by Legalnaija | Oct 8, 2025 | Blawg

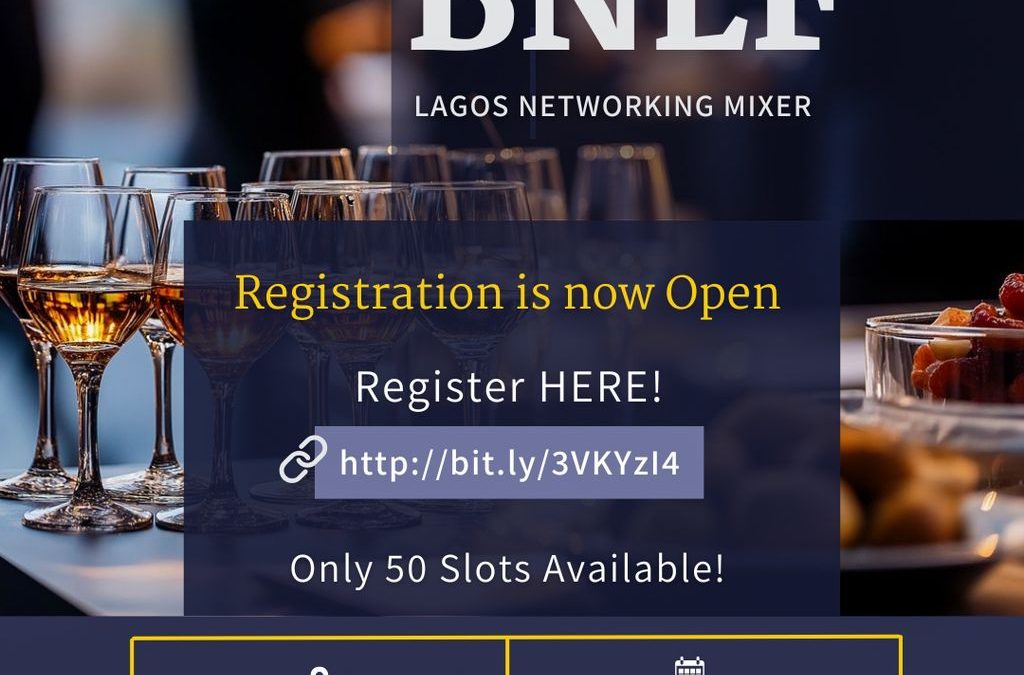

Building Connections in Lagos: Join the BNLF Networking Mixer

In today’s fast-paced legal landscape, relationships matter just as much as expertise. That’s why the British Nigeria Law Forum (BNLF) is excited to invite legal professionals, enthusiasts, and industry stakeholders to the BNLF Lagos Networking Mixer — an evening designed to foster meaningful connections, spark insightful conversations, and grow your professional network.

Whether you’re a seasoned lawyer, a budding legal entrepreneur, or simply passionate about the law, this event offers a unique opportunity to engage with like-minded individuals in a relaxed and inspiring setting.

📍 Event Details

– Venue: Grey Matter Social Space, Victoria Island, Lagos

– Date: Thursday, 23rd October 2025

– Time: 6 PM

– Slots: Limited to just 50 attendees

From policy discussions to practice tips, the mixer promises a dynamic blend of professional exchange and social interaction. Expect to meet thought leaders, innovators, and peers who are shaping the future of law in Nigeria.

🎟️ How to Attend!

Secure your spot now via Tix Africa. With only 50 slots available, early registration is highly recommended.

Follow this link to register!

https://tix.africa/discover/bnlflagosnetworkingmixer

Let’s build a stronger, more connected legal community — one conversation at a time.

#BNLF2025 #Legalnaija #NetworkingMixer #LagosLawyers #LegalCommunity #BNLFEvents

by Legalnaija | Oct 8, 2025 | Blawg, Book

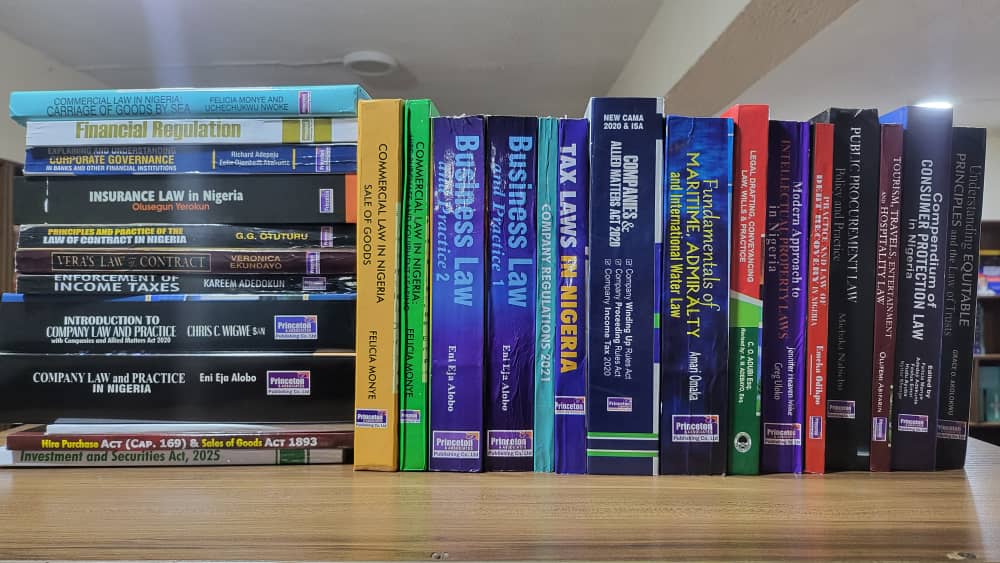

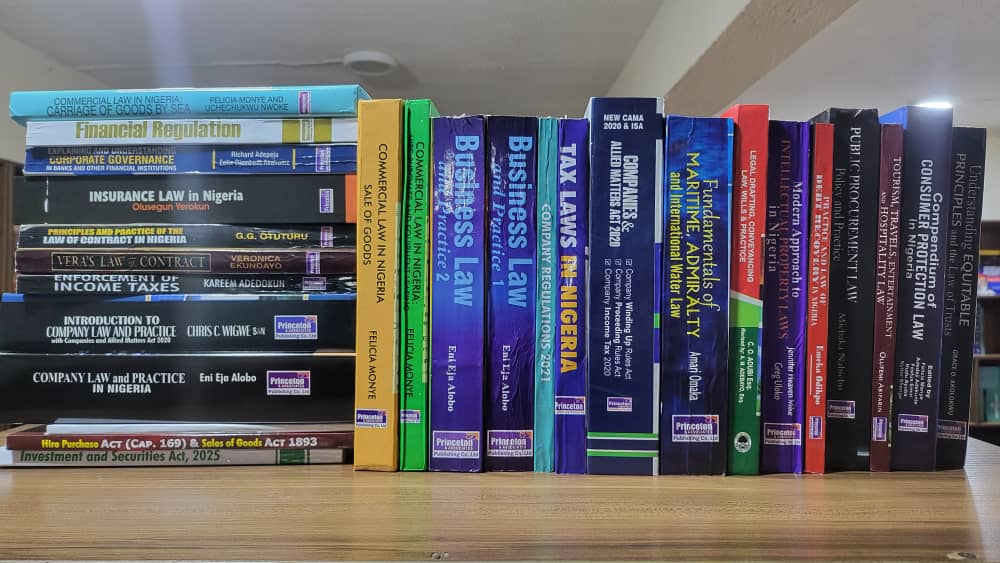

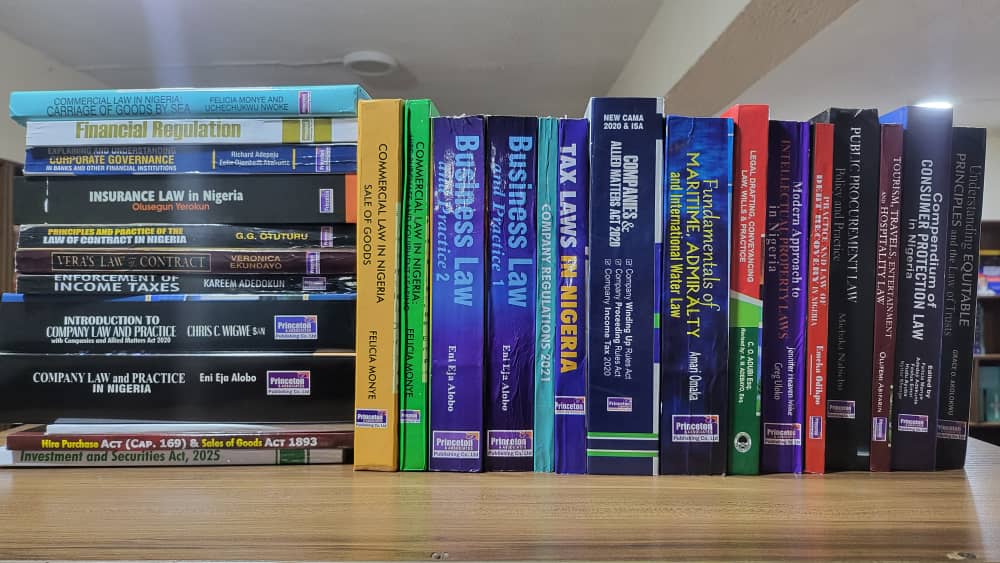

In the fast-paced world of business law, staying ahead means staying informed. Whether you’re advising multinational corporations, negotiating complex contracts, or navigating regulatory frameworks, the right resources make all the difference.

That’s why the Legalnaija Bookstore has curated the Business Law Bundle—a powerhouse collection of 27 essential titles tailored for corporate and commercial lawyers in Nigeria. From foundational statutes to advanced legal commentary, this bundle is your gateway to mastering the intricacies of business law.

🔍 What’s Inside the Bundle?

Here’s a look at the titles included:

- Commercial Law in Nigeria – Carriage of goods by sea

- Financial Regulation Act

- Explaining and Understanding Corporate Governance in Banks and other Financial Institutions

- Insurance Law in Nigeria

- Principles and practice of the Law of Contract in Nigeria

- Vera’s Law of Contract

- Enforcement of Income Taxes

- Introduction to Company Laws and practice in Nigeria

- Company Law and practice in Nigeria

- Data protection Act

- Hire Purchase Act

- Investment & Securities Act

- Commercial Law in Nigeria: Sale of Goods

- Commercial Law in Nigeria: Hire Purchase and Equipment Leasing

- Business Law 1

- Business Law 2

- Company Regulations 2021

- Tax Laws in Nigeria

- Companies and Allied Matters Act

- Fundamentals of Maritime, Admiralty and International Water Law.

- Legal drafting, conveyancing law, Wills and practice

- Modern Approaches to Intellectual Property Law in Nigeria

- Practice and Recovery in Nigerian Law

- Public Procurement Law

- Tourism, Travels, Entertainment and Hospitality Law.

- Compendium Of Consumer Protection in Nigeria

- Understanding Equitable Principles and the Law of Trusts.

Whether you’re a seasoned practitioner or a rising star in the legal field, the Business Law Bundle equips you with the tools to thrive.

🛒 Available Now at Legalnaija Bookstore

Ready to elevate your legal library? Visit the Legalnaija Bookstore and grab the Business Law Bundle today for N230,000 only via this link – https://legalnaija.com/product/business-law-bundle/

Your clients—and your career—will thank you.

For more information, please contact us via email at hello@legalnaija.com or WhatsApp 09029755663.

by Legalnaija | Oct 7, 2025 | Blawg

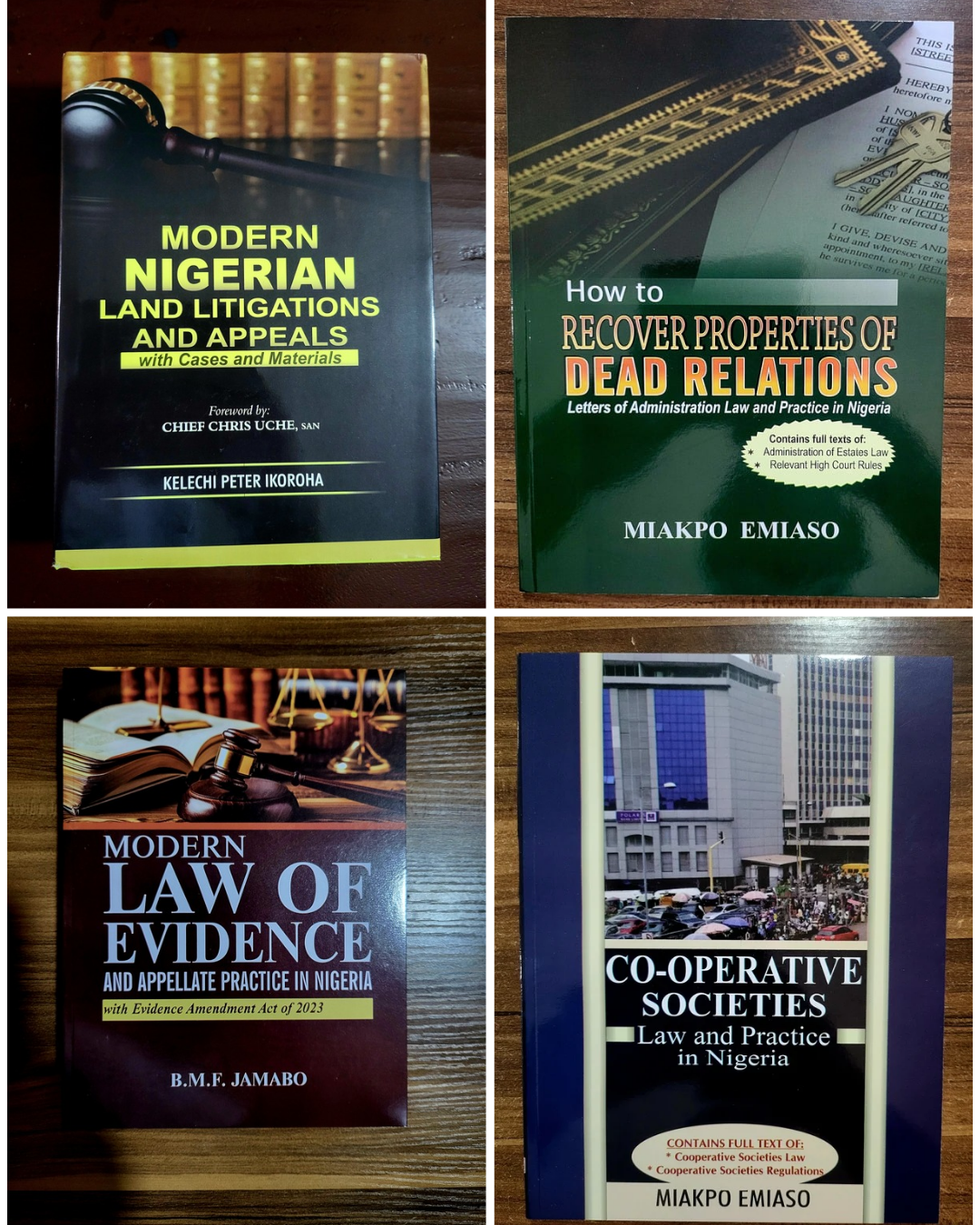

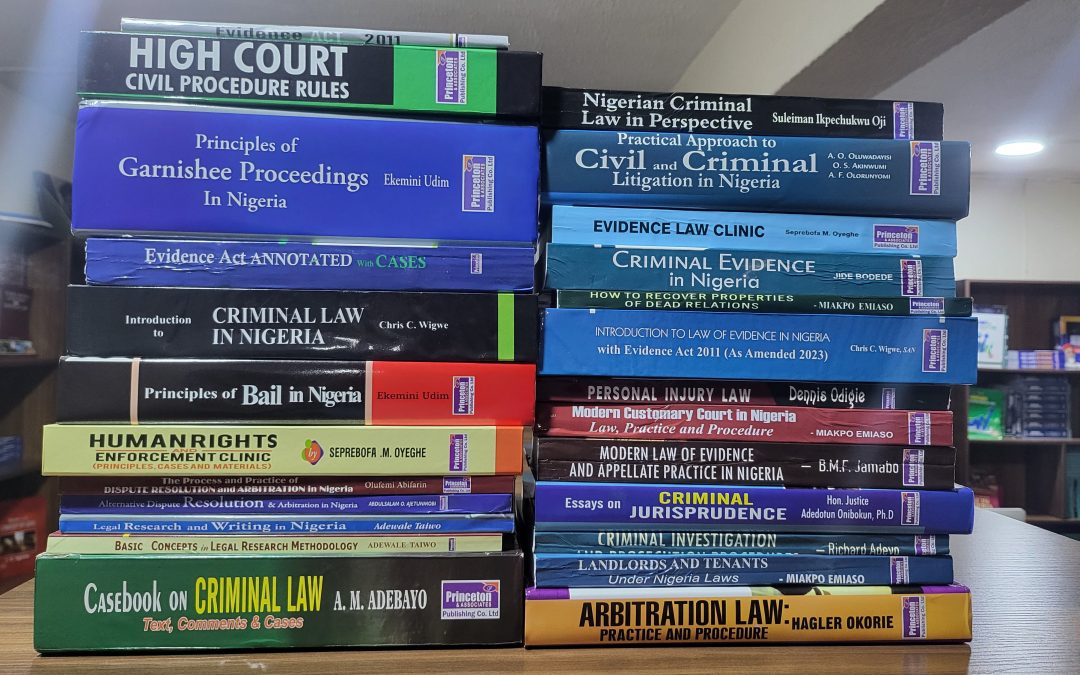

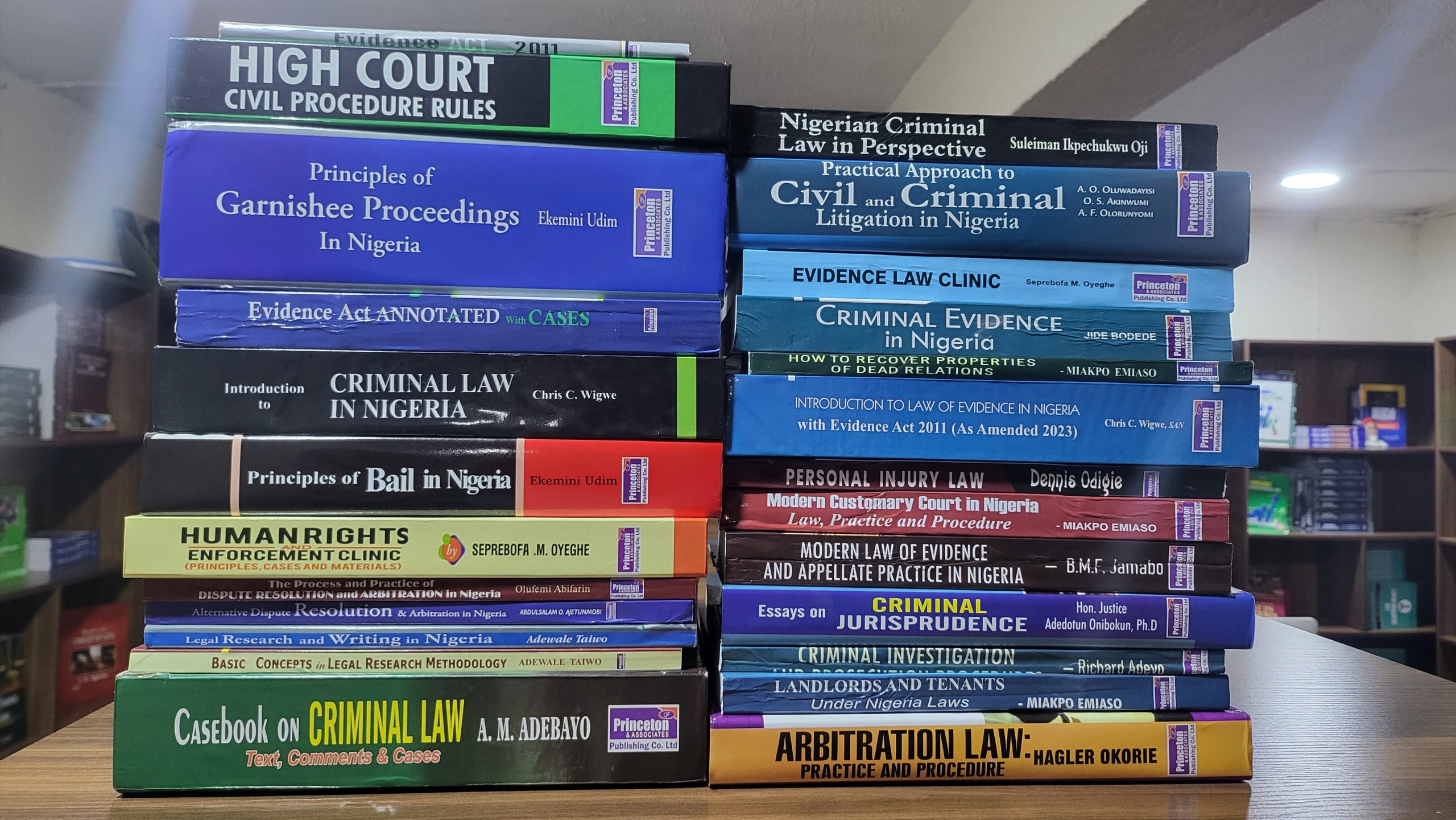

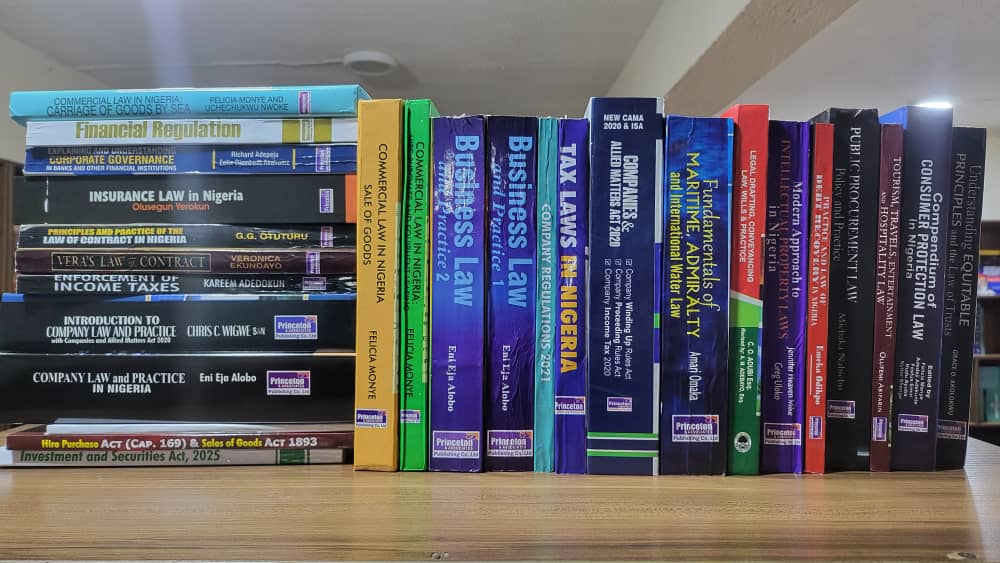

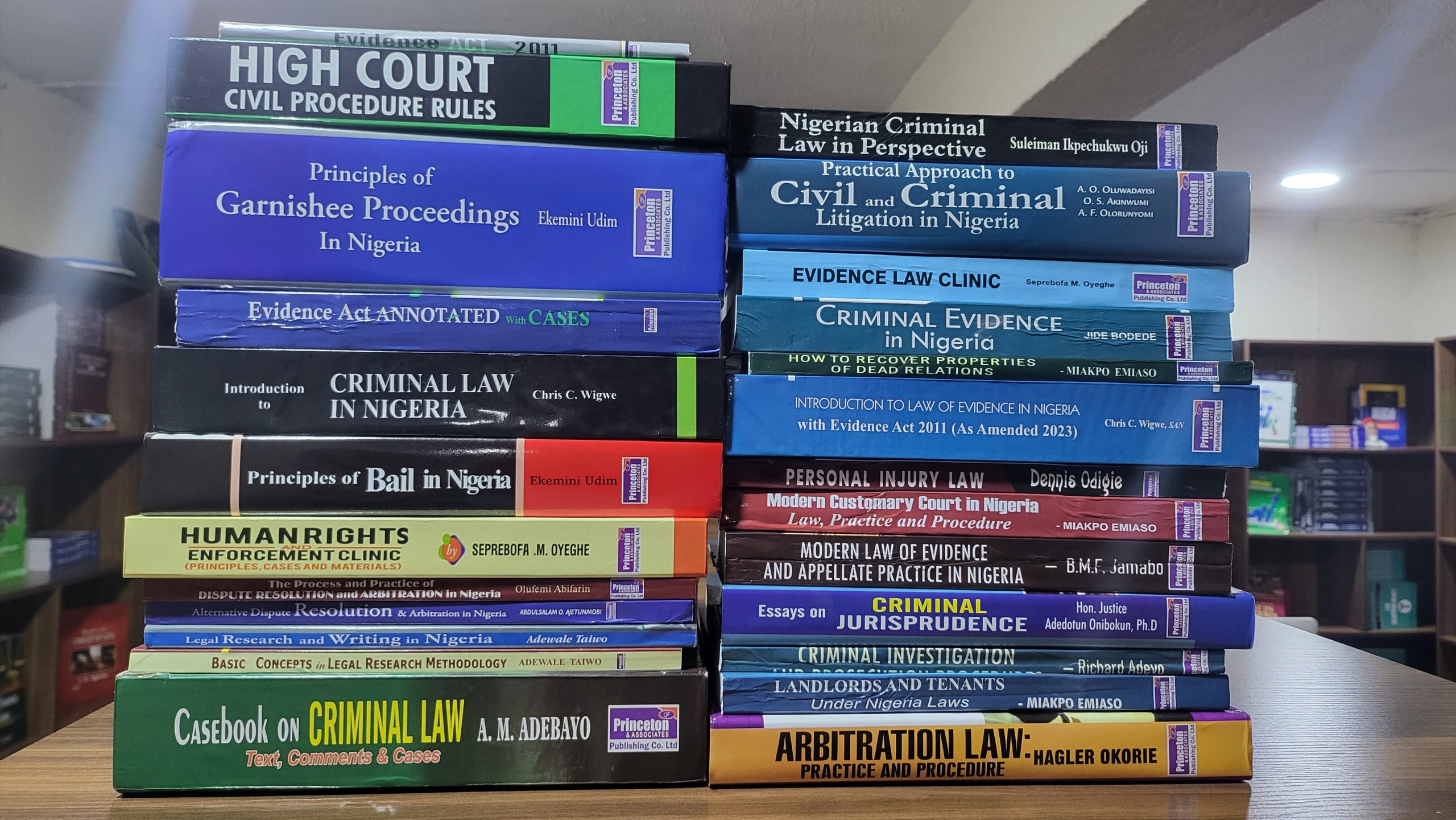

In the fast-paced world of litigation and dispute resolution, knowledge isn’t just power — it’s your strongest argument in court. Whether you’re a seasoned advocate or a rising associate, your library should be as sharp as your cross-examination skills.

That’s why Legalnaija Bookstore has curated a powerful collection of 26 essential titles for lawyers who live and breathe courtroom drama, arbitration tables, and the pursuit of justice.

Why This Collection Matters:

– Covers criminal and civil litigation, evidence law, ADR, and legal research

– Features renowned Nigerian authors and texts tailored to our legal system

– Perfect for law firms, solo practitioners, and law students preparing for practice

What You’ll Find Inside:

From classics like Principles of Evidence to practical guides like How to Recover Properties of Dead Relations, this collection dives deep into:

– Criminal law theory and casebooks

– Civil procedure and trial strategy

– Bail, prosecution, and appellate practice

– Arbitration and ADR frameworks

– Legal writing and research methodology

– Customary court insights and landlord-tenant law

Who Should Grab This Collection?

– Litigators looking to sharpen their advocacy

– Law firms building internal libraries

– Young lawyers preparing for court appearances

– Legal researchers and academics

– Judicial officers seeking reference materials

Lost of books include;

1. Casebook on Criminal Law by A.M. Adewale

2. Evidence Act 2011

3. High Court Civil Procedure Rules

4. Principles of Criminal Law

5. Casebook on Law of Contract

6. Criminal Law Annotated with Cases

7. Introduction to Criminal Law by Chris Ugwueze

8. Principles Governing Bail in Nigeria

9. Human Rights and Enforcement of Criminal Law

9. The Process and Practice of Dispute Resolution and Arbitration in Nigeria

10. Alternative Dispute Resolution and Arbitration in Nigeria

11. Legal Research and Writing in Nigeria

12. Basic Concepts in Legal Research Methodology

13. Casebook on Criminal Law

14. Nigerian Criminal Law in Perspective –

15. Practical Approach to Civil and Criminal Litigation in Nigeria

16. Evidence Law Clinic

17. Criminal Evidence in Nigeria

18. How to Recover Properties of Dead Relations

19. Introduction to Evidence Law in Nigeria

20. Personal Injury Law

21. Modern Customary Court in Nigeria

22. Modern Law of Evidence and Appellate Practice in Nigeria

23. Essays on Criminal Justice

24. Criminal Investigation and Prosecution Proceedings

25. Landlord and Tenants under Nigerian Laws

26. Arbitration Law: Practice & Procedure

🛒 Available Now on Legalnaija Bookstore

Don’t wait until your next court date to upgrade your legal arsenal. Visit the Legalnaija Bookstore today and explore this curated selection — because every great lawyer deserves a great library.

With over 100 successful deliveries to lawyers and law firms outside Lagos alone. You can be sure to get your books delivered speedily!

Order these collection of books tagged Litigation and ADR Expert Bundle. Visit this link to order all the books for 260,000 Naira only https://legalnaija.com/product/litigation-and-adr-expert-bundle/

You can also visit the bookstore for other books in different areas of Practice you are interested in! www.legalnaija.com/store

For information email hello@legalnaija.com or WhatsApp 09029755663.

by Legalnaija | Oct 5, 2025 | Blawg

Why You Need a Lawyer Before Wahala Starts: The Power of Preventive Legal Representation

Why You Need a Lawyer Before Wahala Starts: The Power of Preventive Legal Representation

In Nigeria, we often hear the phrase “I no go court unless wahala dey.” It’s a common sentiment—many people only think of lawyers when trouble has already landed. But what if I told you that having legal representation before problems arise could save you time, money, and serious stress?

Welcome to the world of preventive lawyering—a smart, proactive approach to life and business that every Nigerian should embrace.

Order here legalnaija.com/store

Think Ahead, Not After

Whether you’re signing a tenancy agreement, starting a business, entering a partnership, or even getting married, legal advice is not a luxury—it’s a necessity. Lawyers are trained to spot red flags in contracts, decode legal jargon, and protect your interests before you say “yes” to anything that could come back to bite you.

Imagine signing a land purchase agreement without verifying the title documents. Or launching a startup without registering your intellectual property. Or entering a joint venture without a clear exit clause. These are the kinds of mistakes that preventive legal representation helps you avoid.

For Business Owners: Avoiding Legal Landmines

Entrepreneurs, listen up. Nigeria’s regulatory landscape is complex. From CAC filings to tax compliance, employment contracts to NDAs—having a lawyer on your team isn’t just smart, it’s strategic. Preventive legal counsel ensures your business is built on solid ground, not shifting sand.

For Everyday Nigerians: Peace of Mind

Even in personal matters—like drafting a will, negotiating a divorce, or resolving a landlord-tenant issue—early legal advice can make all the difference. It’s not about being paranoid; it’s about being prepared.

Prevention Is Cheaper Than Cure

Litigation is expensive. Court cases can drag for years. But a few hours with a lawyer to review a document or advise on a transaction? That’s an investment. Preventive legal representation is like insurance—you hope you never need it, but you’ll be glad you have it.

Find a Lawyer Today

Ready to take the smart step? Visit www.legalnaija.com to find verified Nigerian lawyers across various fields—from property law to corporate advisory, family law to tech law. Whether you need a quick consultation or long-term legal support, the right lawyer is just a click away.

Don’t wait for wahala. Get legal help now—and stay ahead of the game.

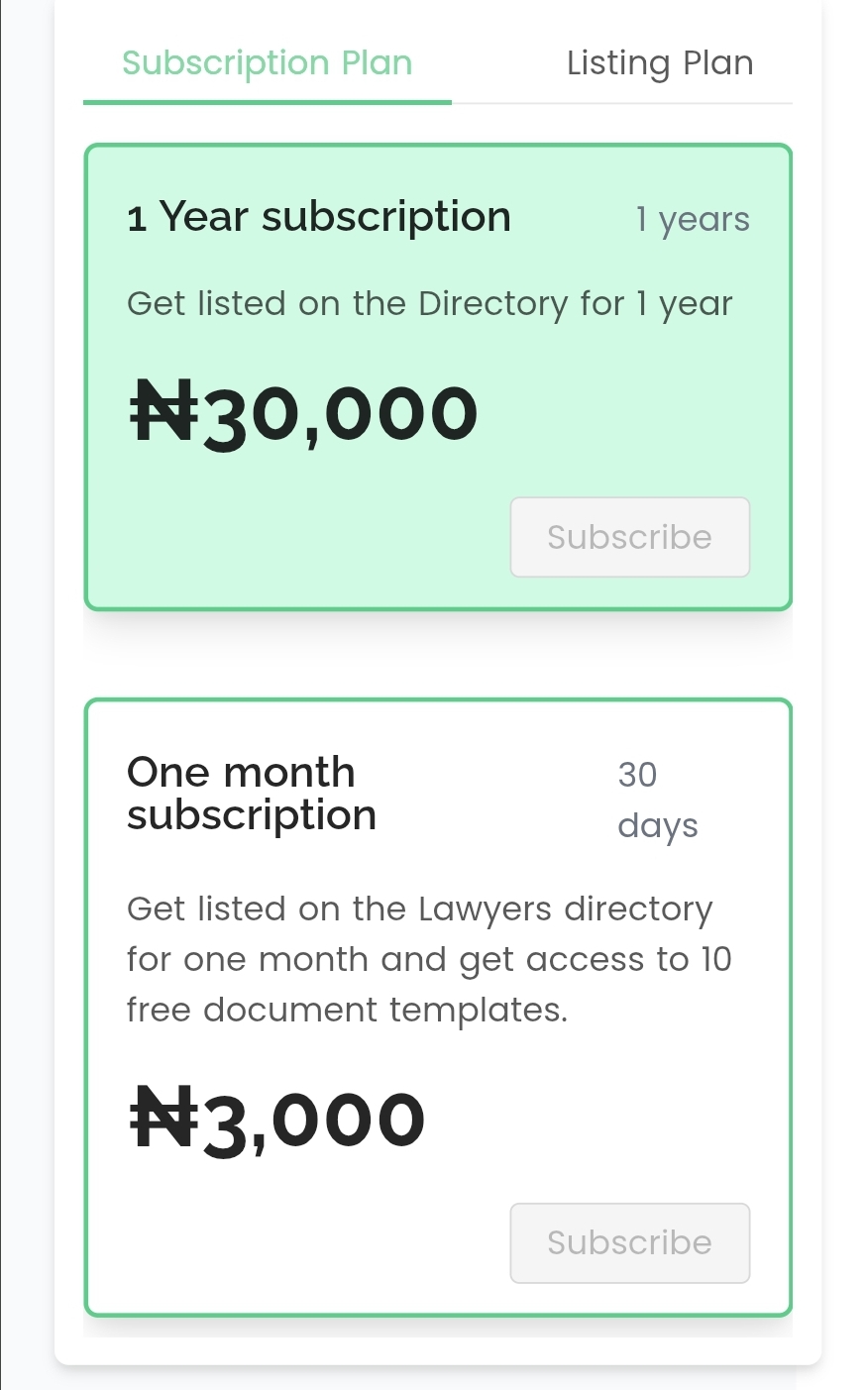

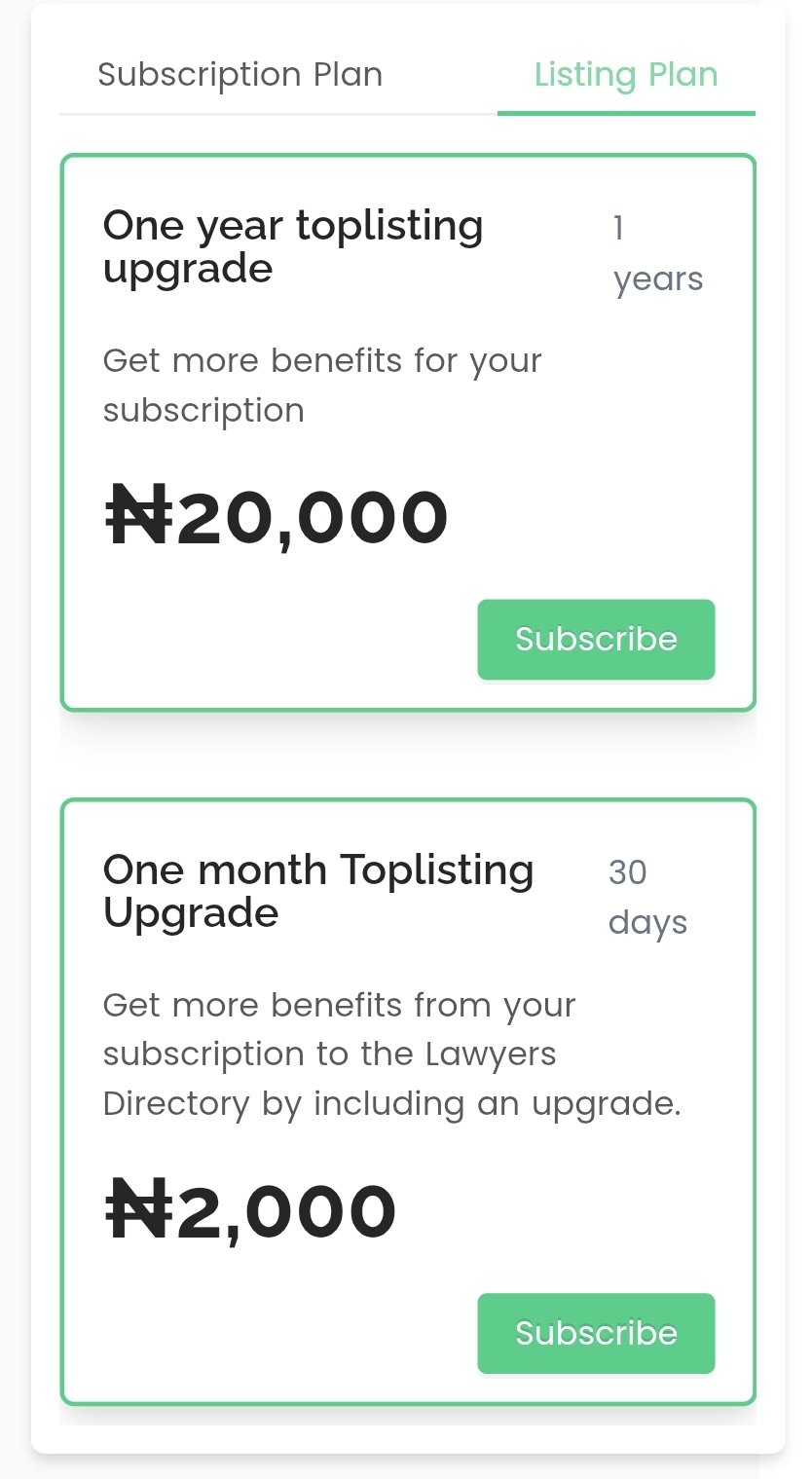

by Legalnaija | Oct 1, 2025 | Blawg

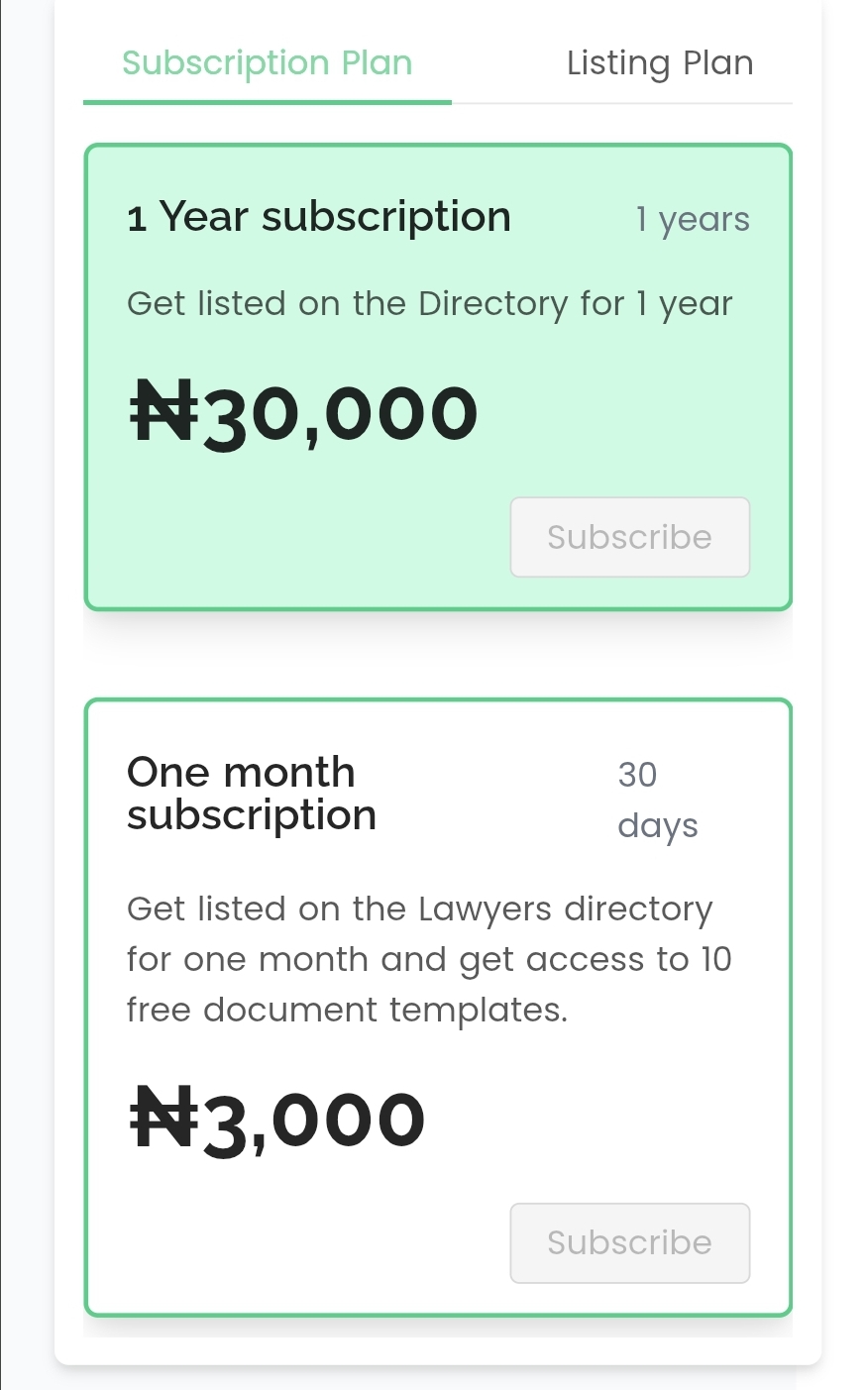

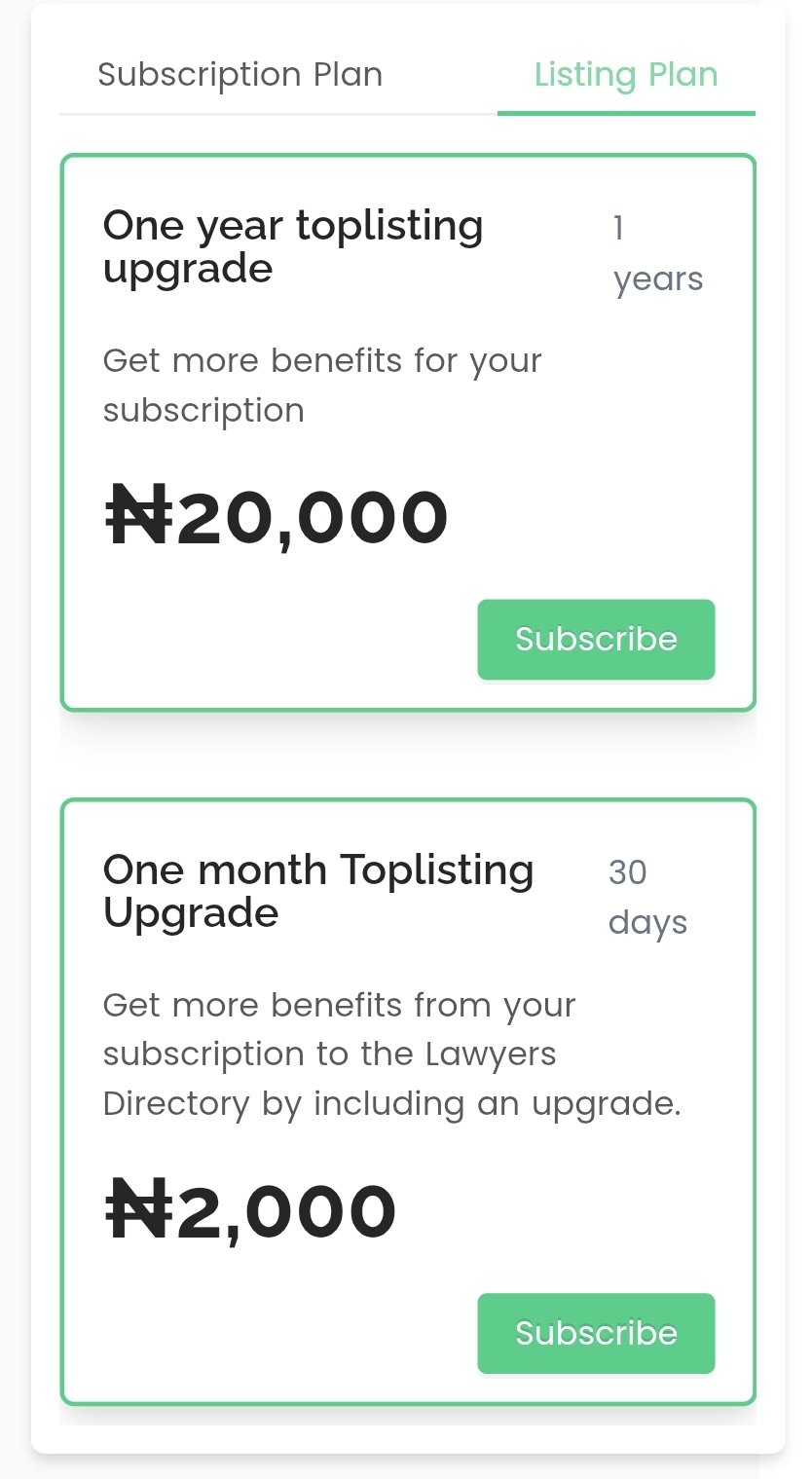

Lawyers, Don’t Let the RPC Hold You Back — We Can Advertise Your Practice For You!

The Rules of Professional Conduct (RPC) may restrict direct advertising by Nigerian lawyers, but that doesn’t mean your practice should remain invisible.

Legal directories like Legalnaija are fully compliant with the RPC — and they’re designed to help you shine. Being listed on the Legalnaija Directory isn’t just ethical, it’s strategic. It’s your gateway to visibility, credibility, and connection with clients who need your expertise.

Here’s the truth:

You don’t have to advertise — because we’ll do it for you. Legalnaija promotes your listing, showcases your practice areas, and helps potential clients find you, all within the bounds of professional ethics.

✅ Stay compliant

✅ Get discovered

✅ Grow your practice

Don’t feel limited. Feel empowered. Join the Legalnaija Directory today and let us help you stand out — the right way.

If you have a Legalnaija account, renew your subscription here – https://app.legalnaija.com/signin

If you are new to Legalnaija, sign up here – https://app.legalnaija.com/signup

For help or more information about registration or subscribing, kindly email hello@legalnaija.com or text 09029755663 on WhatsApp.

by Legalnaija | Sep 23, 2025 | Blawg, Training

Dr. Tolu Aderemi, Partner at the Firm Perchstone & Graeys and Chairman of the NBA Lagos 2025 Law Conference, has launched an Alternative Dispute Resolution and Emotional Intelligence training session for young lawyers. At a press briefing on 22nd September, 2025, Dr. Aderemi announced the training session in partnership with Mr. Fola Alade of FOTEFA Mediation Academy and the Business Law Academy.

Dr. Tolu Aderemi, in his introduction, highlighted how alternative dispute resolution, particularly arbitration has over the years become effective in resolving commercial disputes. Dr. Aderemi further explained that the upcoming Master Class will not only address ADR mechanisms but also emphasize dispute avoidance strategies. According to him, the one-year intensive training program, jointly driven by the Business Law Academy and Fotefa Mediation Academy, will cover ADR, Dispute Avoidance strategy and Emotional Intelligence, thereby producing more well-rounded practitioners.

Mr. Fola Alade of FOTEFA Mediation Academy also provided an overview of the program’s structure. He stated that it will run as a 12-week online course, designed to empower the next generation of dispute resolution practitioners. The program aims to equip lawyers, with a solid foundation in both the traditional pillars of ADR and sharpen the advocacy, analytical and interpersonal skills that define a competent ADR professional, while ensuring that participants are practice-ready for domestic and international engagements.

Mr. Alade outlined that the Master Class will begin with an orientation by Dr. Tolu Aderemi, followed by a negotiation module by Dr. Kolawole Mayomi, a mediation module to be led by Mr. Alade himself, and an arbitration module to be facilitated by Mr. Aaron Ogletree. Other facilitators will include Mrs Laura Alakija, Mr. Hamid Abdulkarim, and Mr. Rotimi Ogunyemi.

While the training session will have practical sessions, the program’s impact will be in threefold:

- For participants – producing confident, well-grounded ADR practitioners capable of stirring negotiation, mediation and Arbitration with professionalism and empathy.

- For the profession – strengthening Africa’s and Nigeria’s ADR ecosystem, decongesting the court dockets, and promoting a culture of peaceful dispute resolution.

- For society and businesses – fostering dispute avoidance and efficient dispute management, thereby improving the commercial environment.

Mrs. Fola, representing the Business Law Academy, while also addressing the audience explained that the program will open with an introduction to ADR, the history and global trends and feature carefully curated modules on ADR, dispute avoidance, and emotional intelligence. According to her, the course will blend theory with practical application, culminating in a closing ceremony that will showcase ADR simulations and celebrate participants’ growth. She concluded that the initiative will contribute to a more stable commercial environment, attract investment, and support sustainable economic growth.

During the interactive session, Mr. Austin Inyam asked about the advantages of ADR and whether non-lawyers could participate in the program. In response, Dr. Tolu Aderemi outlined the many advantages of ADR, including its speed, cost-effectiveness, and ability to preserve business relationships, while acknowledging that the traditional court system remains indispensable in the legal framework. He emphasized that, at best, both methods of dispute resolution should coexist. He further stressed that lawyers, as users of the Act, must understand not only the law but also the underlying principles of arbitration to prevent traits of litigation from finding their way into ADR practice. He concluded by noting that the Master Class is designed exclusively for legal practitioners.

Expanding on the subject, Dr. Alade described ADR as the “technology of dispute resolution,” likening its impact to that of technological innovation. He noted that ADR is universally recognized, enabling practitioners to operate across borders without the licensing barriers faced by litigators. He also observed that clients today are increasingly impatient and prefer their disputes to be resolved swiftly. As a result, they weigh the cost–benefit of pursuing a case in court for years even when they have strong claims, against the value of speedy justice, the likelihood of appeals, and the potential strain on business relationships. He noted that clients are also more inclined to seek lawyers with specialized expertise in the relevant area of dispute who can deliver effective and timely resolutions while preserving professional relationships with the opposing party.

Dr. Tolu Aderemi, in his closing remark, emphasized that the overarching objective of the Master Class is to develop well-rounded ADR experts. He assured participants that the faculty will focus not only on theoretical knowledge but also on practical application to ensure lasting impact.

Dr. Aderemi reiterated that this program, the first of its kind in Nigeria, will offer one of the highest levels of training on ADR combined with emotional intelligence. While the participation process will be rigorous to ensure quality, successful candidates will receive certificates at the end of the program. He also expressed appreciation to the Business Law Academy and Fotefa Mediation Academy for their partnership.

The mode of participation will be announced shortly and all lawyers are encouraged to participate fully in the training.

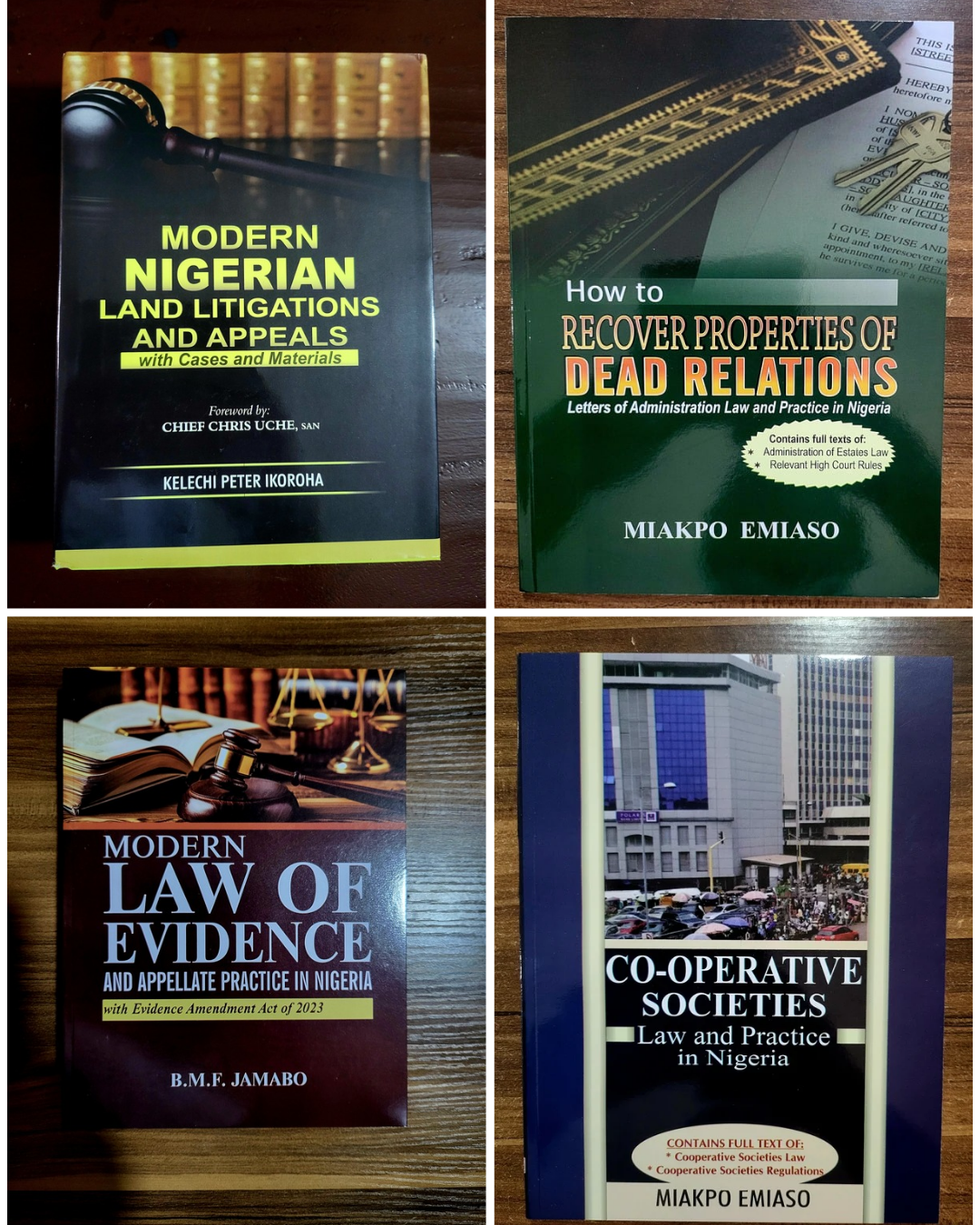

by Legalnaija | Sep 20, 2025 | Blawg, Book

For the next **36 hours only**, lawyers and law firms can enjoy **35% off** a curated selection of essential legal books on the **Legalnaija Bookstore**.

- Use coupon code **WIGANDGOWN** at checkout

- Offer valid for 36 hours only!

Featured Titles:

– *Co-operative Societies: Law and Practice in Nigeria*

– *Constitutional Law and Constitutionalism in Nigeria*

– *Criminal Code Act Annotated With Cases* by A.M Adebayo

– *Electricity Offences and Prosecution*

– *Environmental Law*

– *Family Law and Succession in Nigeria*

– *Gambling Law and Practice in Nigeria*

– *High Court Civil Procedure Rules (2025 Edition)*

– *Information Technology Law*

– *Introduction to Law of Evidence in Nigeria*

– *Landlords and Tenants Under Nigeria Laws*

– *Law and Practice of Intellectual Property and Traditional Knowledge*

– *Law of Banking and Insurance in Nigeria*

– *Legal Drafting, Conveyancy Law, Wills and Practice*

– *Modern Customary Courts in Nigeria: Law, Practice and Procedure*

– *Modern Law of Evidence and Appellate Practice in Nigeria*

– *Nigerian Criminal Law in Perspective*

– *Perceived Corrupt Memoirs of a Nigerian Judge*

– *Urban Planning and Development Law and Practice*

💥 Plus, explore other exciting deals across the bookstore — more titles, more savings, all waiting for you!

⏳ The clock is ticking — don’t miss out!

by Legalnaija | Sep 17, 2025 | Blawg

NBA Legal Education Committee calls for climate-competent lawyering in line with global best practicesop

The Legal Education Committee of the Nigerian Bar Association (NBA-LEC) has called on lawyers to fully integrate corporate due diligence on environment, social, governance (ESG) and human rights, when providing counsel. They also called on governments at all levels to provide increased funding for legal education in Nigeria in order to enhance the development of climate-competent lawyers that can effectively advise clients on global best practices relating to climate change, biodiversity, pollution control and sustainable development in infrastructure and development projects.

These recommendations were made at the 3rd online Seminar Series on Legal Education organized by the NBA-LEC. Recall that as part of the NBA’s efforts to enhance legal education and practice in Nigeria, NBA President, Mazi Afam Osigwe, SAN inaugurated the Legal Education Committee under the leadership of Professor Damilola Sunday Olawuyi, SAN, Deputy Vice Chancellor at Afe Babalola University, Ado Ekiti (ABUAD), with the mandate to promote and advance functional legal education in Nigeria, especially through training sessions and conferences on modern teaching approaches.

In exercise of this mandate, the NBA-LEC introduced the Webinar Series on Legal Education Series, a gathering of academic, legal practitioners and industry experts to discuss practical approaches for promoting the reform and transformation of legal education in Nigeria. This 3rd edition of the series recorded a huge turn out of more than 850 attendees.

While welcoming delegates to the workshop, Chairman of the NBA-LEC, Professor Damilola Olawuyi, SAN highlighted that the rapid introduction of ESG standards in legislation, industry guidelines, and contracts worldwide to address planetary emergencies, such as climate change, biodiversity loss and pollution in key sectors, is transforming the legal profession, especially the meaning of contractual due diligence and the way we practice and teach law. According to the Learned Silk, “to be a competent lawyer in this rapidly changing regulatory landscape includes being commercially aware of climate and energy transition risks. It is for this purpose in that we have put together this Webinar Series to provide an opportunity for stakeholders in legal education, particularly faculty, students, and administrators to explore how to tailor legal education to meet contemporary realities and needs.”

On his part, the keynote speaker, Prof. Onyeka K. Osuji, Dean and Professor of Law, Essex Law School, University of Essex, United Kingdom highlighted the nature, scope and application of ESG in transactional and regulatory context. He noted that the emerging ESG standards place additional duty of care on lawyers to acquire the knowledge, skills, attitudes, dispositions and competencies required to provide risk-free legal advice in today’s rapidly changing world. Drawing from his extensive experience in the UK, the erudite professor also stressed that to effectively perform these roles, legal educators must integrate practical skills in legal education and training both at the University and bar training.

Moderated by the chairperson of the Webinar Series subcommittee of NBA-LEC, Ozioma Soludo, who is also an associate at KENNA, the ensuing panel discussion featured insightful contributions from leading practitioners from Nigeria and beyond. The panelists, Mrs Folashade Alli, SAN, one of the leading arbitrators in Nigeria with about 40 years’ practice experience and current Chairperson of the Section on Legal Practice of the Nigerian Bar Association; Professor Ayodele Morocco-Clarke, Professor of Energy, Climate and Environmental Law and Policy at Nile University of Nigeria, Abuja, as well as Paula-Ann Novotny who is a partner at the global law firm, Webber Wentzel and member of the Business and Human Rights Committee of the International Bar Association, expertly analysed the meaning of ‘climate-competent lawyering’ in Nigerian and global contexts. The discussions also examined the ESG imperatives and the challenges and opportunities for legal education and professional training; the urgent need for universities to integrate climate change and ESG into law curricula and professional standards, as well as comparative perspectives and lessons from global best practices in climate-related legal education. The speakers also highlighted the future role of lawyers in advancing sustainability and regulatory compliance in line with global best practices.

While discussing the way forward, the workshop commended the NBA leadership for providing the innovative platform to reflect on the way forward and called for the swift implementation of the NBA Legal Education Endowment Fund which could go a long way in mobilizing financial support for infrastructure and technology upgrade to implement practice-focused training in universities. While calling on law firms, companies and other stakeholders to contribute to the Fund, the workshop also called for more joint research projects between NBA and law faculties, as well as tailored research programs and subsidized conferences for academic lawyers, as a way of incorporating theoretical and practical law aspects in the profession.

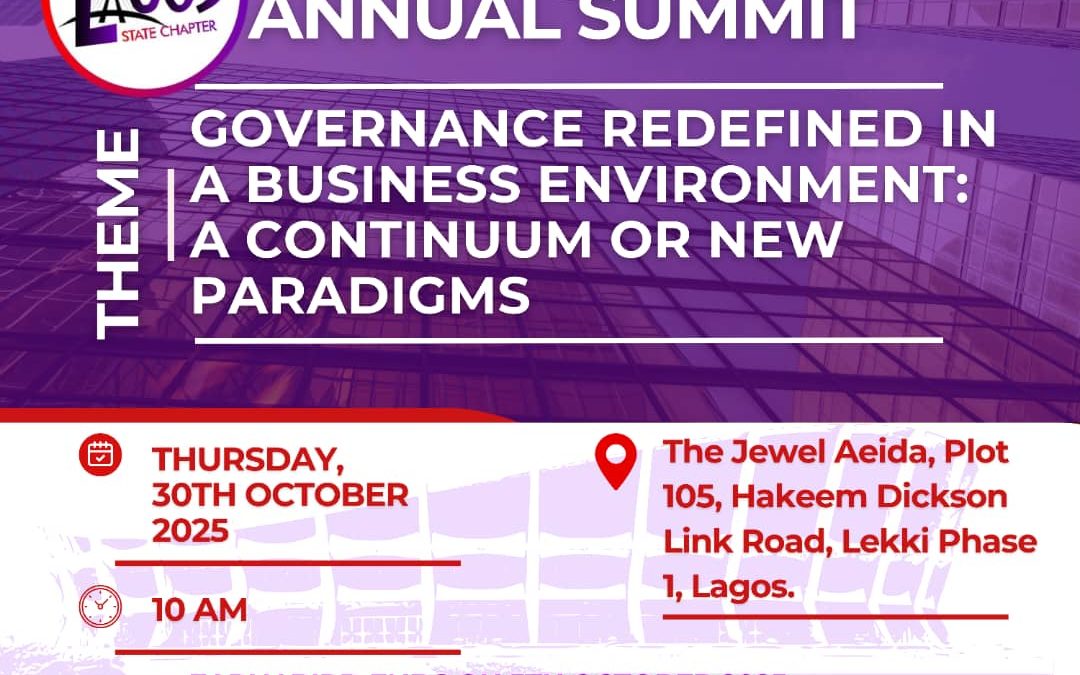

by Legalnaija | Sep 15, 2025 | Blawg

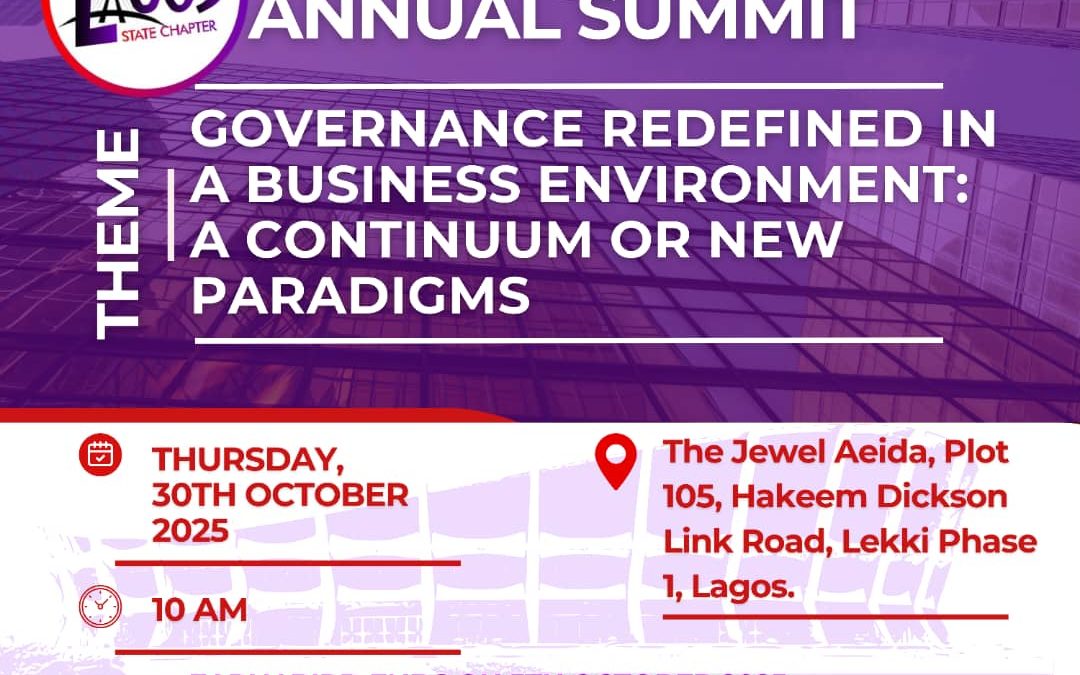

Early bird registration for the ICSAN Lagos State Annual Summit has been extended to 5th October, 2025*

Join the greatest minds in corporate governance at the ICSAN Lagos State Chapter Annual Summit 2025, an unmissable event designed to empower professionals navigating today’s evolving business landscape.

🔍 Theme:

“Governance Redefined in a Business Environment: A Continuum or New Paradigms?”

🗓 Date: Thursday, 30th October 2025

🕙 Time: 10:00 AM

📍 Venue: The Jewel Aeida, Plot 105, Hakeem Dickson Link Road, Lekki Phase 1, Lagos

🎯 Why Attend?

✅ Gain fresh insights into emerging governance trends

✅ Network with top professionals and industry leaders

✅ Explore real-world strategies for effective governance

✅ Earn professional recognition and visibility

Registration Rates:

🔹 Members: Early Bird – ₦40,000 | Regular – ₦50,000

🔹 Non-Members: Early Bird – ₦55,000 | Regular – ₦65,000

*ONLINE PAYMENT LINK:*

Click on the link below to make payment for the Annual Summit

http://bit.ly/3JLzrhG

📞 For inquiries: 08034689366

After payment, please click on the link to register

https://forms.gle/Z1JwEukP8H51oLVw5

📲 Follow: @icsanlagosstatechapter

Attendance attracts points for Membership upgrade

Don’t miss it!

#ICSANAnnualSummit2025

#ICSANLagosCGWeek2025 #governanceredefined

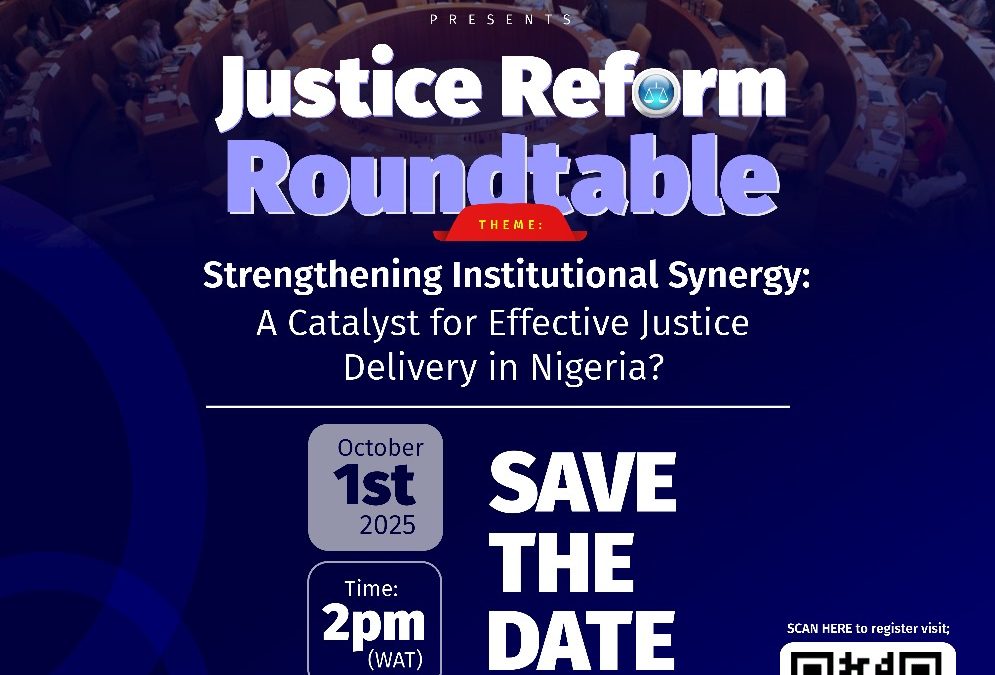

by Legalnaija | Sep 15, 2025 | Blawg

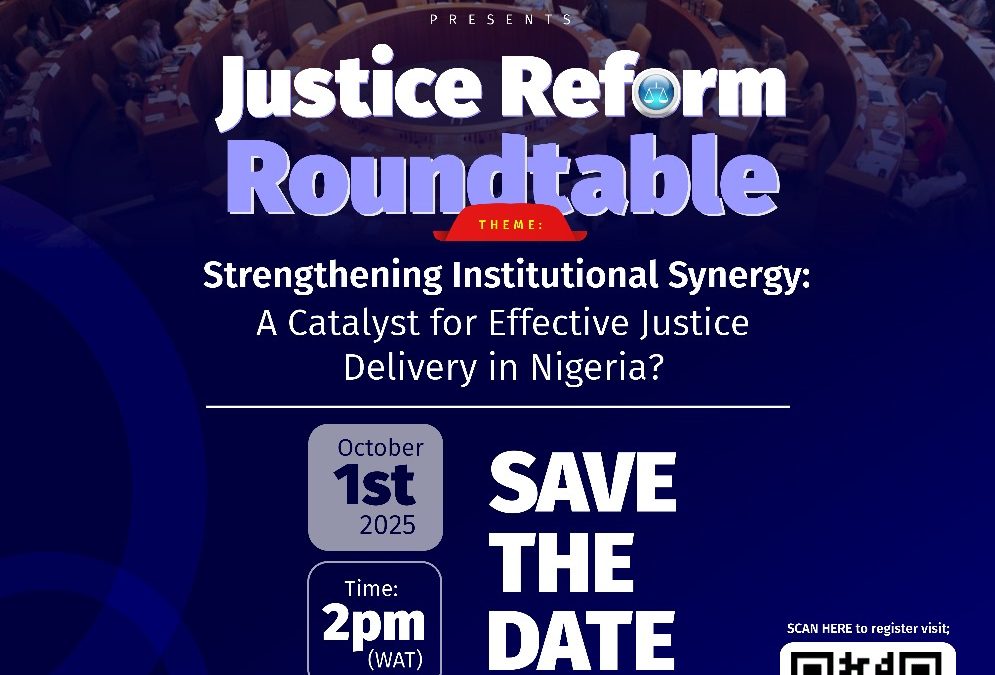

The JAALS Foundation, in its effort to facilitate the reform of the justice system, last year, organized the Walk for Justice, an exercise that saw lawyers, members of the Nigerian Bar Association and the civil public march from Falomo bridge to the Federal High Court, Lagos. In the course of engagement with judicial officers in the court, the need to prioritize capacity building for bailiffs was indicated. To that effect, the foundation organized an intensive training for bailiffs of the Federal High Court, Lagos, amplifying their technical capacity and elevating the quality of their work in expediting justice processes.

Meanwhile, the Nigerian Justice system has, over the years, been infamously riddled by corruption. In 2024, Transparency International’s Corruption Perception Index ranked Nigeria 140th of 180 countries, with a score of 26 over 100. Thus, at this year’s Walk for Justice in February, JAALS led almost 100 participants in a walk to the ICPC office in Ikoyi to engage with the anti graft agency on tackling the menace of corruption and improving the overall quality of justice administration in Nigeria. Albeit, The 2024 WJP Rule of Law Index’s assessment of Nigeria’s justice system reveals a deeper truth: the quagmire besetting the effective delivery of justice in Nigeria is not limited to corruption within the system, but also the absence of genuine institutional collaboration. Nigeria’s justice system was ranked 120th out of 140 countries, with concerningly low scores across civil justice (0.34), criminal justice (0.36) and government oversight (0.35). This conclusion was reinforced upon consultation with the ICPC, who emphasized the lack of institutional collaboration between anti graft agencies, law enforcement and other stakeholders in the Justice sector.

To confront this challenge head-on, the JAALS Foundation is convening the 2025 Virtual Justice Reform Roundtable on October 1st, 2025, themed:

“Strengthening Institutional Synergy: A Catalyst for Effective Justice Delivery?”

This dialogue will bring together stakeholders from law enforcement, the EFCC, ICPC, Code of Conduct Bureau, Nigerian Correctional Service, the judiciary, and the bar. In this consortium, institutional isolationism will be addressed, and concrete pathways for collaboration explored.

We are calling on lawyers, justice advocates, civil society actors, and members of the public to join us in this critical conversation. Together, we can lay the foundation for a justice system that commands public trust and serves the nation faithfully.

📅 Date: Wednesday, October 1, 2025

⏰ Time: 2:00 p.m.

📍 Venue: Virtual (link provided upon registration)

To register, scan the QR code on the flyer or click the link: https://bit.ly/47waIHR

SAVE THE DATE

Why You Need a Lawyer Before Wahala Starts: The Power of Preventive Legal Representation

Why You Need a Lawyer Before Wahala Starts: The Power of Preventive Legal Representation