for violations.

- Strengthen Contractual Obligations: Parties involved in contracts should prioritize the clear and precise delineation of obligations, rights, and remedies. This includes incorporating mechanisms for dispute resolution, such as arbitration, to provide a fair and efficient means of resolving conflicts.

- Contract Management: Effective contract management is crucial to ensure compliance with contractual obligations, monitor performance, and address any potential breaches promptly. Establishing robust monitoring and reporting mechanisms can help identify and rectify issues before they escalate into costly disputes. Many of the infractions committed by the public servants were due to carelessness and weak contract management structures.

- Enforceability of Arbitration Awards: The P&ID case highlights the importance of recognizing and enforcing arbitration awards. Governments and parties to international contracts should respect the integrity and finality of arbitration decisions, as they play a vital role in resolving cross-border disputes and maintaining investor confidence.

Conclusion

Although bribery allegations featured prominently in Nigeria’s submissions on serious irregularity, the legal basis for Justice Knowles’ findings of serious irregularity was that of fraud, which is a different cause of action from that of bribery under English (or Nigerian) law. In this instance, the Court emphasized that “Section 68(2)(g) of the English Arbitration Act is concerned with the question of whether there was fraud and an award or conduct contrary to public policy’-the basis of the London Court’s conclusion. Either way, the case places a glaring spotlight on the potential corruption of arbitrators generally, pleading for increased transparency and probity in arbitration proceedings.

The judgment is also a direct challenge to the arbitration community to, as a matter of urgency, draw up an effective code of ethics of the practice of arbitration. This is the only way Users of the mechanism can continue to find it a credible one for resolving commercial disputes.

While the arbitration process aims to encourage faster and more effective dispute resolution, fostering a system that prioritizes ethical standards with zero tolerance for corruption is a quintessential prerequisite for its credibility.

TOLU ADEREMI

PARTNER, PERCHSTONE & GRAEYS, LP

LL.B (IBADAN), B.L, LL.M (ABERDEEN), DOCTORAL CANDIDATE (DTU), VISITING PROFESSOR ON ALTERNATIVE DISPUTE RESOLUTION (ADR), CHAIRMAN, INTERNATIONAL LAW ASSOCIATION ARBITRATION COMMITTEE, MEMBER, INTERNATIONAL CHAMBER OF COMMERCE (ICC) COMMISSION ON ARBITRATION, PARIS.

by Legalnaija | Nov 6, 2023 | Blawg

Introduction

In an increasingly interconnected world, the digital landscape of any nation is the beating heart of its progress, potential, and prosperity. For Nigeria, a nation teeming with promise, the digital realm represents an unparalleled opportunity to leapfrog into the future. However, like any frontier of promise, this digital landscape is not without its perils. Enter the realm of cybersecurity an omnipresent shield that guards the gates of Nigeria’s digital domain. In an age where data flows like a mighty river, and the lines between physical and virtual reality blur, the significance of cybersecurity to Nigeria cannot be overstated. It’s not merely a matter of safeguarding data; it’s about protecting the very essence of the nation’s growth, security, and resilience.

The implications ripple far and wide, transcending individual businesses and government facilities. In this article, we embark on a journey to unveil the intricate tapestry that is cybersecurity in Nigeria. From the bustling markets of Lagos to the corridors of power in Abuja, from the bustling startups in Port Harcourt to the rural heartlands, this is a story that affects us all.

As we delve into the intricate depths of this discourse, our foremost scrutiny will be directed toward the paramount role played by cybersecurity legislation in molding the nation’s economic landscape, bolstering the security of supply chains, fortifying the integrity of critical infrastructure, and upholding the sanctity of individual privacy and safety. Within this legal odyssey, we shall navigate the labyrinthine confluence of imminent threats and the unwavering resolve to withstand them, acknowledging the inherent vulnerability and cultivating robust digital bulwarks that are not only requisite but fundamental in the protection and preservation of Nigeria’s digital future.

Cybersecurity Landscape in Nigeria: An Overview

The International Telecommunications Union [ITU] defines Cybersecurity as “the collection of tools, policies, security concepts, security safeguards, guidelines, risk management approaches, actions, training, best practices, assurance and technologies that can be used to protect the cyber environment and organization and user’s assets” (Sreenu & Krishna, 2017). ITU also notes that the general objectives of Cyber Security are: Availability; Integrity, (which may include authenticity and non-repudiation), and Confidentiality. Continuous vigilance and adaptation to evolving threats are crucial in maintaining effective cybersecurity (Moreta et al., 2023). Cybersecurity practically acts as the guardian of data quality, preserving trust and the seamless flow of information while shielding against unauthorized access and manipulation. It upholds the essence of a secure digital realm.

The current cybersecurity landscape in Nigeria reflects a dynamic and evolving terrain, marked by both opportunities and challenges. As the nation embraces digital transformation and experiences rapid technological growth, it simultaneously faces heightened cyber threats and vulnerabilities. Nigeria, with its burgeoning digital economy and expanding online presence, has become a prime target for cyberattacks. These threats encompass a wide spectrum, from financially motivated attacks, such as phishing and ransomware, to politically and socially motivated incidents.

In a country where millions of Nigerians engage in daily online activities, from financial transactions to social connections and e-commerce, the digital realm has become an integral part of our lives. The delicate and often sensitive nature of these interactions underscores the critical role of cybersecurity. With online banking, e-commerce, digital communication, and remote work becoming the norm, the nation’s economic and social fabric relies on the sanctity of these digital transactions. The ramifications of a cybersecurity breach can be staggering, ranging from financial losses and personal data exposure to threats to national security. Thus, the importance of robust cybersecurity measures cannot be overstated. As Nigeria accelerates its digital transformation, including e-governance and e-health initiatives, the stakes rise higher. Ensuring the confidentiality, integrity, and availability of digital assets becomes paramount. A secure digital environment not only fosters trust and confidence but also empowers the nation to harness the full potential of the digital age.

The Cyber Security Experts Association of Nigeria (CSEAN) anticipates a gradual escalation in the incidence of cyber threats within the Nigerian landscape, where the Small and Medium Scale Enterprises (SMEs) sector is expected to bear the brunt of these adversities. As per the findings in the CSEAN report, there was an 87% surge in phishing attacks targeting SMEs in 2022, signifying a significant increase from the 37% recorded in 2021.

Cybersecurity Laws and Regulations in Nigeria: Legal Implications and Consequences

Nigeria finds itself at a crossroads where a surge in cybercrimes has reached an alarming magnitude. This multifaceted threat encompasses financial fraud, data breaches, phishing scams, and ransomware attacks. Beyond their digital confines, these perils cast a shadow over the nation’s economic stability, individual privacy, and even national security. In light of this intricate and escalating cybersecurity challenge, the imperative for legal intervention is undeniable. Legal measures must serve as a robust bulwark against the chaos and disarray that these cybercrimes can instigate. The regulatory framework should uphold the rule of law, deter cybercriminals, and ultimately secure Nigeria’s digital future and socioeconomic well-being.

Continuing from the preceding context, let us delineate several of the extant regulatory frameworks that pertain to cybersecurity in Nigeria;

- Cybercrimes (Prohibition, Prevention, Etc.) Act 2015.

- Nigeria Data Protection Regulation 2019.

- National Cybersecurity Policy and Strategy, 2021.

- Nigeria Data Protection Act 2023 (NDPA)

The Cybercrimes (Prohibition, Prevention, Etc.) Act according to its objectives provided in section 1 of the Act was created to establish an efficient and comprehensive legal and regulatory structure to address cybercrimes in Nigeria, safeguard critical national information infrastructure, and enhance cybersecurity measures, including data protection and privacy rights.

Part 3 of this Act meticulously delineates actions that qualify as offenses, along with the corresponding punitive measures prescribed for each transgression. These transgressions encompass a range of activities, including, but not restricted to: unauthorized access to computer systems, violations against critical national information infrastructure, acts of system interference, interception of electronic communications, such as messages and emails, illicit electronic fund transfers, phishing schemes, unsolicited mass emails (spam), propagation of computer viruses, and computer-related fraudulent activities. It is imperative to underscore that each of these infractions carries a unique sentencing regime, with certain egregious transgressions not affording the option of a pecuniary fine due to the gravity of their impact.

Furthermore, the statute also imposes a set of obligations upon individuals or entities engaged in the operation of computer systems or networks. Among these obligations is the compelling duty to promptly report any instances of cyberattacks or intrusions to the Computer Emergency Response Team (CERT) Coordination Center, facilitating the swift enactment of necessary remedial actions. Failure to comply with this specific duty is met with a substantial penalty of 2,000,000 naira and a seven-day suspension of internet service.

It is noteworthy that a subset of these offenses possesses a technical intricacy that necessitates the expertise of a qualified professional to ascertain whether a given action qualifies as an offense under the purview of this legislation.

The Nigeria Data Protection Act being the latest legislative framework governing the domains of data privacy and security, meticulously delineates the obligations bestowed upon data controllers and processors concerning their responsibilities to safeguard the data placed in their custody directly and indirectly by the data subjects. The legislation establishes a commission entrusted with the critical mandate of overseeing data controllers, ensuring that they do not overstep the bounds of authority granted to them by data subjects. This commission is tasked with evaluating the conduct of these data controllers to ascertain their compliance with the stipulations outlined in the Nigeria Data Protection Act (NDPA).

The legislation has seamlessly integrated globally recognized best practices within its provisions, particularly on the obligations and standards imposed upon data controllers in the realms of data processing, data transfer, and various other relevant facets.

The Nigeria Data Protection Regulation was not invalidated by the emergence of the NDPA. However, the Nigeria Data Protection Act (NDPA), being a primary national legislation, holds precedence over the Nigeria Data Protection Regulation (NDPR), which is categorized as subsidiary legislation. Importantly, it is crucial to note that the NDPA, while exerting its legal authority, does not nullify or revoke the NDPR. Rather, the NDPA explicitly stipulates that all regulations promulgated by the National Information Technology Development Agency (NITDA), encompassing the NDPR, maintain their legal validity and remain in effect, as though they were originated or endorsed by the Nigeria Data Protection Commission (NDPC).

The National Cybersecurity Policy and Strategy, The policy document embodies a comprehensive and adaptable framework, placing significant emphasis on the collaboration between the government, the private sector, and citizens to safeguard digital ecosystems. Nigeria aspires to cultivate strong legal and regulatory frameworks that can effectively combat cybercrime, fortify the protection of critical infrastructure, and ensure the privacy of data. This endeavor seeks to be accomplished through the persistent monitoring of cyber threats, the development of incident response plans, and the implementation of public awareness campaigns, all of which are pivotal components aimed at nurturing a resilient cyber landscape conducive to sustainable growth and the secure advancement of digital transformation.

Common Cyber Threats in Nigeria

In the digital age, the pervasive nature of cyber threats casts a daunting shadow over our interconnected world. The dangers are manifold, ranging from data breaches and financial fraud to critical infrastructure disruptions and even threats to national security. What fuels this digital menace is a complex interplay of factors, including the ever-evolving sophistication of cybercriminals, the lucrative nature of cybercrime, and the relative anonymity provided by the digital realm.

While the digital landscape offers boundless opportunities, it also harbors threats that thrive in the nation’s evolving cyberspace. Reports of phishing scams, online fraud, and data breaches paint a picture of a thriving cyber underworld. The reasons behind this growth include a lack of comprehensive cybersecurity infrastructure, limited awareness, and a need for robust regulatory frameworks. Understanding the dynamics of these threats is paramount, for it is only through this understanding that we can hope to fortify our defenses and ensure a secure digital future in Nigeria. Here are some of the prevalent cyber threats wreaking havoc in Nigeria:

- Phishing Attacks

- Ransomware

- Business Email Compromise (BEC)

- Distributed Denial of Service (DDoS) Attacks

- Identity Theft

- Malware Infections

- Online Fraud

- Data Breaches

- Insider Threats

- Social Engineering Scams

These threats collectively pose significant challenges to cybersecurity within the nation, thriving on the unsuspecting and the unprepared. These threats each with distinct characteristics and potential ramifications. Phishing attacks cunningly manipulate human psychology, tricking individuals into divulging sensitive information or falling prey to malicious links. Ransomware, the merciless extortionist, encrypts vital data, demanding cryptocurrency payments for its release. Business Email Compromise (BEC) infiltrates corporate email accounts to initiate fraudulent transactions or financial manipulations, while Distributed Denial of Service (DDoS) assaults inundate digital services with traffic, rendering them inaccessible. Identity theft is the stealthy theft of personal information, which can lead to financial ruin and reputation damage. Malware infections propagate malicious software, compromising security, and spreading chaos. Online fraud schemes perpetrate scams and deception for financial gain. Data breaches compromise confidentiality, often exposing private data to unscrupulous entities. Insider threats arise from within an organization, posing risks to its assets. Social engineering scams craftily manipulate victims into revealing confidential information.

In 2020, Nigeria secured an unfortunate 16th place in the global ranking of countries most severely impacted by cybercrime. A recent development within Nigeria’s cyber threat landscape has unveiled a rather alarming trend: hackers are strategically enticing employees of Nigerian organizations to act as insider threats. Revelatory research indicates that these hackers are offering financial incentives to employees in exchange for access to sensitive information within an organization’s network. While specific instances of staff succumbing to such temptation were not documented, this emerging scenario is undeniably a cause for growing concern. The third quarter of 2022 bore witness to a staggering 1616% surge in data breaches in Nigeria, escalating from 35,472 incidents in the second quarter to a daunting 608,765 occurrences in the third. This unnerving spike signals a pressing need for enhanced cybersecurity measures. In a commendable stance against cybercrime, Nigeria’s Economic and Financial Crimes Commission (EFCC) has undertaken a proactive campaign in 2022, successfully convicting 2,847 individuals involved in cyber-related crimes. This marks a significant stride in the fight against cybercriminals who threaten the nation’s digital landscape and the security of its citizens.

Safeguarding Digital Assets: Best Practices

In a digital landscape fraught with risks and vulnerabilities, the need to adopt cybersecurity best practices has never been more pressing. Healthcare and financial organizations, in particular, find themselves squarely in the crosshairs of cyber threats. To safeguard sensitive data, financial assets, and the trust of their clients, individuals, and entities in these sectors must embrace the proactive measures explored in this section.

- Detecting External Security Flaws: Cybercriminals frequently zero in on organizations lacking robust security protocols, and healthcare and financial institutions are prime targets due to various vulnerabilities. In healthcare, the extensive array of internal systems often remains unpatched, granting cybercriminals easy access. Limited IT resources compound the problem, resulting in outdated security protocols. Furthermore, inadequately secured healthcare member portals can expose patient data to potential breaches. Financial service sectors encounter similar challenges as they modernize their infrastructure, transitioning from legacy systems to digital platforms. During this transition, cybersecurity gaps may inadvertently open doors for malicious actors. Criminals strategically target financial institutions, well aware of their capacity to meet ransomware demands, making them high-value targets in the digital realm.

- Conducting Penetration Tests: Penetration testing is a proactive approach employed by companies to uncover potential security vulnerabilities. By emulating hacker tactics, this method aims to detect and address security weaknesses before they can be exploited. Simulated cyberattacks are designed to exploit existing vulnerabilities, providing valuable insights to fortify defenses and protect sensitive data.

In the healthcare sector, adherence to HIPAA guidelines necessitates robust testing to ward off potential breaches. Similarly, financial institutions must follow government regulations for safeguarding consumer data. In both cases, IT teams play a crucial role in identifying and addressing security system vulnerabilities through comprehensive testing.

- Risk Prioritization Based on Business Impact: After identifying vulnerabilities in your assets, the next crucial step is to prioritize them according to the potential risks they pose to your organization. This prioritization process guides your efforts in enhancing security and establishes benchmarks for future assessments. To streamline this process, security ratings come into play. These ratings assign a letter grade to your security posture, reflecting how effectively it safeguards vital data and information. This grading system offers clarity, highlighting areas that demand immediate attention within your security framework. Additionally, these ratings prove valuable in third-party risk management, showcasing your commitment to due diligence during vendor onboarding and ongoing monitoring.

- Utilize Automated Cybersecurity Solutions: Incorporating automation into your corporate network environment plays a pivotal role in risk reduction and security enhancement. Automated cybersecurity solutions prove invaluable in network monitoring, offering IT teams the gift of time to concentrate on addressing high-risk threats.

Moreover, these automated solutions excel in reducing incident response times and swiftly curbing the propagation of attacks across networks. When appropriately configured, automated resources can extend their capabilities to assess security metrics. It is highly advisable to focus on metrics conducive to the automated gathering of data for comprehensive cybersecurity management.

- Stay Current with Regular Updates: Staying at the forefront of cybersecurity defense mechanisms is essential to ensure your security remains resilient. Regular updates and modifications are indispensable, as they empower IT teams to adapt to evolving security technology and emerging threats promptly.

- Develop an Effective Incident Response Plan: Preparedness is key in cybersecurity. An incident response plan, including dedicated teams and action checklists, minimizes harm and enables a swift recovery. The plan’s complexity varies with the attack and organization size. Regularly update and rehearse the plan for optimal performance and adaptability in the face of evolving cyber threats.

Safeguarding digital assets is an ongoing endeavor, necessitating the expertise of adaptable and continuously learning security professionals. As the threat landscape constantly evolves, these individuals must remain at the forefront of emerging trends, ensuring they are well-equipped to thwart even the most sophisticated cyberattacks. The resilience of organizations, the protection of sensitive data, and the preservation of trust in the digital age hinges upon the dedication and vigilance of such security experts.

Conclusion

The realm of cybersecurity in Nigeria stands at a critical juncture. While existing laws make strides in addressing cyber threats, more stringent measures are imperative to deter the audacity of cybercriminals and bullies. The role of legislation extends to ensuring the unwavering adherence of organizations, particularly public entities, to robust cybersecurity best practices. With public organizations safeguarding highly sensitive data, their commitment to data protection is not just an obligation; it is a covenant of trust with the public they serve. The future of cybersecurity in Nigeria hinges on the unwavering resolve of lawmakers and organizations to fortify digital defenses, guaranteeing the resilience and integrity of our digital landscape.

by Legalnaija | Nov 6, 2023 | Blawg

Sports right from its inception has predominantly been for entertainment purposes. However, the concept of rewarding winners in these sporting competitions and the egoistic nature of man have made sports more than just entertainment for these athletes, who also want to be recognized as some of the best in their field.

It is often misconceived that the ban on the use of performance-enhancing drugs in sports was just to eliminate the undue advantage that these persons have against their opponents who do not use these drugs. While this was an important factor taken into consideration in the full deliberation, another factor was also as important if not more important. This factor is the issue of the health of these athletes who partake in the use of these drugs. The intake of some of these banned substances can lead to Cardiovascular problems, liver and kidney damage, lead athletes to addiction, and many other temporary and permanent health concerns. The dangers of these performance-enhancing drugs have led to the formation of several organizations and agencies to help regulate the growing issue of doping, one of these organizations is the World Anti-Doping Agency (WADA)

World Anti-Doping Agency (WADA)

The World Anti-doping Agency is an organization set up on 10 November 1999 in Lausanne, Switzerland. The International Olympic Committee (IOC) spearheaded the motion to establish this foundation to combat the ever-growing concerns of doping in the sports ecosystem. The agency’s official headquarters is situated in Montreal, Quebec, Canada while the office at Lausanne now serves as the regional office in Europe.

WADA works in collaboration with many national and international sports federations, and other stakeholders to establish and enforce the World Anti-Doping Code, a set of anti-doping rules and regulations that apply to all athletes and support personnel worldwide. This agency maintains a prohibited list of substances and methods that are banned in sports, it is a flexible list and it gets updated annually to reflect different research in the field of medicine.

The interference of different regulatory bodies on the issue of doping in sports is predicated on well-analyzed reports pointing towards the short and long-term negative impact of doping on not just the athletes but also the sports events involved and most importantly, sports in general.

“Sanctions serve as a lesson for Wayword deeds” mischievous actions that defy the norms, can trigger reactions, unleashing storms. Sanctions can befall, harsh yet fair, a price to pay for those who dare. Sanctions are provided under regulations that are set to keep the chaos in check.

The Legal Repercussions of Using Performance-Enhancing Drugs in Sports

The idea of law and sanctions in curing mischief is based on the principle that individuals who engage in harmful or unethical behavior should be held accountable for their actions and face consequences as a deterrent to future wrongdoing. The use of laws and sanctions to prevent mischief can take many forms, including fines, imprisonment, community service, and other forms of punishment. Laws and sanctions can serve as a means of deterrence by sending a clear message that certain behaviors are not acceptable and will be met with consequences. They can also provide a sense of justice to victims of mischief and serve to restore public confidence in the rule of law.

The legal implications of using performance-enhancing drugs in sports carry jurisdictional flavor meaning that different jurisdictions treat their cases differently but in generality, the issue of doping in sports is no light matter. A critical appraisal of this is best done by examining some of the legal implications enforced by most internationally recognized sports organizations such as the International Olympics Committee (IOC), Fédération Internationale de Football Association (FIFA), world Anti-Doping Agency (WADA), Union of European Football Association (UEFA) and so on;

- Disqualification and Forfeiture Medals and Prizes: This is predominantly what most sports organizations go with and some of the world’s greatest athletes have been on the receiving end of this. Ben Johnson, a Canadian former sprinter, was widely recognized as one of the world’s fastest men. In the 1988 Seoul Olympics, Ben Johnson came through, grabbing with him both the gold medal in the 100m sprint and more impressively shattering the world record at that time, finishing with a time of 9.79 seconds. However, he was to enjoy this galore for just a few days as the International Olympic Committee (IOC) sanctioned him for doping, amongst many other sanctions handed him were disqualification from the race and making him forfeit his gold medal. Ben Johnson was found to have tested positive for the anabolic steroid stanozolol, which is a synthetic steroid that is commonly used by athletes to enhance their performance by increasing muscle mass and strength.

- Payment of Fines: Several factors impact the weight of the fine to be levied on athletes caught doping, the substance taken, the financial strength of the athlete, how many times the athlete has been found in violation, and the governing body sitting on the case. Fines as high as $250,000 have been slapped on athletes for doping as seen in the popular 2016 case of Tennis star, Maria Sharapova. Sharapova tested positive for a banned substance, Meldonium at the Australian Open. Meldonium is believed to improve endurance, reduce fatigue, and enhance recovery time, which could provide an unfair advantage to athletes who use it. Its ban has been a controversial topic in the sports world as it has been argued that evidence of its performance-enhancing effects is not strong enough to warrant a ban, but it is still recognized as a banned substance and still makes the list of banned substances according to World Anti-Doping Agency (WADA).

- Contractual Disputes: Sponsors and employers who are contracted to these athletes most times have zero tolerance for doping and often include doping in the termination clause as a cause to terminate the contract between them and the athletes. In some situations, things get messy to the extent that parties involved in the contract are before the court seeking its intervention. In the 2016 case of Maria Sharapova, after the tennis star tested positive for the banned substance, she lost several endorsement deals, one from Nike. Sharapova instituted legal proceedings against Nike, arguing that Nike had breached the contract between them as they did not provide her with sufficient notice and an opportunity to cure any breach before terminating the contract. In the end, Nike agreed to pay Sharapova an undisclosed amount, it was reported that Sharapova would receive compensation for the remaining value of her contract with Nike, which was worth about $70 million over eight years.

- Criminal Charges/Investigation: Largely doping does not attract criminal charges but in some jurisdictions, effective efforts have been made toward strictly policing doping. In Germany, there is the Germany Anti-Doping Act. The act was enacted in 2015 and it criminalizes the use, possession, and distribution of doping substances. This law applies to every sport in Germany. Athletes who obtain banned substances through prescription fraud, such as forging prescriptions or obtaining them through unlicensed sources can face criminal charges in the United States of America for charges related to fraud and drug trafficking.

- Ineligibility for Future Events/Tournaments: Athletes found guilty of violating anti-doping regulations, most often are suspended from competing in future tournaments at least for a limited timeframe. Maria Sharapova was suspended from competing in any tennis event for 15 months by the International Tennis Federation. In some cases, even when the period of suspension is over, some tournament organizers are reluctant to invite these athletes to their events. Justin Gatlin is a true victim of organizers’ reluctance to invite athletes with past doping records. In 2015, the organizers of a Diamond League track and field meeting in Shanghai, China, refused to send out an invitation to Gatlin citing their policy of not inviting athletes who have been convicted of doping charges.

- Loss of Records: Numerous world records set in the past have been expunged from history and it is now like they never happened just because the athletes with these records are doping. It is important to note that testing positive for banned substances even after the tournament could be enough to erase the record set. Sometimes suspicions might lead to an athlete getting tested after the event. However, the type of banned substance and the organization governing the tournament will determine the severity of the case.

- Reduced Funding: It is not inconceivable that events rocked by the doping crisis will find it tough to secure funds for subsequent events. Just as in the case of sponsorship for athletes, brands do not want to work with organizations or persons that will smear the brands’ image in the eyes of the public. The Tour de France, which is one of the most recognized cycling races in the world lost one of its most dominant sponsors, Credit Lyonnais as a result of several consistent doping scandals in the sport.

- Increased Regulations on doping matters: Laws and regulations have always been a means of encouraging positive behavior and curtailing mischievous habits. It is these tools that organizations and event organizers employ to restrain players from resorting to doping. These regulations are sometimes made stricter and drug tests more frequent in such a way that it becomes practically impossible to dodge.

CONCLUSION

Athletes are responsible and strictly liable for any substance found in their bodies and as so athletes are to treat their bodies as a temple. The athlete is to handle his/her body as a job and be very cautious of all food intake and products they use on their body. Medications and supplements taken by these athletes might contain banned substances that the athlete unknowingly consumes. There is a possibility that an environment heavily polluted with banned substances can be dangerous to the athlete as he/she might inhale enough concentration that can show up during drug tests. It is advised to be well aware of all banned substances to avoid mistakes along the way. Doping has ruined many careers and erased many established careers just like Lance Armstrong who had all his cycling accolades taken after it was found that he was doping his whole career. Doping generally undermines the integrity of sports and will always be given zero tolerance.

Relevant Materials

- “Maria Sharapova Sues Nike Over Termination of Contract After Doping Scandal.” The Guardian, 14 Mar. 2018, theguardian.com/sport/2018/mar/14/maria-sharapova-sues-nike-over-contract-termination-after-doping-scandal.

- “About Us.” World Anti-Doping Agency, https://www.wada-ama.org/en/about-us.

- “Prohibited List.” World Anti-Doping Agency, https://www.wada-ama.org/en/what-we-do/prohibited-list.

- https://www.nytimes.com/2013/10/23/sports/cycling/lance-armstrong.html

- https://www.wada-ama.org/en/what-we-do/prohibited-list

- https://www.nytimes.com/2006/07/30/sports/30iht-doping.2322317.html

- https://www.theguardian.com/sport/2015/nov/05/justin-gatlin-olympic-sprinter-banned-doping-offence

- Photo: www.procon.org

by Legalnaija | Oct 30, 2023 | Blawg

A MATTER OF PRINCIPLE| Muhammadu Buhari

RARELY in modern times can so few have tried to take so much from so many. If Nigeria had lost its arbitration dispute with Process & Industrial Development in a London court on 23 October, it would have cost our people close to USD15 billion.

We won, and all decent people can sleep easier as a result. Justice Robin Knowles said Nigeria had been the victim of a monstrous fraud. But it was a close-run thing. As the judge said: “I end the case acutely conscious of how readily the outcome could have been different, and of the enormous resources ultimately required from Nigeria as the successful party to make good its challenge.”

But ordinary Nigerians never took the decisions that ended up before Justice Knowles. Had Nigeria lost, it would have required schools not to be built, nurses not to be trained and roads not to repaired, on an epic scale, to pay a handful of contractors, lawyers and their allies – for a project that never broke ground.

How did it get to this point? How did Nigeria prevail? Was this a one-off, or par for a shabby and distasteful course? What are the lessons for the future?

The ‘P&ID Affair’ was already firmly set by the time I came into office in 2015. A company registered in the British Virgin Islands that no one had heard of, with hardly any staff or assets, had won a contract to build a gas processing plant in Cross Rivers. The company was owned by Irish intermediaries who knew Nigeria well and had done business in everything from healthcare to fixing tanks.

The previous government could not supply the gas. The plant was never built. Construction was not started. P&ID did not even buy the land for the facility. But the contract, incredibly, was clear: P&ID could sue Nigeria, and claim all the profits it might have made over 20 years as if everything had been completed.

Nigeria was in court in London, trying to talk down liability and costs. Back at home, fixers were looking to work out a quiet settlement. This is often the way. A lot of contracts end up in dispute. P&ID won a settlement in 2017 of USD6 billion, with compound interest. People, including out of work ex-British Cabinet Minister Priti Patel, were queuing up to insist we paid, or risk Nigeria becoming an untrustworthy trade pariah.

It was clear that far from the whole story had been told. I tasked Abba Kyari, my chief- of-staff and Attorney General of the Federation, Abubakar Malami, with finding a way, even at that late stage and despite so much conflicting advice, to get us a fair hearing. Working with a number of different agencies and senior officials of government, we began to find a huge amount of evidence, not all of which Justice Knowles was to accept. But he agreed that P&ID had paid bribes. He agreed that one of P&ID’s founders had committed perjury. And he agreed that P&ID had somehow found in its possession a steady supply of Nigeria’s privileged internal legal documents, outlining our plans, strategies and problems.

My own view is that this whole, sorry affair shows how important it is to follow the legal process in resolving a dispute. It shows that given time and opportunity for each side to present their case, the temple of justice can satisfactorily resolve all disputes without resort to extra-judicial measures. It was definitely worth the struggle: this was an attempted heist of historic proportions, an attempt to steal from the treasury a third of Nigeria’s foreign reserves.

But even at this moment, we should note what the English judge cautioned. The arbitration process in London “was a shell that got nowhere near the truth.” We need better contracts, in the public and private sector. And we need greater transparency: the reality is that, had P&ID not conjured up quite such an outlandish ransom, they may have found themselves in the same place as the myriad other invisible contractors who all too often quietly take Nigeria for many millions in out of court settlements. Sterner sanctions are indicated for Nigerian public officials who have been proven to connive with foreign criminals to defraud our country.

Nigeria has won this battle with corruption, but the war is far from over. As Justice Knowles concluded: “This case has also, sadly, brought together a combination of examples of what some individuals will do for money. Driven by greed and prepared to use corruption; giving no thought to what their enrichment would mean in terms of harm for others. Others that in the present case include the people of Nigeria, already let down in so many ways over the history of this matter by a number of individuals in politics and administration whose duty it was to serve them and protect them.” Well said.

Muhammadu Buhari served as President of the Federal Republic of Nigeria 2015-23

by Legalnaija | Oct 16, 2023 | Blawg

PRIVCON PRIVACY AWARDS: CALL FOR NOMINATION

The conveners of PrivCon Nigeria – an annual privacy and data protection conference in Nigeria – are delighted to announce the call for nominations into varying categories of their inaugural PrivCon Privacy Awards 2024. These awards have been established to identify and celebrate outstanding contributions to the growth and development of privacy and data protection in Nigeria.

Nominations are now open into the following categories:

- Privacy Leading Light (Legal) for lawyers in private practice or in-house counsel.

- Privacy Leading Light (Tech)– Privacy professionals in tech (non-lawyers)

- Privacy Leading Light (Academics): University lecturers teaching law, cybersecurity, ICT and other related courses.

- Privacy Leading Light (Research): Researchers with published works in the area of privacy, data protection, cybersecurity or related subjects.

- Privacy Leading Light (Women category): Women in tech, female lawyers

- Privacy Leading Light (Advocacy): Non-governmental organisations leading privacy/data protection advocacy in Nigeria.

- Privacy Team of the Year (Private sector): Private and public companies with formidable privacy departments.

- Privacy Team of the Year (Public sector): Government agencies with formidable privacy departments.

- Best Privacy Culture Development: Nigerian Organisations with the best privacy culture

- Best Privacy Product/Programme: Nigerian Companies with privacy-enhancing products or programmes

- DPO of the Year (private sector): DPOs in private or public companies.

- DPO of the Year (public sector): DPOs in government departments

- DPCO of the Year: licenced DPCOs in Nigeria

- Rising star (Legal): young lawyers (1 -5 years post-call)

- Rising star (Tech): young privacy professionals (1-5years experience)

- Rising star (Undergraduate): University students (including postgraduate and law school)

Nominations are invited from individuals, organizations, and entities who have made significant strides in promoting the privacy and data protection industry in Nigeria. Please consider submitting nominations for deserving candidates in these categories.

HOW TO NOMINATE:

Head over to PrivCon Privacy Awards website at www.privconprivacyawards.ng. Fill out the nomination form with the required information. Include a detailed description of the nominee’s contributions and why they deserve recognition in the selected category.

NOMINATIONS TIMELINE:

Call for Nominations Opens:16th October 2023

Nominations Deadline: 30th November 2023

Shortlisted Nominees Announced: 7th December 2023

Voting starts: 8th December 2023

Voting closes: 8th January 2024

Final Nominees Announced: 31st January 2024

Panel of Judge Announced: 1st February 2024

Awards Ceremony: April 2024

For any inquiries or require assistance, please contact host@privconnigeria.ng

Join us in celebrating those who have made significant strides in advancing privacy and data protection in Nigeria.

Olamide Oyetayo

Olamide Oyetayo