The Nigerian Blawg

As the legal profession welcomes an influx of new starry-eyed wigs estimated at about 4,000 every year, their chances of securing juicy opportunities in existing law firms are few and far between. The labour shortfall in addition to the worrisome number of disillusionment among young lawyers is a burden that GreySage Consulting, a Lagos-based legal seeks to bear.

With hands on approach, GreySage Consulting has teamed up with experienced and dynamic attorney, Akinyemi Ayinoluwa, for exclusive an session with young lawyers. The session is scheduled for December 7 at a special location in Lagos.

Willing participants will leverage an opportunity to learn to create career enhancing tips. With keen understanding of the dynamics of the terrain as a professional who has continued to make a huge impact, Akinyemi will beam his lazer on four important topics areas:

1. How to build a Community that supports your law practice;

2. What you must do before starting a practice in Nigeria;

3. How to cultivate a Personal Brand that supports your career and;

4. How Nigerian lawyers can leverage content in a digital world.

Akinyemi revealed, “Having studied industry trends and the effects of globalization, we want to equip young lawyers with affordable vital information and resources that can acquaint them with entrepreneurial skill set, a Do-It-Yourself approach to career development, and creating a prosperous and fulfilling work life.”

“Among some of the issues young Nigerian lawyers grapple with are such issues as low Remuneration, unbearable work environments, unemployment, lack of Opportunities for growth and promotion, as well as lack of healthy Work/Life balance. We assure that we will help move your career and practice forward, and you will have fun doing it,” he added.

To book a spot, click on the link below, or send an email to greysagelaw@gmail.com or call +2349098028375

https://docs.google.com/forms/d/e/1FAIpQLScRlu1dM0guZyPWwlUbFhPQTnxe0yJ9ZC0XFqRtrBWoyXLJSw/viewform

About GreySage Consulting

GreySage Consulting Ltd. is a new consulting company headquartered in Lagos, Nigeria. The firm is dedicated to empowering practitioners in the Creative and Legal industry, via trainings, seminars, advisory services, industry-specific events, mentorship, and Network events.

The applicant must be a concerned person. This implies legal or equitable

interest.

Section 31(1) of the Act refers to the applicant as a “person concerned”. This

is not any person. Is Tekwando a “person concerned”?

The Senate also called on commercial banks operating in the country to configure their machines to dispense up to N40,000 per withdrawal pending the outcome of the investigation by the Senate committees tasked with investigating the excessive and illicit bank charges.

Speaking on the Motion, the President of the Senate, Dr. Abubakar Bukola Saraki said: “This is a motion that affects the lives of every Nigerian — irrespective of what part of the country you come from or whatever political affiliation you might have. This is why we are here: to always defend and protect the interests of the Nigerian people.”

The Senate President stated that the Senate must work to ensure that the Senate’s resolutions on the excessive bank charges goes beyond the debate stage, so that whatever action the Upper Legislative Chamber takes, would come into effect.

“This Senate has done this many times before; when there was a hike in the mobile telecommunication data charges, we intervened and put an end to that. When there were discrepancies and increases in electricity prices, we also took action. We have done this on a number of similar cases. Therefore, on this, I want us to take effective resolutions,” Saraki said.

Other Senators who contributed to the debate, called on banks to review their charges.

“The common man is also a victim,” said Senator Emmanuel Bwacha, “Banks declare profits and you wonder where these profits are coming from — it’s from the sweat of the common man. Let us come up with a law that puts banks on their toes.”

“It won’t be out of place to institute a committee that will call on the CBN to tell us what these charges are about. The Senate by fiat should abolish charges if they can’t be verified,” said Senator Bala Ibn Na’Allah.

“The Senate must take a serious stand on this issue. Nigerians are really suffering. The banking system is not encouraging. I had an issue, took it to the bank and was refunded but how many Nigerians can do this? The issue needs to be addressed,” stated Senator Kabiru Gaya.

“For me, this is a major step that we are taking. This is because I introduced the first ATM machine that came into Nigeria over 25-years ago,” the Senate President, Dr. Saraki told his colleagues, “Now, after 25-years, we should have grown out of these excessive charges and moved on. So, I believe that this something that we must address to create an environment that protects all Nigerians, because these kind of charges in this economy affects everyone.”

The Senate further directed its Committees on Banking, Insurance & other Financial Institutions and Finance to conduct an investigation into the propriety of ATM card maintenance charges in comparison with international best practices and report back to the Senate.

The Senate also directed the aforementioned committees to invited the Governor of the CBN to appear before it to explain why the official charges as approved by the CBN are skewed in favour of the banking institutions as against the ordinary customers of the banks.

Finally, the Senate called on the Consumer Protection Council to look into the various complaints of excess and unnecessary charges by Nigerian Banks.

Upon assuming office, the Buhari-led administration pulled funding for many government scholarships and bursaries leaving many students distraught and unable to complete their studies. In 2017, the President of The Senate, Dr Bukola Saraki, on the sidelines of the 137th Assembly of the Inter-Parliamentary Union, met with Nigerian students in Russia to hear first-hand the plight of those whose scholarship funding had dried up. Most of them felt abandoned by Nigerian authorities and had become stranded; barely able to make ends meet.

Speaking with them, Dr Saraki noted that the feeling of abandonment must be quickly dissipated by working urgently to alleviate the difficulties faced by these students. According to him “we must look for ways to reestablish the pipelines and remove the bottlenecks, so that our students who went abroad with the promise and assurance of scholarship funding, will get their stipends as at when due” .

Back here in Nigeria, parents and guardians find that they cannot rely on government awarding scholarships or bursaries to students of public tertiary institutions as a means of supporting the education of their wards. It has become critical to come up with solutions to the problems of financial aid being faced by Nigerian students both locally and internationally.

It was in response to this that Senator Isah Misau (Bauchi Central) sponsored the Student Financial Aid Scheme Bill. The Bill seeks to provide for the granting of loans to eligible students at higher institutions and repeal the provisions of the Nigerian Education Bank Act 2004.

The Student Financial Aid Scheme Bill went for the first reading in the National Assembly on the 20th of October, 2015 and second reading on the 15th of November, 2017. Lending support to the bill, Senator Sam Egwu (Ebonyi South) recalled that he benefited from scholarship in the old Anambra state and that the scheme would help indigent students studying in higher institutions.

The function of the bill shall be to:

The power of the scheme includes the power to:

– Promote and control staff as may appear to the scheme necessary and expedient

The Student Financial Aid Scheme Bill shall maintain a fund which will consist of:

– Money appropriated by the National Assembly

The Bill as of now has been referred to the Committee on Tertiary Institutions and TETFUND.

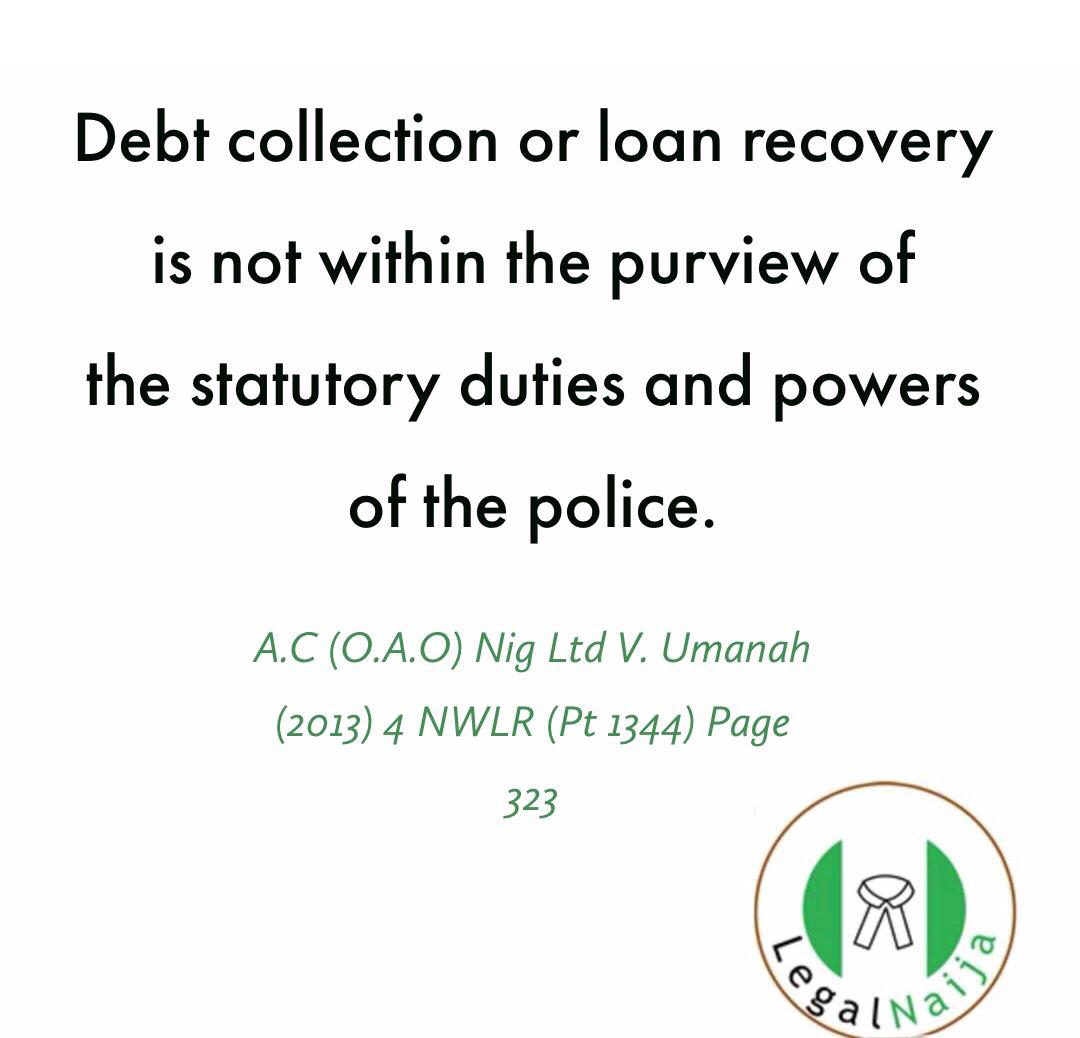

“The statutory duties of the police under the Police Act is to maintain peace, law and order in the society. Debt collection or loan recovery is not within the purview of the statutory duties and powers of the police”.

Learn and Share

@legalnaija